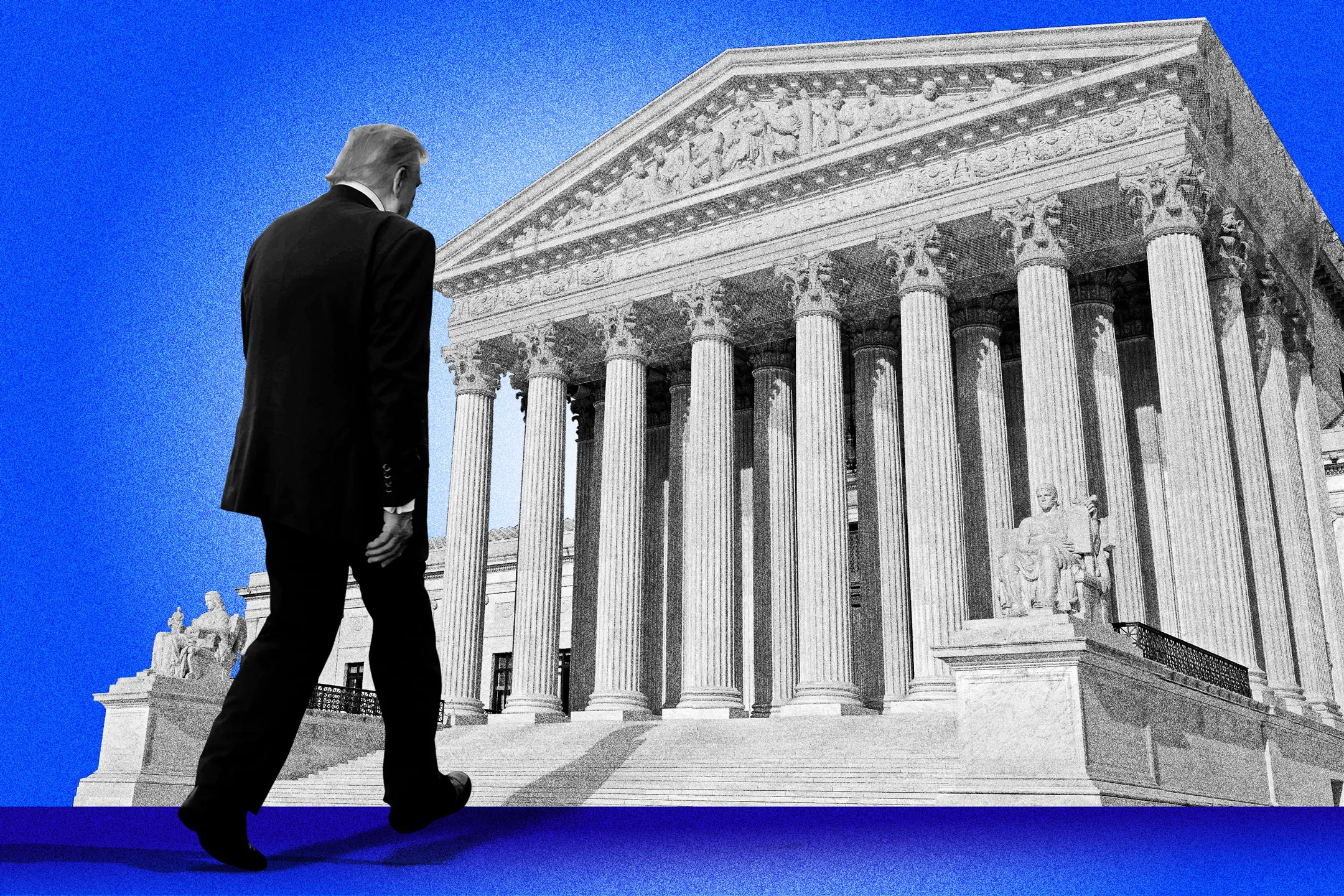

Are Trump’s tax rates a tax? Scotus has an oral weight

The US Supreme Court heard highly anticipated oral arguments on Wednesday in the legal arena for President Donald Trump. It is a crime that the President calls “the life” of the “nation’s life”.

The Trump administration is seeking approval to maintain tariffs ranging from 10% to 50% in many countries. The President’s lawyers are seeking a reversal of the appeals court’s ruling that said the White House does not have jurisdiction over the neighborhood tax plan.

Lawyers for both sides said their cases in front of the nine highest cases for more than two hours on Wednesday, opposing doctrines, oral teachings and the interpretation of principles that can determine the fate of taxes.

When Justices Amy Coney Barrett and Neil Gorsuch pressed the lawyer representing the Trump administration with tough questions, some analysts said it seemed that it was not inclined to listen after the joke before it was organized. But over time, the attorneys general faced their own tough questions about whether the tax rates were authorized by the President’s executive power.

It remains unclear whether at least a few of the court’s judges, with a conservative majority, are leaning.

For consumers, integration of learning resources v. Trump and Trump v. VOS options may be one of the most extreme economic conditions in recent history, affecting everything from stock prices and the labor market. Trump’s tariffs are intended to boost American productivity, but they risk causing inflation. Taxes are also always deeply controversial.

Trump said that winning the tax case will make “financial security and security for the whole country,” the trade fair is worth negotiating with countries “who are committed to social reality on Tuesday evening. However, economists who promote free trade say that tariffs stunt the economy and result in higher consumer prices.

Summary of Scotus Oral Regons in the Trump tax case

Democrat-led states and businesses filed lawsuits back in April challenging most — but not all — of Trump’s taxes, ultimately leading to opposition to the bailout funds.

The Trump Administration, represented by Attorney General D. John Sauer, pointed out that the International Emergency Economic Powers Act, or Emergency, gives the President the power to impose tariffs. Before his announcements on “liberation day,” Sauer said, Trump had decided that “the freakish mess has brought us to the brink of economic and national disaster.” That was in addition to the drug trafficking of opioids, which constituted a secondary emergency.

Sauer said: “These emergencies are killing the country and they are not sustainable.

Neal Katyal, one of the lawyers representing small businesses, said that the President does not have the emergency authority to impose tariffs on many trading partners. He pointed out that Trump has imposed a 39% tariff on Switzerland, a partner in the US that actually conducts the rest of the trade.

“Taxes are taxes,” Katyal argued in front of the excuse. “They’re taking dollars out of America’s pockets and putting them into the wealth of the US.”

Is the tax a ‘tax’ on American consumers?

Sauer suggested that Trump’s tariffs are controlled by foreign trade, not tariffs. This is an important question in this case because, constitutionally speaking, the power to tax lies with Congress.

But Justice Elena Kagan, nominated to the court by Barack Obama, pushed back on Sauer’s line of thinking: “You want to say that the tax rates are not taxes, but that’s exactly what they are.

Barrett, who was nominated by Trump in 2020, appeared skeptical during the national debate about whether the power to “manage” the importation of the Ieenda document that includes the power of taxation.

“Can you point to any other . . . time in history when the phrase ‘Import Control’ was used to justify a tax authority?” he asked.

Chief Justice John Roberts, a George W. Bush attawtee, also noted that Ieeena “has never been used to determine taxes,” adding that “nobody has argued against it.”

After all, many consumers are always worried that the tax rates will act as a tax in the form of higher prices. Prices have been rising rapidly, with prices rising by as much as 3% in September. Goldman Sachs and Bank of America estimate that prices have increased by about half a percentage point for the year.

When will the supreme court rule on taxes?

With oral arguments being made, the court can issue its opinion at any time between now and the end of its term in June or July.

The Supreme Court granted the administration’s request for a “quick review”; However, that does not come with a set deadline. The administration is asking for a quick turnaround because the long delay increases the “economic disruption,” according to the announcement by the secretary of Scott Decrent.

Tax rates will continue to be in effect for the time being. On the social front, Trump said the country would be “unprotected” against other nations in terms of trade if the Supreme Court holds down.

However, this Supreme Court case will mark the end of tax rates, whatever the outcome. The administration says it has a plan b to justify the limited tax rates for other reasons. In recent weeks, Trump has also added some special tax rates, which are at high risk of legal challenges. And the existing tariff rates for steel, aluminum and cars are not dependent on Ieeesta and are not affected by this case.

More from money:

Will the Supreme Court stop Trump’s tariffs? Experts weigh in

Should you invest your 401(k) in private equity?

Retirees are panicking prices that will cancel social security exits