Bilt Blue Card Review (New Card, No Annual Fee, $100 Building Cash Offer)

Application link

Terms apply

Features and Benefits

- $100 Bilt Cash Welcome Offer: Earn $100 in Bilt Cash when you apply and are approved.

- This card earns two different types of rewards: Bilt Points and Bilt Cash, which we will explain in detail below. Based on our estimate (not an official estimate from Bilt), Bilt Points are worth about 1.6 cents/point, because our 1:1 transfer partners include several high-value programs like Hyatt, JL, AS, and UA!

- Earn 1 Bilt points for everyday spending (ie, excluding rent and mortgage).

- How to get points for rent and mortgages is complicated, see Bilt 2.0: Explains Two Options for Scoring Rents and Loans for your information.

- Cellular Wireless Telephone Protection.

- No Foreign Currency Transactions.

Bilt points overview

Bilt rewards points are variable and valuable. Its 1:1 referral partners are:

- Acco (3:2 ratio)

- Aer Lingus (EI) Avios

- Alaska Airlines (AS) Mileage Plan

- Air Canada’s (AC) Aeroplan

- Air France (AF)/KLM FlyingBlue

- Avianca (AV) LifeMiles

- British Airways (BA) Avios

- Cathay Pacific (CX) Asia Miles

- Emirates (EK) Skywards

- Etihad (EY)

- Iberia (IB) Avios

- Japan Airlines (JL) JAL Mileage Bank

- Marriott

- Qatar Airways (QR) Privilege Club

- Southwest Airlines (WN) instant rewards.

- Air (NK) Free Air

- TAP (TP) Miles&Go

- Turkish (TK) Miles & Smiles

- Virgin Atlantic (VS) Flying Club

- United Airlines (UA) MileagePlus

- World of Hyatt

- IHG

- Hilton Honors

- Red Maiden

Note that Hyatt points, JL miles, AS miles, and UA miles are very valuable and not easy to earn.

Bilt points can also be used on the Bilt travel portal, powered by Expedia, at a flat rate of 1.25 cents/point. While this isn’t the best way to spend Bilt points, it is a flexible way to redeem points.

Bilt points can also be used as statement credit at a fixed rate of 0.55 cents/point. It is not recommended to use points in this way because the average is too low.

Bilt Cash Overview

Bilt Cash is a newly introduced rewards program for Bilt Card 2.0, and is separate from Bilt Points. Cardholders earn 4% Bilt Cash on purchases made with the Bilt Card (rent and mortgage payments excluded). However, Bilt Cash expires:

- Bilt Cash earned expires at the end of the same calendar year. Up to $100 in Bilt Cash can be carried over to the next year.

Bilt Cash cannot be issued as a statement credit. Its main rescue options include:

- Convert to Bilt Points: When paying rent or mortgage, cardholders can choose a non-payment mode (otherwise a 3% fee applies) and convert $30 to Bilt Cash → 1,000 Bilt Points, up to the current building value (for example, a payment of $2,000 allows the conversion of up to 2,00 Bilt points).

- Eligible purchases: According to Bilt’s official list, Bilt Cash can be used in the Bilt app to adjust spending in the following categories: hotel reservations through the Bilt Travel Portal, Lyft, fitness classes, purchases at partner restaurants, Gopuff home delivery, and Bilt Collection. The exact limits and salvage value of this use will need to be determined after the program is fully implemented.

- Status upgrade: On Hire Day, Bilt Money can be used to temporarily upgrade your Bilt membership status.

Bilt Elite status overview

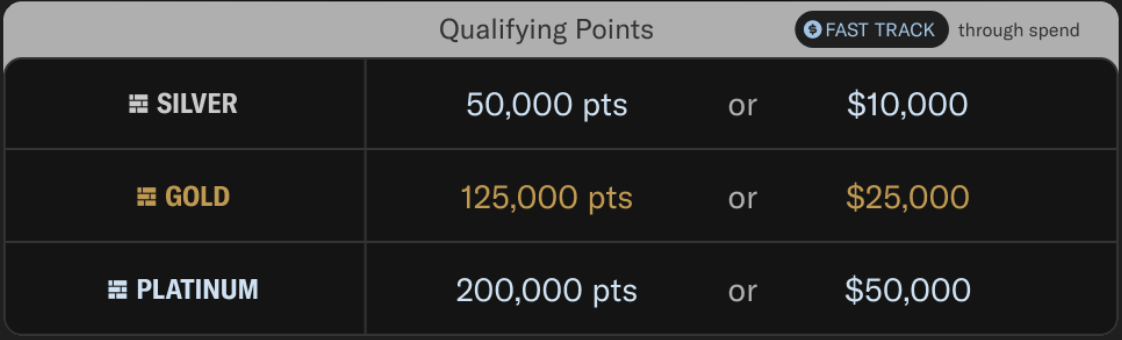

Bilt has the following Elite Status categories:

Except for Blue, which you get automatically when you sign up, the requirements for each category are as follows (note that rent payments do not count towards spending requirements):

After reaching a given level of Bilt Elite Status, you can unlock additional benefits during special promotions. For example, Bilt has previously offered referral bonus promotions on Hire Day, and members of the top tier can receive larger referral bonuses.

Related Credit Cards

| Card name | Bilt Blue | Bilt Obsidian | Bilt Palladium |

|---|---|---|---|

| Annual Fee | $0 | $95 | $495 |

| Bilt Points Earning | 1x on rent, loan, and daily use | 3x on dining or shopping (choice of one; up to $25K/year in groceries); 2x trips; 1x on rent, loan, and daily use | 2x in daily use; 1x on rent and loans |

| Getting Bilt Money | 4% on daily use | 4% on daily use | 4% on daily use |

| Credits | N/A | $100 Bilt hotel credit ($50 every six months) | $400 Bilt hotel credit ($200 every six months); $200 Bilt Cash every year |

| Other | N/A | N/A | PPS |

Summary

In the era of Bilt 2.0, Bilt Points themselves have not changed—and are still very strong. Bilt continues to offer a variety of transfer partners, including some hard-to-find and highly valuable ones, and often runs generous transfer bonuses on Bilt Recruit Day, which is always Bilt’s biggest advantage.

However, one of the biggest selling points of the old Bilt Card—free rental payments—is no longer on the new card. The newly launched Bilt Cash also comes with an expiry date. Under the new system, if you want to pay off rent or a mortgage without cash while still earning Bilt Points, every $1,000 in rent/mortgage requires $750 in daily spending. Compared to the old Bilt Mastercard, this is less attractive. In addition, the system is very complicated and causes a headache.

As a card that can be paid off annually, its ability to earn points is also weak: Bilt Points are only 1x for regular spending. When marked against a 2% cash back card, even with the solid use of Bilt Points, it’s still hard to justify.

Historical Supply Chart

Note: Only the Bilt Points section is shown in the chart; the Bilt Cash section is NOT shown.

Application link

Terms apply

See the Guide to Benefits and Rates and Fees for more details.

If you like this post, don’t forget to rate it 5 stars!