Why did the stock market grows 15% forever?

Here’s a question we have received in the animal inbox this week:

They always say the stock market is back 10% in the last 100 years with high-industry. You you guys have You said that the New Mag 7 is a more rewarding way than companies. Who knows what the future holds but why everyone is in the pencil in leaves 4-5% because the markets are high? It seems that there is hope for newest gains of profit and new companies is the technical industry and industries. W wA HY NO N’T WANT that anyone thinks annual returns in the next 25-50 years will probably like 13-15%.

This is a good question in the thought.

If companies work well with higher beneficiaries should not expect higher restoration?

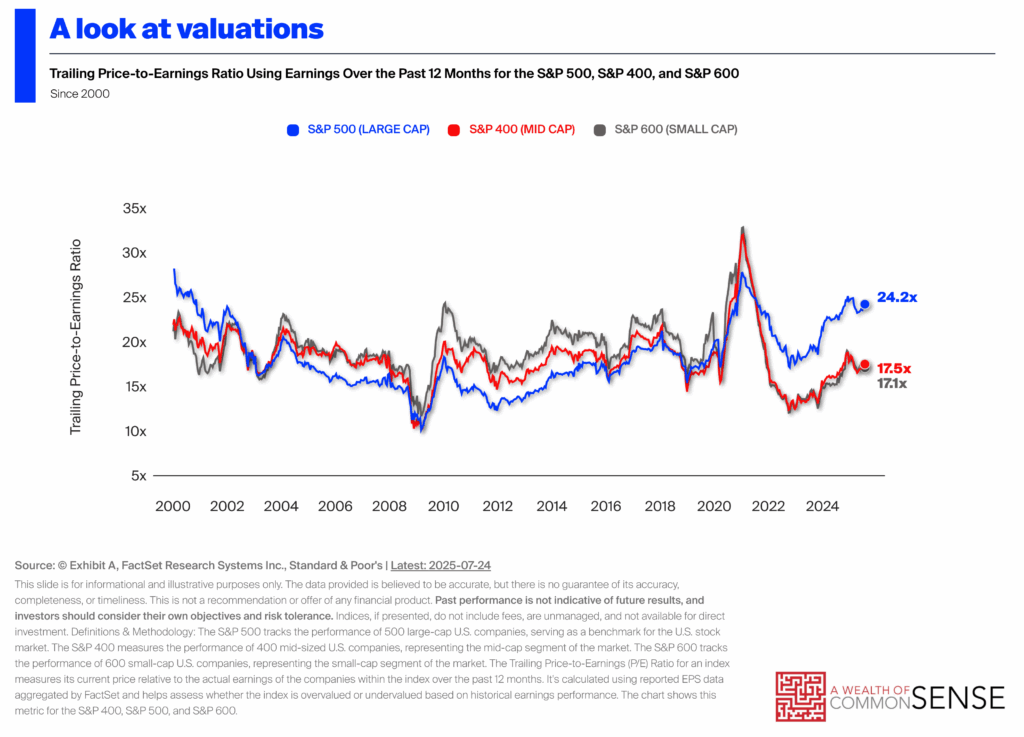

We may have just found this exact situation. But now the values show these facts:

Can the prices remain high or move forward? Certainly. It wouldn’t be possible when that happened. Prices if Be more because Tech stocks now rule the market.

But there are limits. Even under the high margins, company benefit and sales are still integrated with economic growth and use of consumers.

The economy has already been very grateful so it is impossible for us to get the same growth levels we have seen in the past.

The Law of Hleiber is the idea that great animals are more efficient than small animals. Geoffrey West wrote about this idea in his book:

If the animal is double the size of another (there are 10 lbs. VS. 5 000 Lbs.

Economic Economic is limited. West explains again:

We have already seen that a heavy massive mouse requires almost a number of 32 levels of support even though it has approximately 100 – a limited economic empowerment of the Licerber’s law.

Best Body Small Power should be produced per second to sponsor the tissue gram. Your cells work harder than your dog, but your horse’s work is so hard. Elephants survive less than 10,000 times but their metabolic values are only 1,000 times, even though she had 10,000 times many cells to support.

Elephants are more efficient than a mouse but they do not grow in the size of the cruise ship.

Exponential Returns of Market for ~ $ 50 trillion stock will eventually eliminate all the economy so that there are limits to growing prices.

This is also a bull market question. No one is asking this kind of question during the bear market. It is how it works.

This saw me thinking about the things that people say or think during bull and bear market:

Bullfare markets: It’s too early to sell and it’s too late to buy.

Bear markets: It’s too early to buy and it’s too late to sell.

Bullfare markets: I’m a clever person?

Bear markets: I am an idiot?

Bullfare markets: Why do I catch any bonds or cash?

Bear markets: Why am I not more obligations and money?

Bullfare markets: I will wake up later. I’m just a little higher I swear.

Bear markets: I will just wait until the dust remains.

Bullfare markets: Investing is easy!

Bear markets: Why do I do this to me?

Bullfare markets: Live live for a long time!

Bear markets: Buy and hold dead!

Bullfare markets: Losers’ separation.

Bear markets: I should have been frustrated above.

Bullfare markets: Why isn’t that?!

Bear markets: Thank God I don’t have you that.

Bullfare markets: Carefully.

Bear markets: Neglected hope.

Bullfare markets: That person who has wanted that the permanent accident is unfair.

Bear markets: That person who lives that the accident is bright. He saw it coming.

Bullfare markets: Quoting Warren Buffett.

Bear markets: Quoting Mike Tyson.

Bullfare markets: Someone destroys me.

Bear markets: No one is warring.

Bullfare markets: Looking after the charts all day with the hope that they continue to rise.

Bear markets: Keep charts every day in the hope that they stop going down.

Bullfare markets: This will last forever.

Bear markets: This will never end.

Michael and I discussed the moral market behavior of a bull and much of this animal’s video this week:

https: /www.youtube.com/watch? v = myfq0qmow0

Sign up for a compound to miss the episode.

To learn more:

Pandemic Babies & Market for the Calculary

Now here I read it later:

BOOKS: