Where did all the opponent go?

I had a jokes in the 2010s who walked like this:

I’m a broth.

Radius

It was a pleasure to always get out of the biggest financial crisis.

We all study Short.

Everyone wanted to be Steve Esman, Michael Burry or MereDith Whitney.

Like most of the market, the contranism moved far away. Everyone thought you were facing grain was a way of making money.

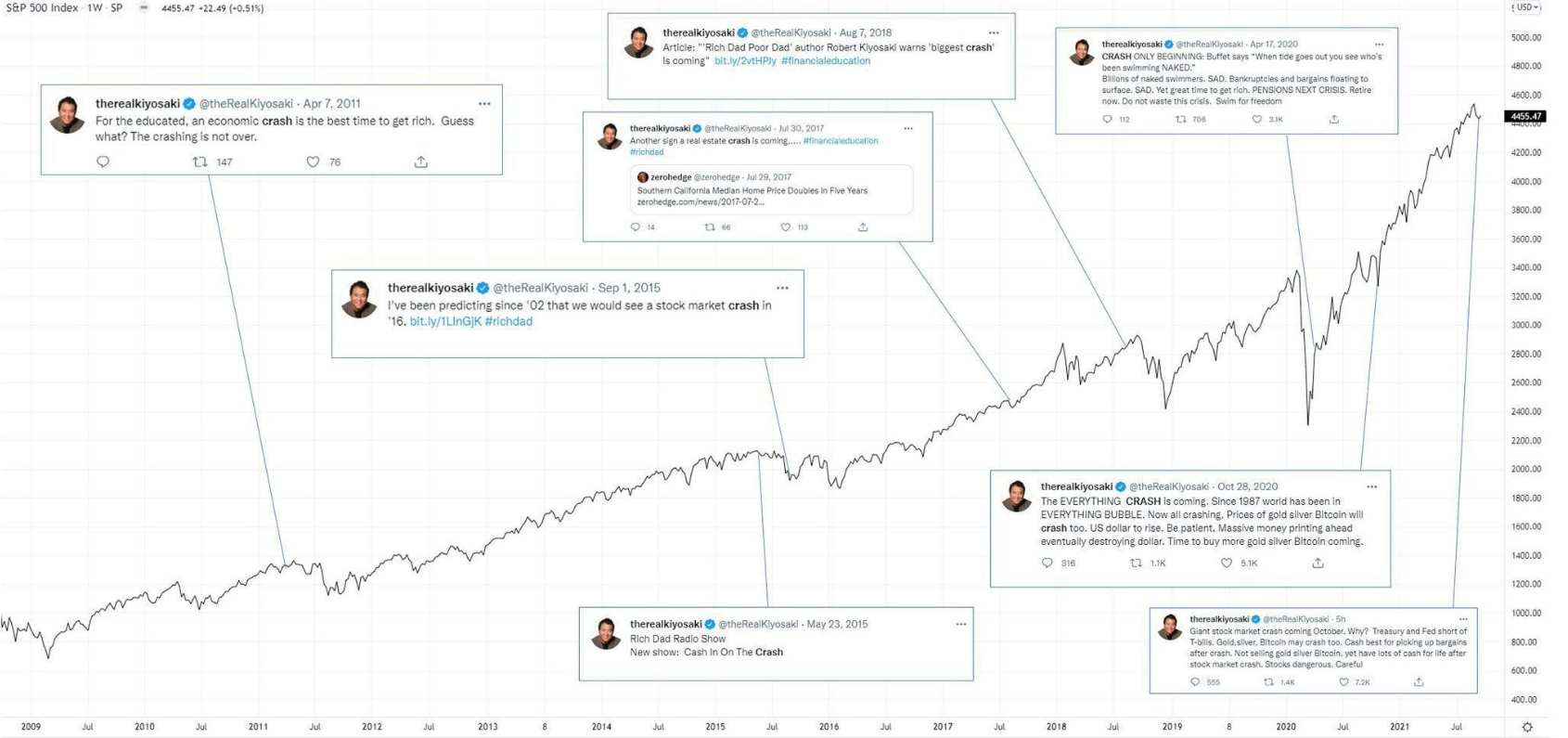

Hero Helge forms a permabears tracking one of the big bull market!

The investment office worked for investing a title bag with John Paulson’s bag. Unfortunately it was the Fund-of-Funds currency so the allocation was not greater enough to make a loss elsewhere. There was some regret that they did not grow.

Resentntly Bias is organized during the big time so after the disaster created a new investment bag only in the next large area. Investors were happy at the time at the time, but they were trying to bribe the Japanese Guests and other esoteric activities that had never worked.

A double-based trade of life does not go near often. Who knew?

It cannot mean that this bag was closed with a short order as the financial land did not appear every one year.

At the end of the 2010s Aprarian meeting began to change. The bull market was long enough to release all the crash calls. He died in the case of 2020s as the first level of mind beats the second rate pants. Everyone realized that making predictions are easier than making money when it comes to Perma-Contrationary.

I think you can say the new Buy a DIP The direction of mind is united in some ways. But in the early-2010 everyone thought that the market would appear again. Now everybody thinks he does nothing without going up. The shortest is included in a large mong.

He has people who made a portfolio changing life that changes lives, not in watching a herd but invested in it. Why would you sell NVIADI, Bitcoin, Tesla, Facebook, Reference Money, etc.? All the fastest falls back. Do not fight the habit. Up and right.

Permabears is basically divided and thrown into Pundit prison.

No one listened to these people again because they were not good for 15 years to understand. Whenever the people stopped people they decreased to all the situation where they wanted them to be attacked in the past and died.

That is the advancement.

There is also a big difference between legal robbers and permaleaar Charlatans deviations with your worst financial fear.

We begin to see some of the competitors from someone who is not concerned the current environment is far away.

Howard marks wrote new memo about AI, high calculation and why you are concerned:

OverValking existence will never be provenAnd there is no reason to think that the conditions discussed above which means it will be repaired anytime soon. However, they were taken together, and told me that the stock market was “raised” to “encourage.”

Burton Malkiel wrote OP-ED of New York Times on the article:

Here’s the World:

No one does not know where the stock market will go next. But there are bad symptoms that investor hopes for investors who may be in hand. The latest global packaging suggests the question of whether they make the same mistakes they have made in the past – mistakes can prove the main line. If history repeats, what can we do to protect our future?

OK, make sure. People have been saying that we are at 9th Inner from such 2017. What does this to investors mean? What should you do?

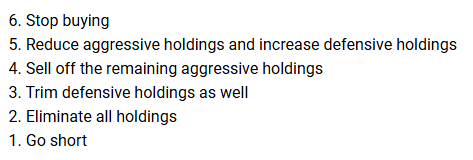

The grades offer specific options of fear of fear:

Here is his medicine:

Because “being overthrown” has never been a girl with “sure to go down shortly,” rarely go to those extremes. I know I have never had it. But I have no problem thinking that it’s time to sell 5. And if you lighten the expensive rising out of history and switch to things that seem safe, there may be little loss from the market. . . Or anyway is not enough to lose more sleep.

That seems reasonable for people who are worried about AI bubble explosive.

Malkiel gave the same advice:

Market time can damage the well-considered investment plan. Because the Bipolar Mark does not mean that you should also.

There are some actions of actions to take. Once you retire, and you need money soon, you should invest in temporary bonds for safe. Suppose you were on your late 50s, and your retirement fund is limited, for example, 60% of shares and 40 percent. Check to see if the recent increase in stock increases your equivalent position, perhaps about 75 percent. If so, sell enough stock to return to the assignment of 60/40 is good for your age and risk tolerance. Recycling periods is always reasonable and gives you a good opportunity to buy low and high sales.

The difficult part of trying to predict the most vulnerable markets that no one knows you are 1996 years or 1999 where. Everyone knows where you’re in financial trouble when it happens. Bubbles are not only known for the benefit of looking back.

I don’t know where we’re in it. There is a thoughtful behavior and using AI money in Binga is another one. But people have been calling this market because of the tenth. The market may look unreasonable longer than you think.

The opposite will be returned at a particular time.

The current environment cannot last forever.

But in the most time of the puppet is not good.

This practice is usually your friend … until they end.

Michael and I discussed operators, exposed markets and much more about the animal’s village this week:

https:/www.youtube.com/watch? v = zc8vxxx39io

Sign up for a compound to miss the episode.

To learn more:

Comprehensive is usually wrong

Now here I read it later:

BOOKS: