Two good styles in household economy

You don’t have to look hard on bad news these days.

Even if stock and economic market increases easier to find negatives at any time you want.

For example, of course stock market is at all times at all times but this helps the rich continue to improve. The top 10% is the owner of 87% of the stock market while 1% high consisting of every stock. At that time, the bottom 50% are only 1% of the US market market.

See how easy it was to change the good news into bad news.

You can do the same thing as the housing market.

Of course, home equity is universal at all times and at 90% own about 60% of housing stock in the country. But what about all the people who are written down to buy a house because the prices and prices are very high?

Good news and bad news are common in the eye of the beholder. These things are rarely darker and white but rather a gray shade.

There is enough health that travels on these days and then let us look at the appropriate two development of wealth development occur in 2020s.

The Wall Street journal has a new story showing while the rich gets destroyed, and many people come to board:

Some statistics from article:

Among the Americans do not have any $ 30,000 income and $ 80,000, 54% now have taxable investment accounts. The part of those investors enter the market in the last five years.

And about 40% of the new investors in the market from January 2020 plan to invest at least ten long-term policies including retirement.

These are the best news!

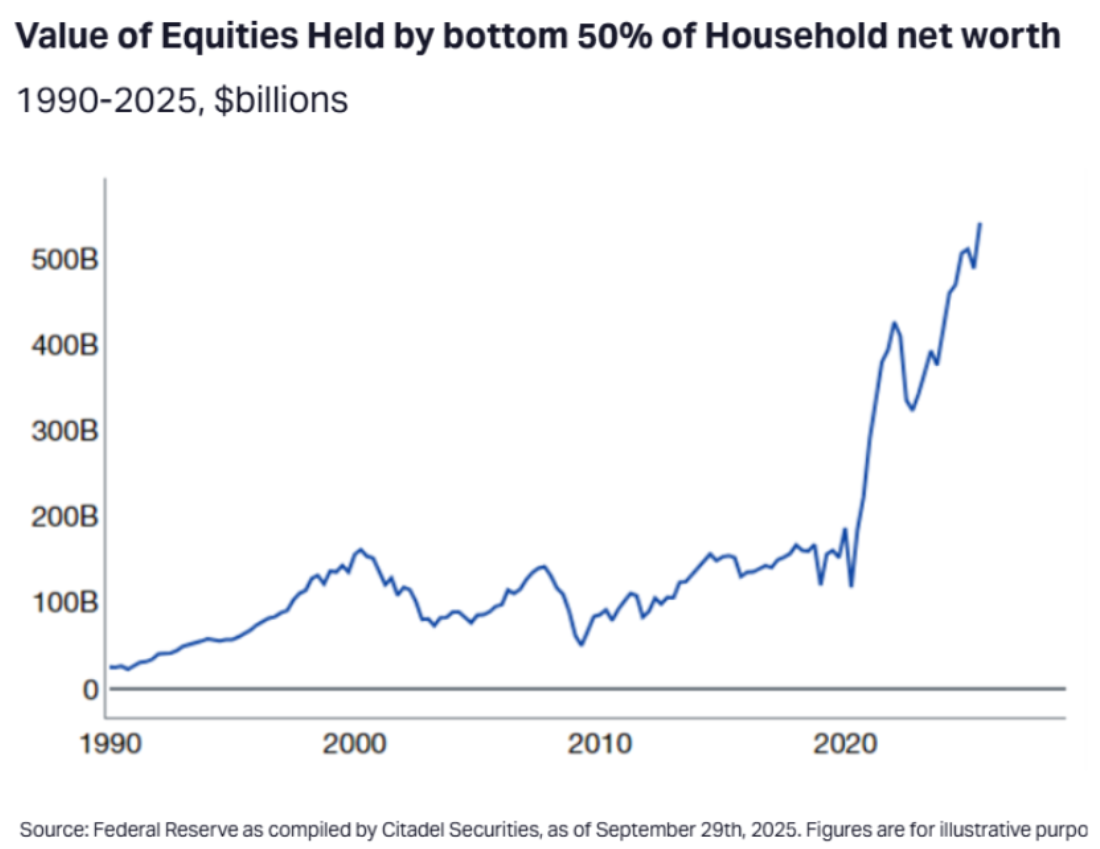

Just look at the great increase in the market value of shareholders held by 50% over the decade:

Yes, it is still less than the highest 10% or more 1% but advancing here to be celebrated.

Robinoy has a lot of flak’s influence over the years by making investment fees but the company has done the best work for new investors to register for the merchant account.

Here is Steve Quirk at a company ceremony last year:

Half Half A people in Robabi ,, 24 million customers, this is its first time, the ble. We begin to move their investment methods and bring everything they need as they continue to invest.

It is estimated that about half of the billion users – 12 million people – open their first seller account in company.

This happens in places like the JP Morgan Chase:

In May, those with the middle income to be calculated about a third of Chase customers.

Another story from Wall Street Journal looks that high housing prices influence stock market:

Here is the bad news:

The General Gen Z-Persent Home Level Between 1997 and 2012 – is simply, data from the National Association of RealTors Show. At that time, the first time for the first time of the family consumers at all times. Collected, this is a headmills with domestic builders and those who would like to sell their homes.

A monthly fee payable on $ 400,000 on the home page around $ 2,170, based on current values and assume that the consumer has $ 60,000, or low payout. This is about 36% tax payments after money in the middle household.

Here is a good unprecedented housing outcome of the selected housing market:

JPMORGAN Change Report found 37% of the age of 25 using investment accounts in 2024, from 6% of the age group in the past 10 years.

Young people take money will not save low payments, closing costs, moving costs, etc. And hurt in the stock market.

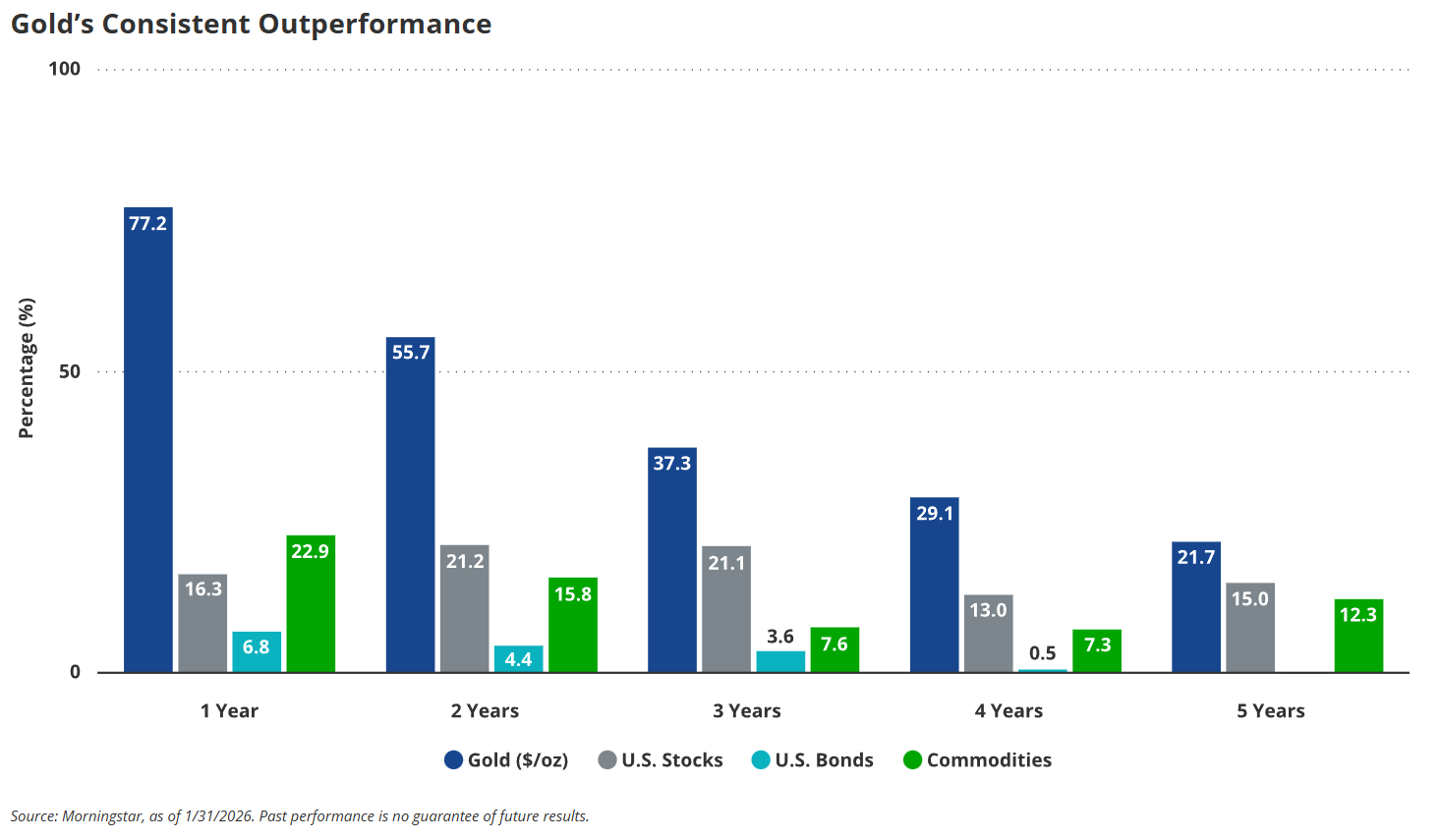

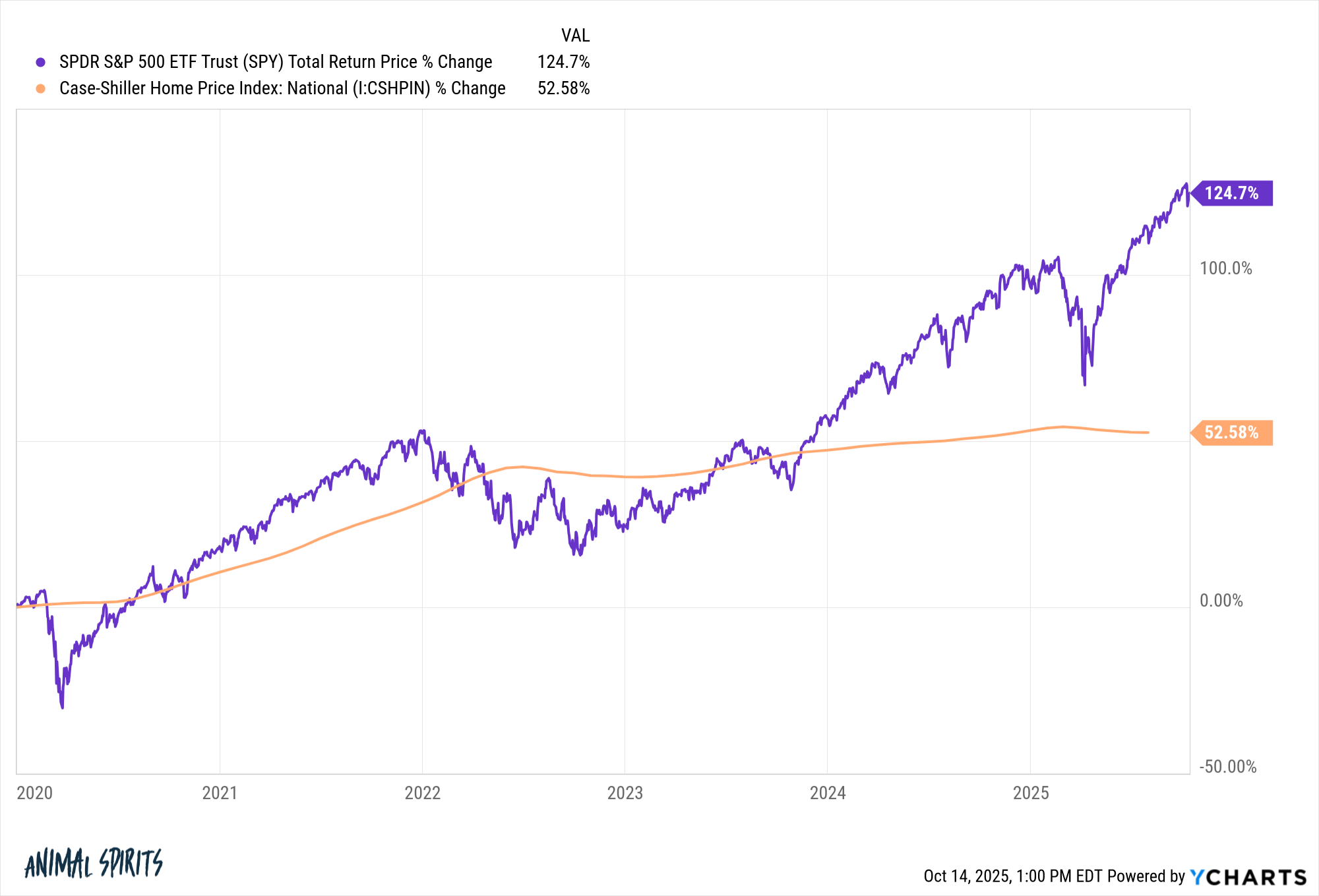

Even in large sums of the housing market in the past ten years, the stock market is more than double the return of real estate1 To 2020s:

These youths will be financially improved by investing in stock market and commencement rather than to include their income.

Of course, you don’t just buy a house for investment purposes. For many people, there is a mental part of the return calculations.

I feel sensitive to those people who can afford a house in the current market. Does not appear OK.

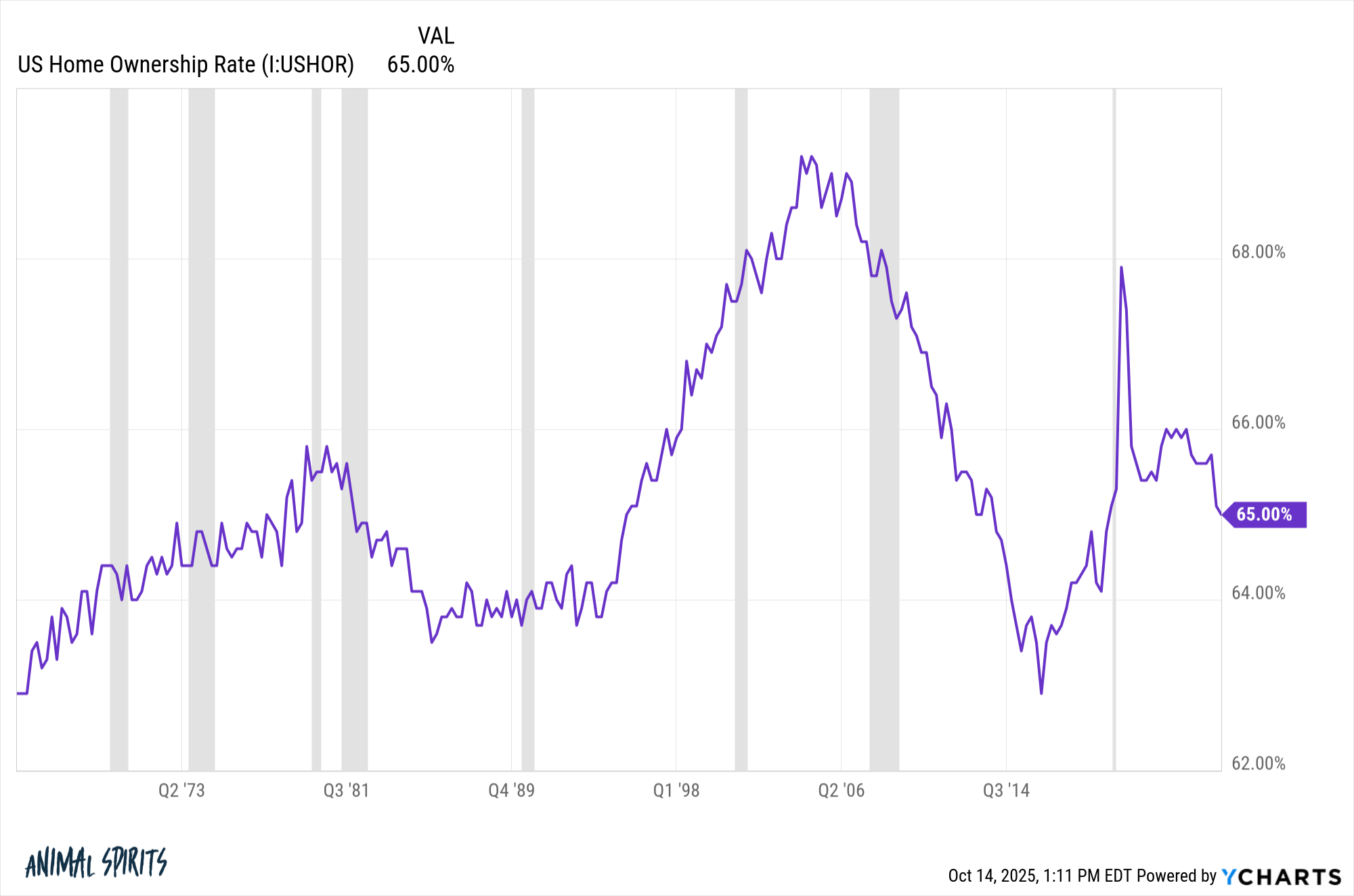

But it is appropriate to recognize that the patent rate in America is 65%:

62% of America’s home stocks, up to 52% in 2016.

We still have an unequal of the heart and top cost of housing. I just can’t do those claims.

However, most Americans are financial. Low lowlands invest in stock market than before. Teenagers are involved in custody in a large way.

This is a good progress. The stock market is the world’s largest wealth of the planet.

We can remain better but this good news.

To learn more:

Two large styles in the decade

1Necessity has no housing funds. Counting actual Restoration of Housing after all illegal costs and loneliness is almost impossible.