What if things are better than they seem?

I’ve always been a glass-full kind of person.

I don’t worry too much about things out of my control. I try not to get caught up in the Gloom-And-Doom Vortex that so many people have been caught up in since 2008 in finance and the advent of social media.

That’s not to say that I’m of the opinion that things are bad for most people these days.

Everything is expensive. There’s never been a worse time to be a first-time HomeBuyer. And the rich continue to wreak havoc as wealth inequality threatens to tear society apart.

Everywhere you look these days the media reminds you that we live in a K-based economy:

The idea here is that rich people are the only ones doing well in the economy today. They have all the goods. They spend all the money. They get to be all fun and all struggle.

Here is an article from the Wall Street Journal on the subject:

Here is the explanation:

Investors’ rosy feelings about getting more money — at least on paper — have the potential to spend on restaurants, business-friendly airline tickets, home improvements and more, to keep the broader economy buoyant.

It’s a very different story for everyone. Americans with large investment portfolios generally feel better about the economy than those without stocks.

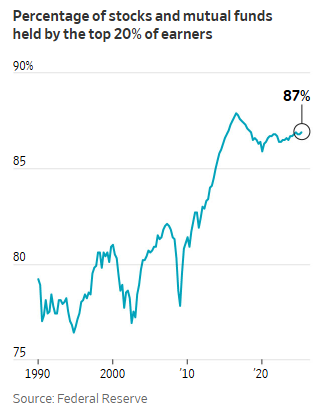

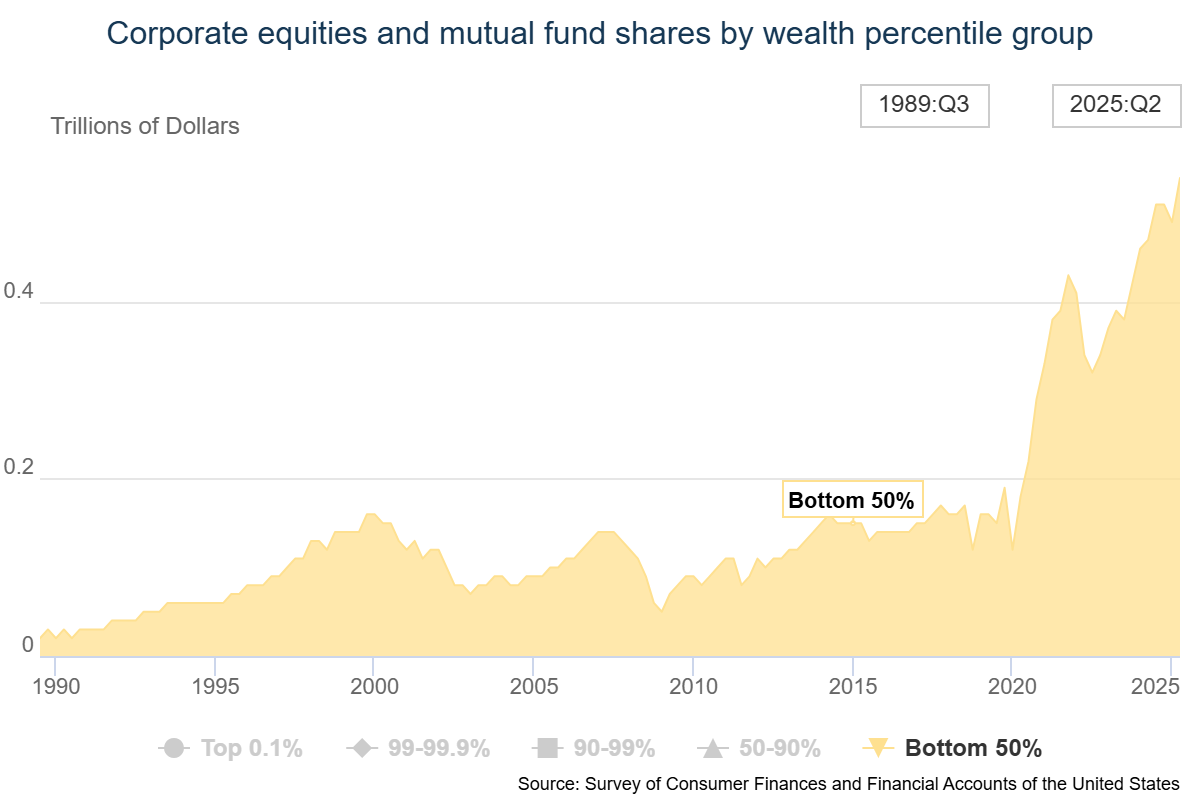

Just look at how concentrated stocks are in the hands of the rich:

Stocks are expensive. Housing is expensive. Borrowing rates are expensive. Food is expensive. DayCare is expensive. Health care is expensive.

I understand why many people are upset with the current environment. It doesn’t seem fair that rich people should be able to enjoy the economy while many others suffer.

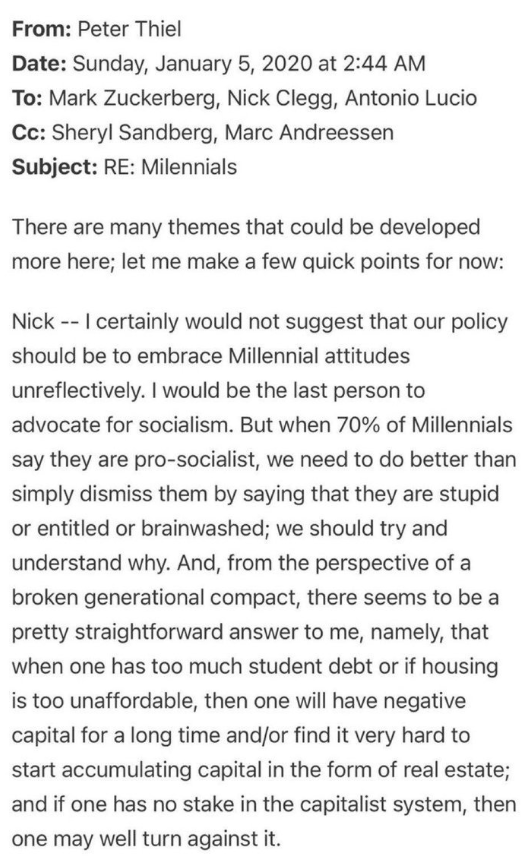

An old email from Peter Thiel was posted this week explaining why so many young people are inundated with the current system:

This is a valid point. If you don’t get to participate in dealing with the system you will fight the system.

But it’s not entirely accurate. It’s based more on vibes than facts. I have no idea that the current environment is difficult for some people. However, what if things are not as bad as they seem?

Let’s take a look.

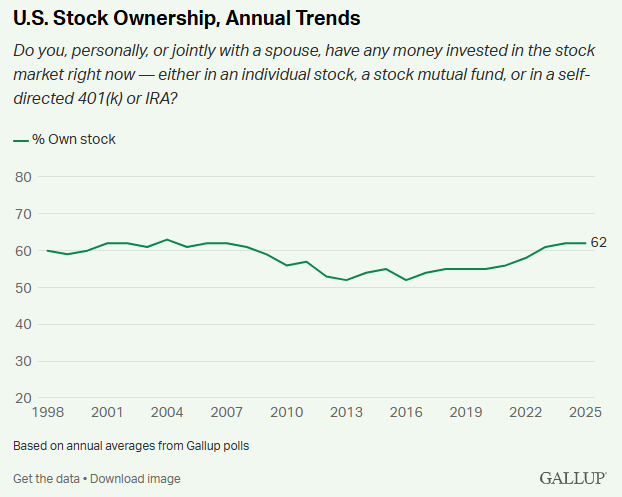

Yes, rich people dominate the stock market. But almost two-thirds of all households now stock some fashion:

In the first period – the 1980s less than 20% of Americans invested in the stock market. There is a way many people are profiting from stocks going up now!

And it’s not just rich people. 30% of 50% saw the value of their stock holdings increase by 350% as of 2020:

Is it the lowest price for the total price? Yes, but this development is worth celebrating. Many people are involved in the greatest creation vehicle ever created.

There are many structural reasons why households invested less in the stock market back in the day. But half of them were baby boomers who went to school, got married and bought a house again there- buy stocks later in life.

For many young people they have put it off. Houses are expensive so buy shares now and (hopefully) a house later.

Here are some stats I wrote before that are worth highlighting:

- 54% of Americans with incomes between $30k and $80K now have a tax-deductible account and half of them have entered the stock market in the past five years.

- Roway has something like 25 million customers. For most of them, it’s the first account they’ve ever opened.

- About 40% of 25 year olds now have investment accounts up from 6% in 2015.

- Households with income under the current One-Third Account for JP Morgan clients are moving money into investment accounts from 20% in 2010.

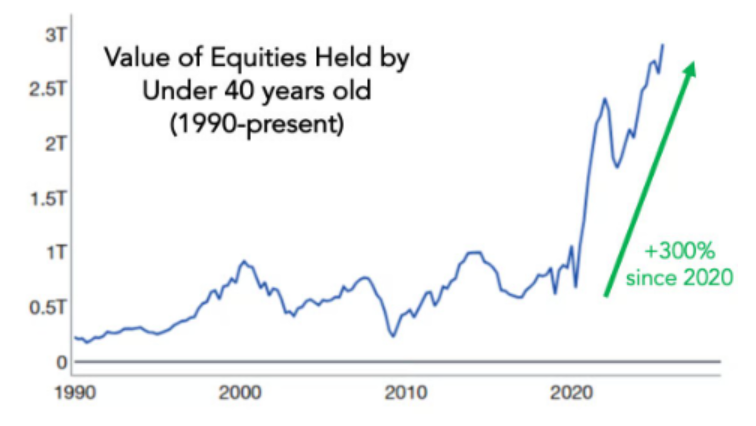

We have come out of the houses to be your biggest investment in the stock market. Just look at the increase in stock holdings among people under 40:

If they stick with these new ones they will be very rich because of the compounding benefits of their previous investment. Investing in the stock market is more diversified, more liquid and offers more flexibility than owning a home.

Of course, there are psychological benefits to owning your own home. These things don’t always boil down to numbers.

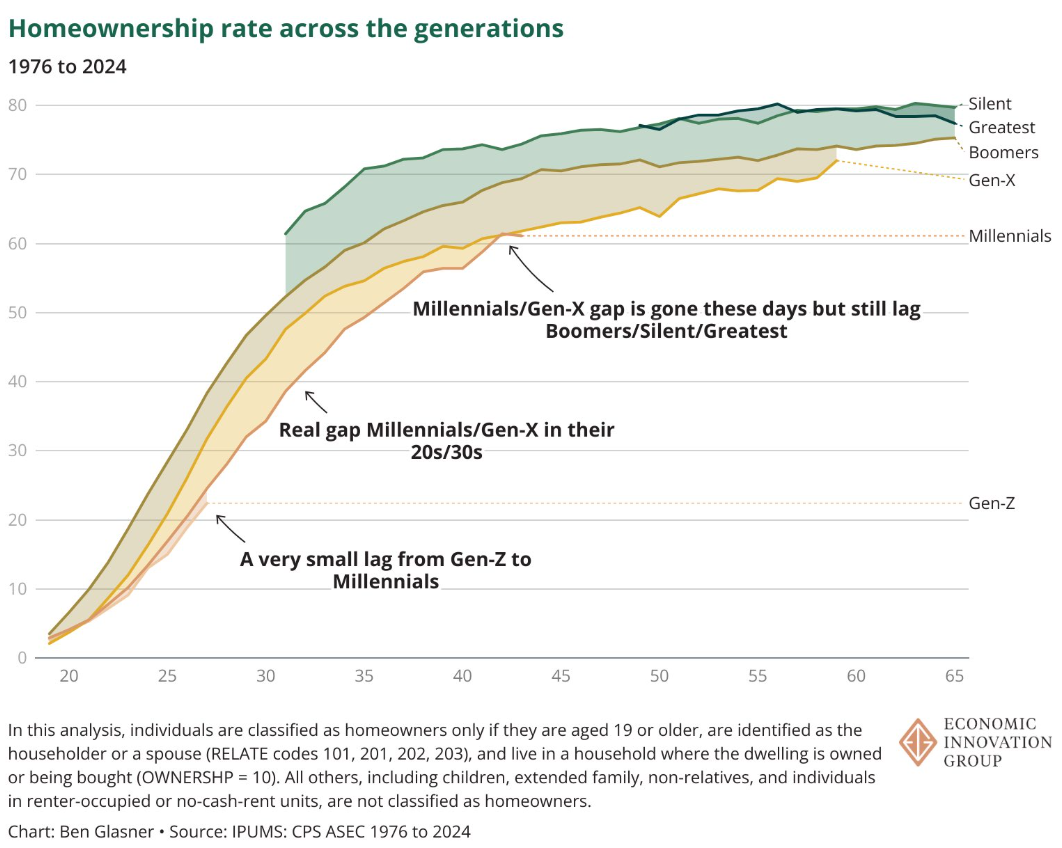

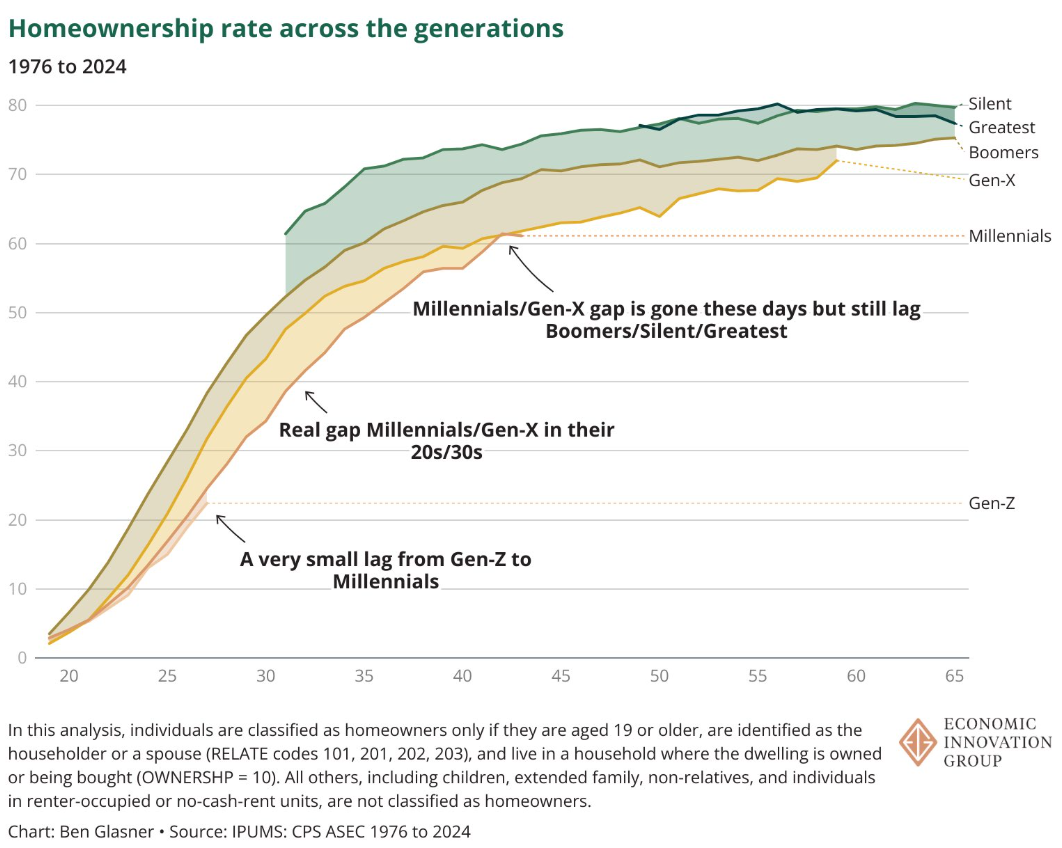

But while today it is a dirty place to be a first home, young people are becoming home owners. It’s slower than previous generations:

It’s still uphill again on the right at a slower pace.

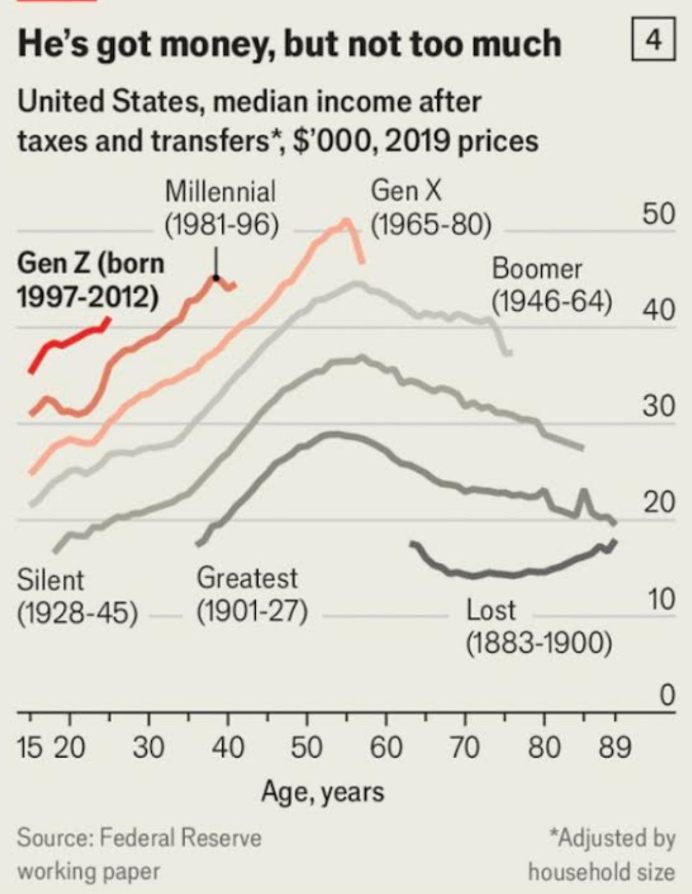

And I’m confident that many young people will be able to afford a home at some point. Why? They make more money than previous generations did even after accounting for money:

Does this mean that everything is easy for young people today?

Of course not.

Life is very expensive. Comforts have become necessities.

It’s hard to get ahead when paying off student loans. Babies are expensive and daycare costs are outrageous. New cars now cost $50k. The Media Home sells for about half a million dollars.

Life is still difficult for many people and will always be. I do not see this fact. No one likes to feel things are better by association than by experience.

But maybe things are better than what you read in the news and social media.

People hate the economy right now and he’s doing great. How will people feel when we enter a real recession?

Michael and I went on Plain English with Derek Thompson this week to talk about the plight of young people, the housing market, AI and more:

And we hit the K-Shape economy week by week:

https://www.youtube.com/watch?v=l2ri8y81tgs

Subscribe to the compound so you don’t miss an episode.

Further reading:

Are young people deprived?

Now here’s what I’ve been reading lately:

Books: