Reviewing My Heaviest Bundle

Warren Buffett always had a place on his desk with a sign written in big letters that read: VERY VERY MUCH.

Buffett reads a lot. When he learns something he doesn’t understand or is too difficult to predict or too complicated, it goes into a very tight box.

There are a lot of things in my hardbox right now:

Individual stock selection. I have retired from picking stocks in my brokerage account like 7 times now. I think it will eventually stick to this. I’ve had some luck with my picks, but stock picking has never been my strong suit.

I also find that 95% of my attention is placed on 5% of my portfolio when I own individual stocks.

Rule-based strategies that get the emotions out of the system are much easier for me to stick with and cause much less brain damage along the way.

Predicting major cycles. People have been predicting bubbles and recessions for 17 years straight. None of them were right.

It’s fun to guess what will happen based on what’s happening now and what happened in the past.

But it really doesn’t help my investment process to predict what will happen to the broader economy.

Even if I knew what was coming, I’m not sure it would make it easy to gauge investor reaction or policy.

The US health system. There are some big problems we have as a country that have specific solutions.

Social Security requires some changes in the estimated retirement age and the tax coverage of high earners. The housing market needs more supply and less red tape for builders.

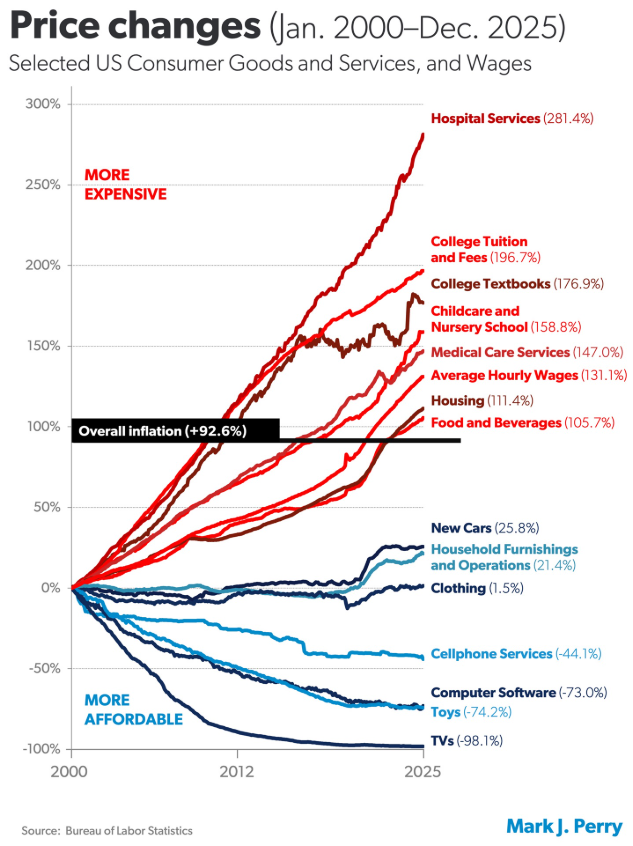

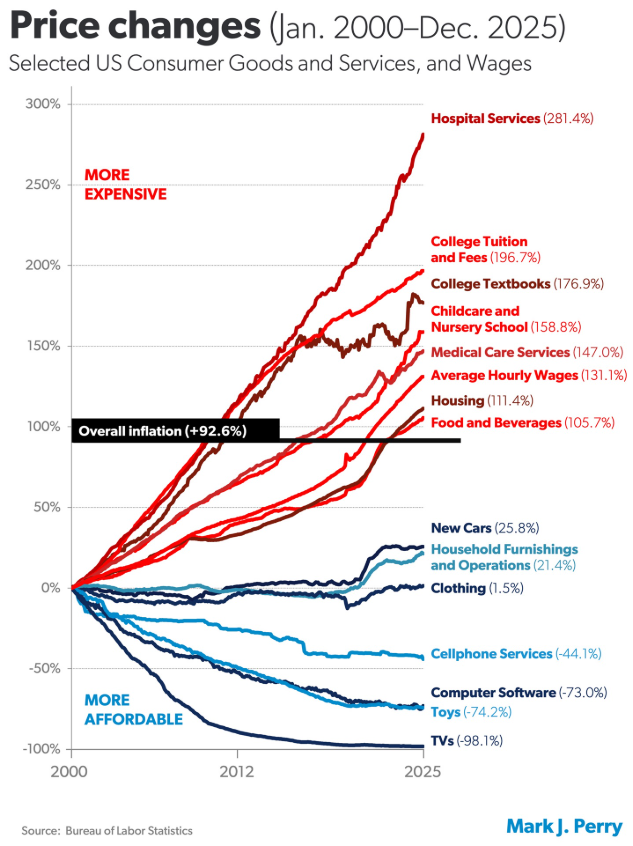

I don’t know how we fix health care in this country without blowing up the system and starting over. Check out Mark Perry’s century chart of various inflation factors:

Wages were higher than overall inflation. That’s good news. College education eventually came to a halt. But look at the hospital facilities.

Hedge fund managers can make a killing with a performance chart that goes up and to the right in such a smooth line. That’s an off-the-charts-good Sharpe Ratio.

How do we reduce health care costs when we have 70 million people entering their retirement years who will need all kinds of health-related care in the coming years?

I don’t know.

Youth games. When I was growing up it was easy. Play for the YMCA team when you’re young, then play for your school. No club games. There are no AAU teams. There are no crazy tryouts when you’re 7 or 8 where adults judge you and make you feel good or bad about what team you’re on.

Everything was greatly postponed.

Now it is very competitive and intense. Parents find coaches for their children in primary school. If you don’t make a team in 5th grade they make you think your child’s work is done. People spend thousands of dollars on out-of-state tournaments for their middle school kids.

It costs thousands of dollars to join these groups. It’s crazy.

How did we get to this place?

Are my children participating? Yes, I’m a hypocrite playing the hand I’ve been dealt.1

Picking AI winners and losers. Here is a question from a reader on this topic:

I heard Michael talk about dumpster diving in software stock for trade (in ETF). I’m curious if you are surprised by these software stocks that have bombed. Does anything seem good about the trade? What about a long-term position? Asking for a friend.

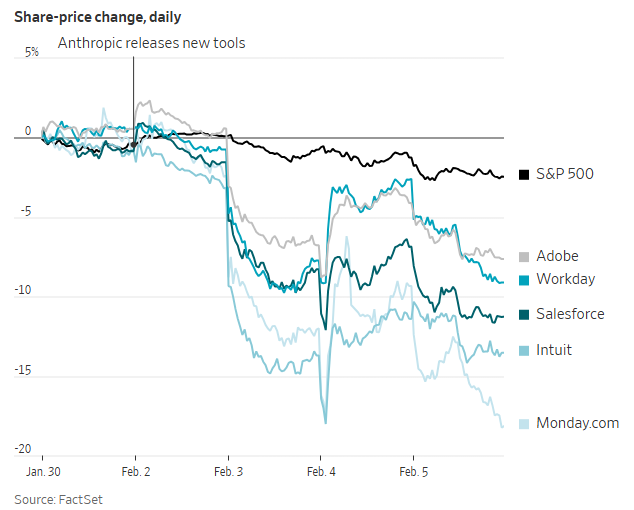

The Wall Street Journal had a piece this week about how AI is eating into software stock performance:

Here’s your gist:

On Thursday, Anthropic unveiled its most advanced model yet, capable of integrating data and analytics, using teams of coding assistants, and tasks like product management. Shares of software companies including Salesforce, Intuit and others fell again on Thursday, although more slowly than earlier in the week.

And the chart:

The software stock complex is now in worse shape than the Independence Day panic:

Some great names that absolutely smoke:

Is now the time to go bottom fishing? Catch falling knives? Go dumpster diving for software stocks?

On the other hand, the moats of these companies can be broken forever with the arrival of AI models and agents. Why pay someone else for software that you can develop and manage yourself?

On the other hand, how many companies will be able to get comfortable with writing vibe code for the critical systems and work tasks of their customers and employees?

These companies may have lost their pricing power but it wouldn’t surprise me to see a few winners emerge from the rubble.

Still, I’m not in the business of picking winners and losers in the AI revolution.

I own stock market index funds. I own the Nasdaq 100.

I will let the winners and losers sort themselves out and make my index funds benefit the winners.

AI moves at lightning speed. Winners and losers change every week.

It’s very hard to know how this will play out so I’m not playing.

Josh Brown joined us on the show this week to help answer this question:

We also discussed questions about Netflix, setting trailing stops, mobile debt and how to manage wealth as a young advisor.

Further reading:

Iceberg Crash

1To be honest my two youngest are still playing for Y in b ball right now.