Why does ultra-giachy invest more money

“Let me neatly tell you,” F. Scot FinensGerald wrote 99 years ago. “They are different from you and me.” However, even though he has a lot of money, It is emerging that they are concerned as generalism by protecting their nest eggs from the stock market.

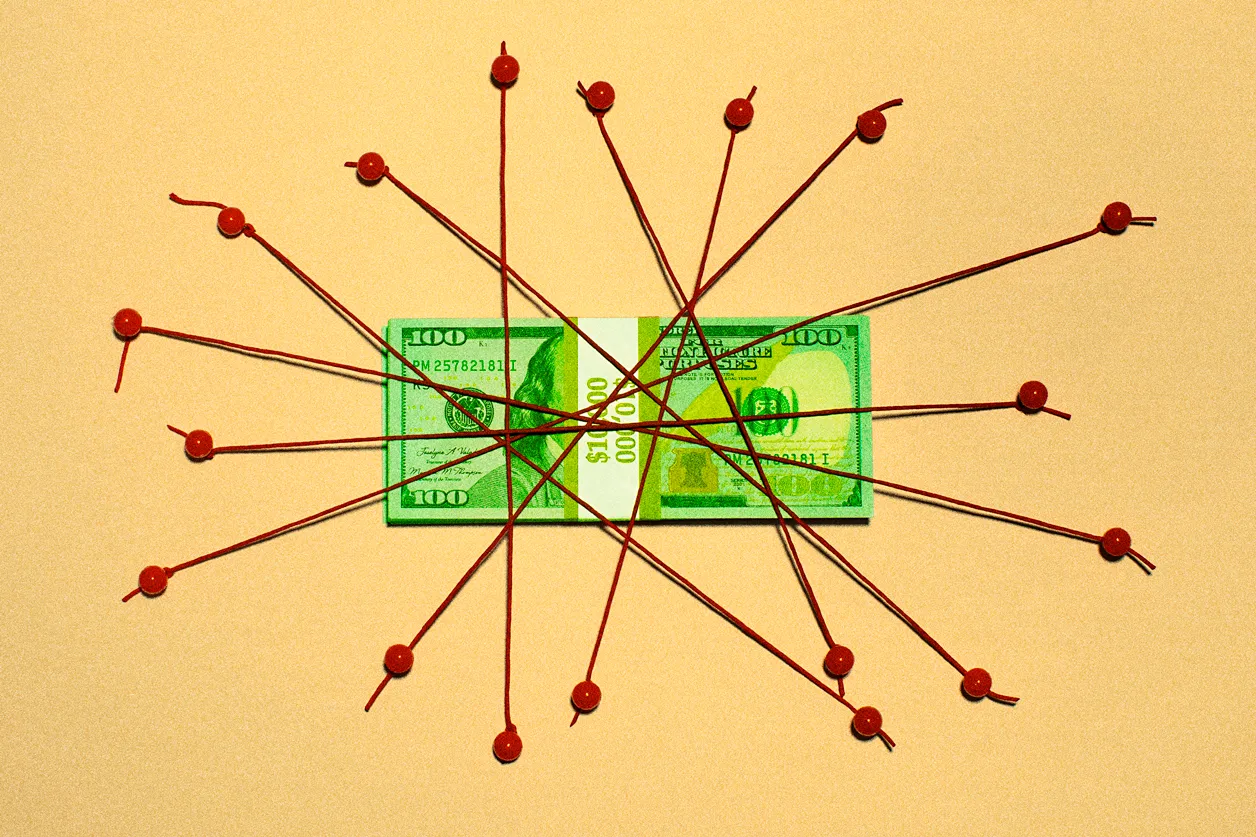

According to Finctrx, an analytics company that includes the data at Ultra-High-Funcy’s office (Uhnw) investors (UHNW) investors, specific investment deals that fall by 32% across the first six months of 2025 months.

These findings are not surprising with rich investors. John Zimmerman, the Ascent Capital Management Management Management Management Mandi, says he sees two ways from his Uhnw customers.

First, those Who are involved in businesses or industry that have a major impact on the reduction strategies for reduction. Second, Those who do not need to market currently put their money.

“There is no urgency for them to send the capital,” Zimmerman said. “All basically say, ‘We will wait and see what happens.'”

Interest and external AI

Uber-rich Uber investors even provide popular investment measures and a rotating cycle similar to the health care in the cold shoulder, reports the CNBC. It was found that the only nature of the business where accurate investment produced within the first half of the year was associated with artificial intelligence.

Counselors who work with this people can verify that. Zimmerman says: “Companies involved with AI continue to be interested,” Zimmerman said. “We are in the well conducted by expertise.”

Although this continues to continue, Zimmerman advises. He says: “Balisa is very difficult to see because repeats are very high,” he said, a victim of hope and hopes that might or may come to plants.

“If you are a Fundamental investor, the price will be very difficult,” he said.

Jonathan Flack, US and the World’s Worldwide Family Discussion Office of PWC for PWC, says the other way at Uhnw’s challenge to focus on the use of the Ai.

“They actually invest in data centers and difficult goods that will be required to support AI and the growth of AI,” Dlack said on the CNBC interview.

Divorce provides cash flow and reducing the risk

Nancy McColgan, holding the Director of Verdlence Family, the division of student financial advisers, says her clients at Uhnw today is looking at the skin of the skin. “We don’t have many family offices wanting to invest in direct layouts.

Money-generating goods also look for more among Uhnw investors. “In some cases, they may be looking for goods that cast money dropping on money can only be different from growth,” McColgan said. He notes that when marketing appreciation has been solid, much of this staff is driven by tech companies that have the future powerful but does not offer distribution.

“Obviously, stock market has produced many growth, but is very focused. They also want to ensure that their productive portfolios,” he said. His customers are interested in categories such as power and services, and other infrastructure assets such as paid roads and bridges.

The Real Estate has other Averets Class Class Classs who want its strength to produce money.

“Almost all our Ultra-High-high interested customers are interested in a real estate in some way,” said Zimmerman. When there is a lot of economic uncertainties, “the visible assets are inclined when people resurrect,” he said. “Real buildings are often a safe place in these times.”

The Real Estate can provide free fluctuations and flow of money, especially the construction types of skills, McColgan adds. “Certainly, households in many places, is a good thing to live,” he said.

You don’t need to be rich to invest as they

While wealth opens in investment opportunities for planting many people with just 401 accounts

Most of the time, this means having a plan, adhering to and evaluating investment in their base in hype – good or wrong.

“I just see a lot of examining,” Vicki Odette, partner at the Hynes Boone Law field, tell CNBC.

“Every investor should make sure that he or she does not overact on the market work,” McColgan said. “Draw close to any type of market active market with caution but do not approach ‘You must do something quickly’ mind.”

Much from money:

Stock Market Analysts (carefully) hope as tax fear die

Buffett identifier is in love with high records

What financial advisers are telling people financial advisors in the United States to do with their own money