Will home prices bottom out in 2026?

A student asks:

Do you think we will finally see house prices fall in 2026? Redfin says there are more sellers than buyers and people owning 3% I know prices don’t fall often but it looks like a soft labor market mixed with sky high prices could finally make it happen. What do you say, ben?

If you had told me back in early 2022 that interest rates would go from 7% all the way to 8% and continue above 6% for years now.

Nope.

The prices go on and on.

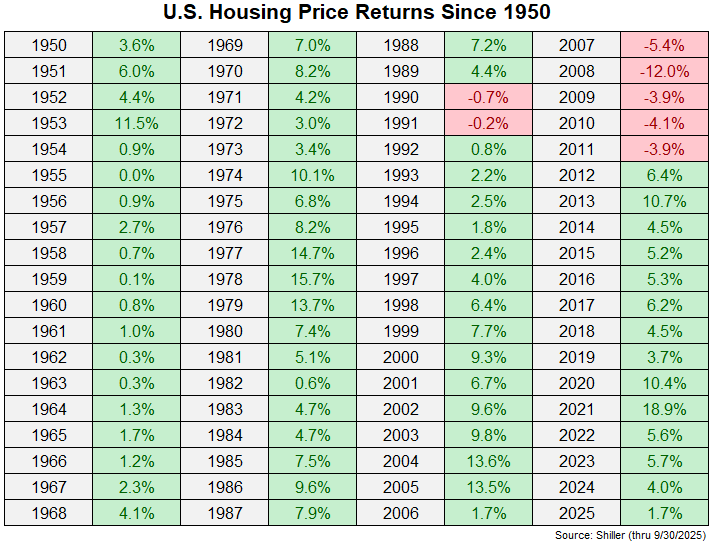

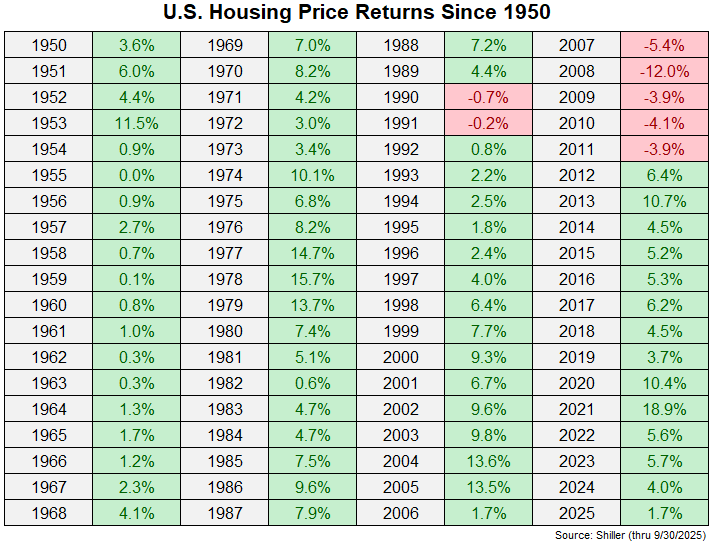

According to Robert Shiller housing data, prices are up 6% in 2023, 4% in 2024 and about 2% (so far) in 2025.

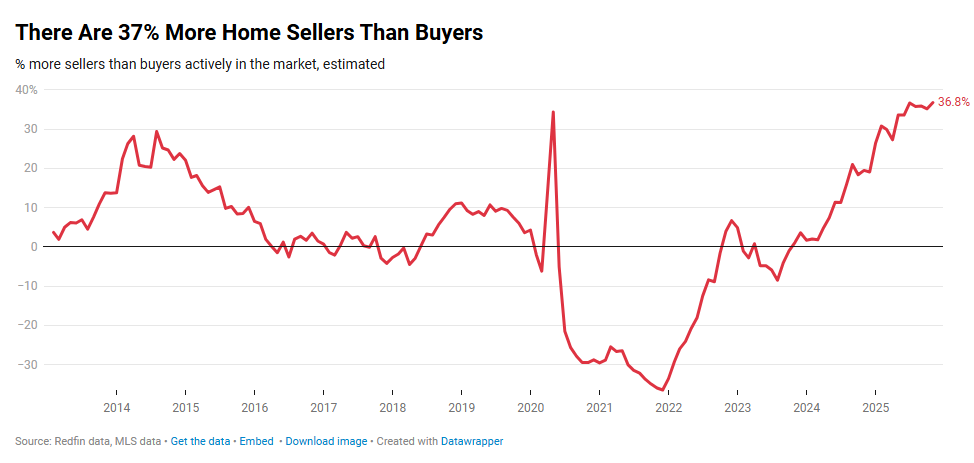

However, I think you can make a case that consumers are finally fighting back a little bit and saying enough is enough.

RedFin Data Estimates Sellers Purchased by Buyers of Main Line Exits:

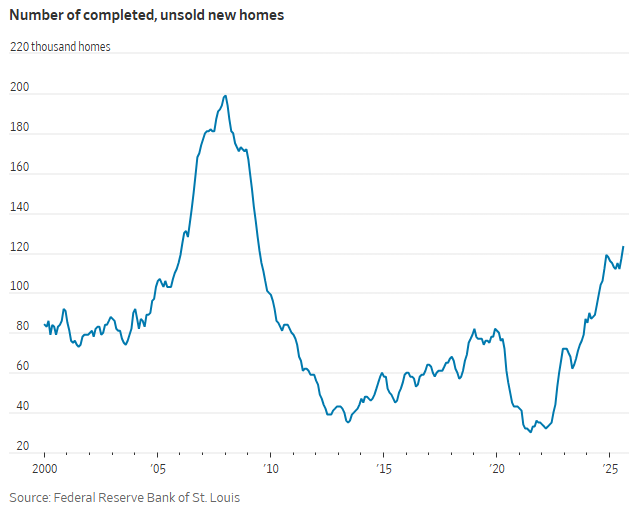

The Wall Street Journal says that builders are struggling to load new homes despite offering rock-bottom prices:

America’s biggest builders are struggling to sell homes even if they offer buyers 4% mortgages. Their experience suggests rate cuts alone will not be enough to boost weak sales in the broader housing market.

The number of new homes completed but not seen has reached levels last seen in the summer of 2009, data from the Federal Reserve Bank of St. Louis Show. At the end of last year, builders hoped that sales would recover by 2025 and tens of thousands of units were built to provide enough spring shopping season. But the demand was not picked up, and many households remained unoccupied.

The number of new, vacant homes is rising rapidly:

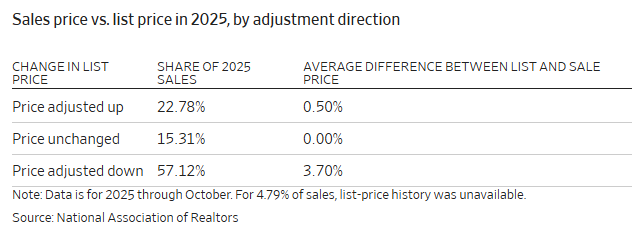

And real estate is now seeing marks. NAR data shows that nearly 60% of homes sold by 2025 come with at least one price cut.

So why aren’t house prices going up?

One reason home prices across the country are falling so often:

Prices have fallen identically seven times in the last 76 years. And those 7 years were combined into two different financial crises – the savings and loan crises of the 1990s and the great financial crisis.

And while prices crashed more than 25% in the DEBACTION of 2008, it only fell 2%.

There were 11 recessions in this 78-year time frame since 1950 so even if there is a recession it is unlikely that home values will fall.

House prices do not fall on a firm basis. If you hold onto hope by accident, you may be waiting too long.

However, these are the prices across the country.

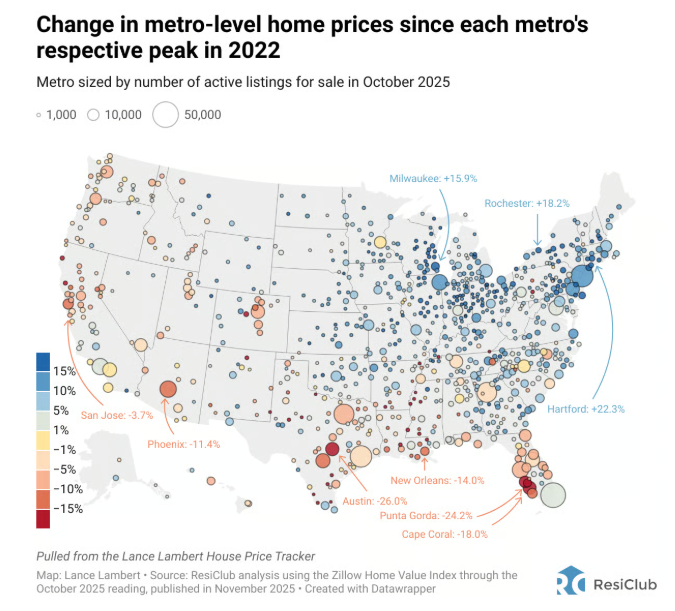

Everyone knows the local houses. In some parts of the country, house prices are already falling.

Lance Lambert points out that there are parts of the country where home prices have fallen, in some cases:

The housing market in the south is seeing some houses that are the size of houses. Places such as Austin (-26%), Cape Coral (-18%) and New Orleans (-14%) remain in double-digit declines.

It is also true that the regions with the highest prices are experiencing the biggest price booms of the last ten years. From the summer of 2020 to the summer of 2022, home prices increased by nearly 70% in Austin and Cape Coral. But the good news is that some of them are too active in these areas.

Some sanity have re-entered the market in certain areas.

This year has been unpredictable in many ways so I’m not sure it makes sense to make this kind of prediction for more than one year.

My base case would be that house prices are likely to focus on the recovery of money to play catch-up – bad rates can’t be fake rates that surprise me above 6%.

Lower mortgage rates can open up demand for buyers on the sidelines. But what if these lending rates fall because the economy slows down or enters a recession?

Even if there is some sort of correction in the near term it’s hard to make a case for a total crash.

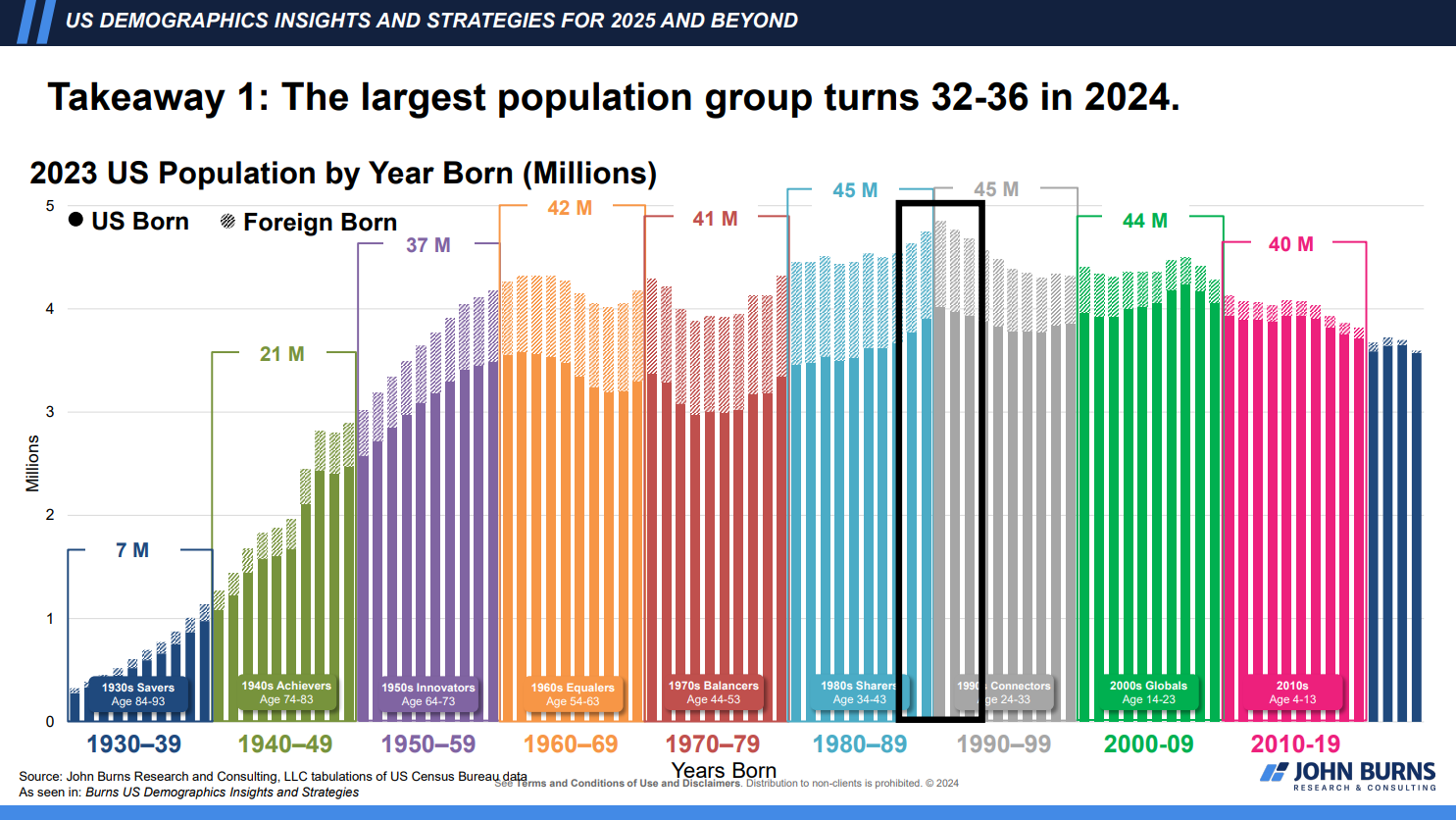

You still have the demographic tail when it comes to housing demand in the older age bracket in the US, according to HomeBuing.

It wouldn’t drive me crazy to see prices fall because they rose so quickly but I would be surprised if prices fell.

I delved deeper into this question with a recent compilation of questions:

https://www.youtube.com/watch?v=ieke8eo9sna

Bill Speet joined me for our 200th episode (!) to answer questions about the benefits of Roth IRAS for early retirement, how to save, how to handle retirement planning risks and how members should manage their money.

Further reading:

4 questions about the housing market