What if you pay your 3% fee early?

Working in the wealth management business has changed the way I look at and interact with so many other aspects of my life.

I’m always thinking about the daily connection between building the stock market and the economy. How does this business make money? What does it mean for consumer spending that the airport is busy today? I wonder how much that family spends most of their income in retirement and 529 accounts?

I read constantly. Working in the markets requires you to pay attention to what is happening. You don’t have to do it all, but there is a lot of reading, writing and thinking involved. Outside of work I do a lot of reading, writing and thinking too. Right or wrong, it’s hard to turn it off sometimes.

I got better filters now. People in the financial world are constantly offering opinions, analysis and predictions. When you do it long enough you realize that the wrong people are always like that, even the smartest (or mostly).

Financial performance has given me a better BS detector to filter out the noise in other areas of life.

Finance has taught me to keep my emotions in check. It has been hammered home over and over again the importance of keeping my emotions out of my finances. That’s not always easy but I’ve always spent years finding out that I can repay myself under my financial decisions.

Don’t humiliate me, I’m still human. I’m drinking too much, I’m crazy, I feel greedy, I’m nervous, you’re worried, I’m nervous and all the emotions.

But sometimes my wife wonders why I don’t show more enthusiasm. I don’t live too high or too low and it makes me think that studying behavioral finance all these years has done this to me.1

I am comfortable dealing with uncertainty. You have to be willing to say it I don’t know always work with the markets and focus on what you can control.

You have no choice.

I find this helpful in other areas of my life. The process results.

I’m a big mess with money. Wealth management requires you to work with many wealthy people. You basically have two options for how this makes you feel about money:

(1) He is constantly jealous.

(2) He becomes a circle in it.

Working with extraordinary wealth has brought me down. I know that acquiring great wealth does not guarantee contentment.

Don’t get me wrong, I still feel greed, fear, jealousy and all the other emotions it produces. I respect wealth and all it can do for you.

But money doesn’t impress me as much as it does.

Almost all important decisions exist in the gray state. Financial decisions can be difficult because there is often no right or wrong answer. Many financial options include trading and are Matsunatial according to your goals, your risk profile, personal structure, etc.

This is the case with life’s most important decisions.

Take this guy, for example:

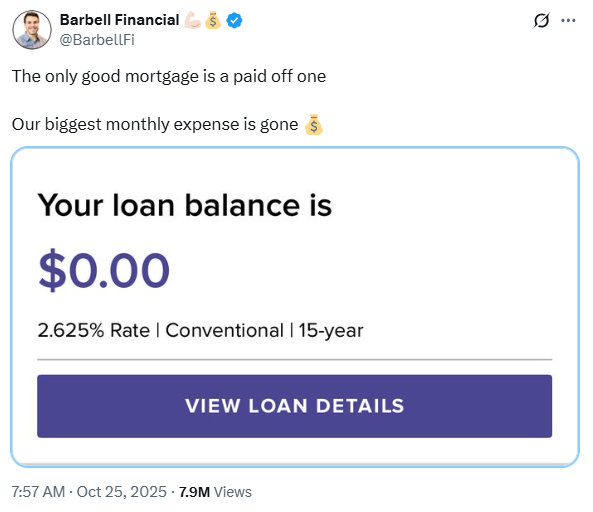

He went viral by posting how he paid off his 2,265% mortgage.

Some people are angry about this decision. Some people understand completely.

While I’m not black or white when it comes to financial decisions I think this is nuts. I will never do this.

I get people who want to pay off their loans because they have bad credit, a desire to be free from the debt burden or simply want financial flexibility.

At 5%+ shown rates, make sure I get that. But I can’t accept this reason with a low rate of 3%. Inflation rate of 3%. Senior debt is beneficial. Your house is not there.

Just keep the money you can use to pay off the loan in T-Bills or a high-yield savings account. Because the love of God does not pay the lowest money loan!!!

I wish I had borrowed it More money where interest rates were 3%.

Sometimes people take money ethics too far. Burying your money in the backyard may help you sleep at night, but that doesn’t mean it’s a wise decision.

And guess what?

This guy doesn’t care. His mortgage is paid. Who cares what I think?

That’s another thing I learned in finance – Most people don’t change their minds or their behavior.

Ah well.

Michael and I talked about feelings vs. money, we pay mortgages and more in this paper that week of spirits of the week:

https:/www.youtube.com/watch?v=04j_d4ncuu4

Subscribe to the compound so you don’t miss an episode.

Further reading:

How much is a 3% mortgage?

Now here’s what I’ve been reading lately:

Books:

1Or maybe it’s just my nature?