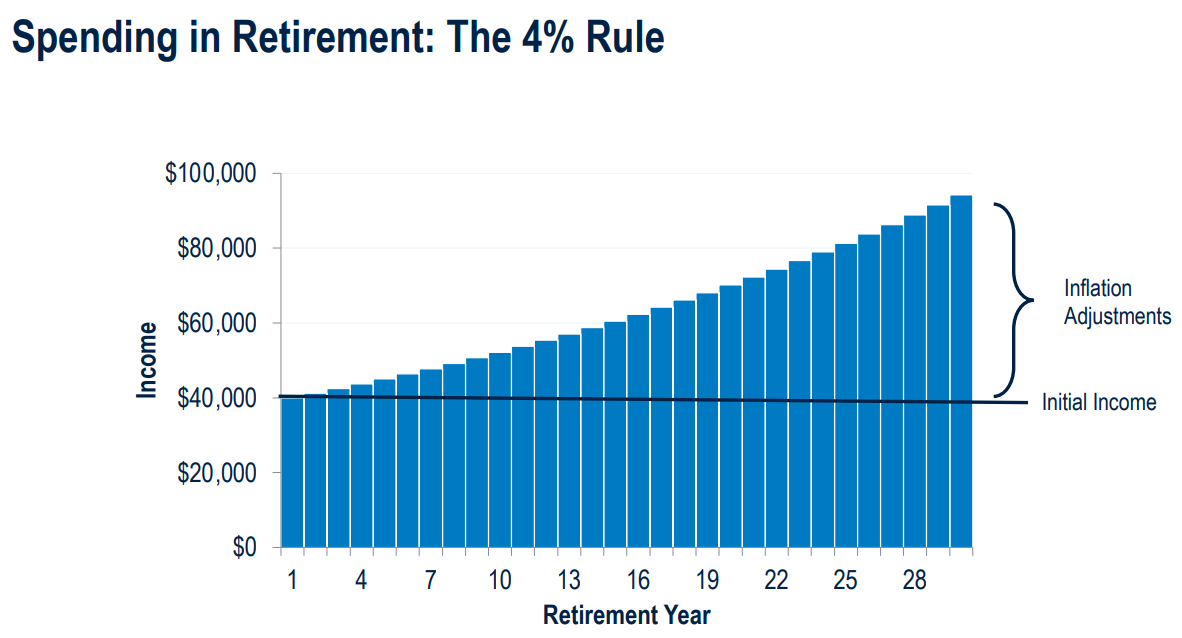

Why the 4% rule is like a 2% law

I talked to Bill Bengen last month about his 4% Retirement Rule.

I have been receiving all kinds of questions from retirements and people approach retirement for what the right amount is: Should I take 4% to my portfolio? 4.5%? 5%? 7?!!

The truth is no appropriate answer to something like this.

The best strategy of retirement requires fluctuations and maintenance of courses according to the nature of the market, inflation and your financial spending standards. No one is following this thing like it showed in the spreadsheet.

Whatever your desired number is spoken by drawing your portfolio, we have a research indicating how much people spend their portfolios during retirement.

Is low than 4%.

David Blanchett and Michael Fanke examine how much retirement he spent from their various fees of the receivables. Their research received the following:

- Retired ones spend about 50% of their storage.

- Taked children 65 years of age at least $ 100K that is used for just 2.1% annual from qualified and informal accounts.

- The highest 20% of the total can spent over a million dollars over what they spend more than 30 years of life.

Most retirements are worried about 4% legal but most of them are nearing such a safe withdrawal measure for many reasons.

I feel people who don’t want to touch the principal and want to spend their portfolio money. You can always sell stocks in your investment creation to create distribution but many people cannot bring.

There is an existing psychiatric problem because you worry about taking your money, inflation, high health costs, high risk sequence, something from the left field.

It is a world’s first problem, but a problem for a particular part of the people.

It is interesting enough, money to solve the problem problem of some people.

Blanchett’s research shows that a retirement retirement is often spend more than those who do not have a certified mat. Annuitissities actually pay for the episode of your principal to spend but many people find comfort in that general benefit. This is reasonable because most of us are used to get the payment.

The lack of paycheck is one of the horrors of retirement.

The problem Most people are very similar to the finances such as Colonoscopy, advisers are included.

There are many dichotomies like this when it comes to financial arrangement.

I find this article interesting and many angles to cover here so I talk to Blanchett to learn more about earnings, enjoy your counselors, 4% and more:

https: /www.youtube.com/watch? v = Oou5Gdifwxpc

If you are a financial advisor, subscribe to our YouTube station and newspaper for more.

To learn more:

Is the rule of 4% still working

This content, containing security related ideas and / or information, provided for information purposes only and should not depend on specialist advice, or allow any services. There can be no guarantee or guaranteed that the views expressed here will work at any facts or circumstances, and should not depend on any way. You must contact your counselors in respect of the Law, business, taxes, and other matters related to any investment.

Comment in this “Post” (including any flowers, videos, and social media) reflecting personal opinion, opinion, and analysis of such comments, and should not be considered by the comments of Ritholtz Welply Management LLC. or contacts or as description of the advice services provided by Ritholtz Welpz Welice Management or Refund of any Kitholtz Welp Welice Management Clever.

References in any defense or digital goods, or operating data, for display purposes only and they do not recommend investment or donate funding services. The charts and graphs are provided within the information of information and should not be honest where he makes the investment decision. Past performance is not shown to future results. The content only speaks from the date indicated. Any assumption, display, foreclosure, guidance, prospects, and / or ideas that have been expressed in the material can change without notice and may vary or contrary to the opinions.

Comound Media, Inc., the Affilory of Ritholtz Wealth Management, receives the payment from different organizations to find ads on the integrated podcasts, Blogs and emails. Such ads installation does not do or be allowed to sync, support or support, or any of its encounter, is the content conductor or its employees. Investment in achieving involves the risk of loss. With additional advertising efforts they see here:

Please check the disclosure here.