Why Vanguard Icon Jack Bogle Promotes Low-Cost Investing

Investing doesn’t require checking earnings reports and analyst forecasts, trying to identify stocks that are about to take off. In fact, the key to reaching your long-term financial goals is often to keep investing simple.

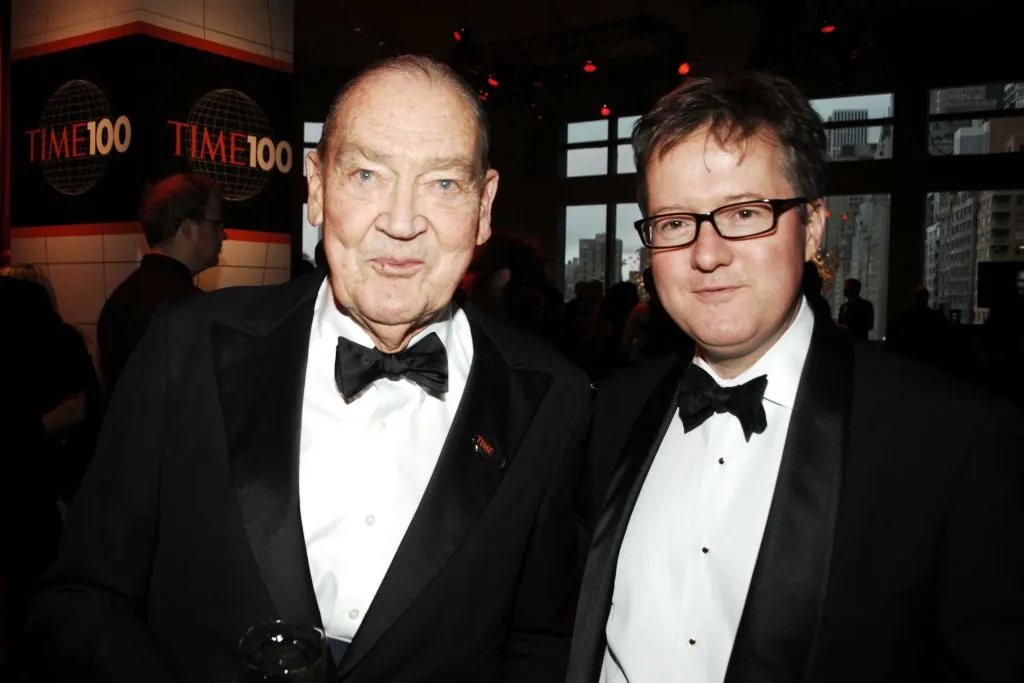

Vanguard founder Jack Bogle pioneered low-cost investing, ushering in a new era of affordable mutual funds and exchange-traded funds (ETFs). If you are 50 years old and about to retire, you may be wondering how to adjust your portfolio to fit your risk tolerance, time horizon and goals. Bogle’s low-cost investment model can help – and implementing it can be easy.

Consolidating power of low payments

Investing in cheaper index funds instead of funds with higher expense ratios won’t change your returns overnight, but it can result in big savings over time. There are plenty of ETFs like the S&P 500 and other popular benchmarks with expense ratios under 0.10%. Funds that charge 1% of the fee rates look very unattractive in comparison.

For example, someone with $500,000 in their portfolio invested at a 1% expense ratio will pay $5,000 in fees at the end of the year. But someone investing the same amount in funds with 0.25% expense ratios would pay just $1,250.

Gold Offer: Sign up with American Hartford Gold today and get a free investor kit, plus get up to $20,000 in free silver on qualifying purchases.

Why simplicity reduces risk for late-stage investors

Bogle’s recommended approach is to invest in a few broad index funds and have long holding periods. That way, your wealth is not dependent on a single stock or sector. It rises during bull markets, but losses tend to be worse during bear markets and corrections.

Consistently buying shares of index funds on a dollar cost basis, such as monthly, and holding for a long time helps you avoid making investment decisions based on emotion.

Save Smartly: Manage your money with Rocket Money’s budgeting app, one of Money’s favorites

How to go ‘Bogle style’ in the 50s

Applying Bogle’s investment advice in your 50s may not require major changes. It involves an audit to see what funds you have invested in and how much you are paying in fees. If you are not diversified across assets, such as stocks and bonds, domestic and international assets, and assets of various sizes and sectors, invest in funds that offer more diversification. If you’re paying more than you’re comfortable with in fees, you can sell shares at higher interest rates and invest in affordable ones.

As you approach retirement, it may make sense to increase your retirement savings accounts so you can enjoy tax benefits along the way. While Roth accounts protect you from taxes on withdrawals, a traditional retirement plan allows you to enjoy tax-deferred contributions.

Extra Money: See how you can get up to $1,000 in stocks when you fund a new SoFi investment account

Analyze your current tax situation and what tax bracket you expect to be in in the future to determine which type of account you should invest in. Tax diversification can also help reduce risk and costs in retirement: Many investors invest in employer-sponsored retirement accounts such as 401(k)s, as well as individual retirement accounts (IRAs) and taxable brokerage accounts.