The next trend is in the bubble

A student asks:

Can you talk about how to use Momentum indicators and stop losing to profit from the ai bubble? Since I have been an investor in the mid-1990s this sounds like the beginning of a bubble, if this is one. I think there might be a low-risk way to make a profit without picking individual winners or timing up by using momeum indicators and using a trailing stop for eTF-based eTFs.

In the spring of 2006, Meb Faber published a research paper titled A valuation approach to strategic asset allocation.

The idea was to use a 10-point moving average to direct your allocation between risk assets (stocks) and cash (t-bills).

The rules were simple. At the end of the month:

- If the current price is greater than the 10-month moving average, stay invested in the stock.

- If the current price is below the 10-month moving average, invest in cash.

If you are in UpTrend, you are buying or staying invested. If you’re in trouble, sell or stay cash.

The idea behind the plan is to reduce volatility and the risk of heavy market pulls in risk assets.

The paper’s timing was no better. A little more than a year later, the stock market began to experience serious financial problems. The IS&P 500 fell nearly 60%.

So how did Faber’s rules work? Very well.

MEB updated his paper after a few years to show how the door is done in the real world:

This strategy didn’t come out very high because you need to wait for the descent to catch before getting the signal but you missed most of the kills.1

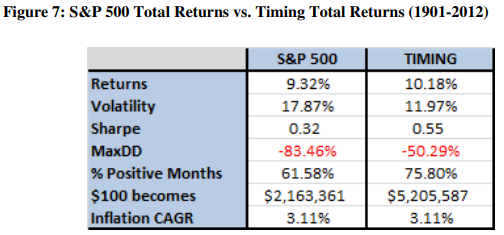

These were the long-term trend return profiles following buy and hold:

The next trend didn’t take the whole table off the table, but it did dampen the most significant changes in the 110+ years of data.

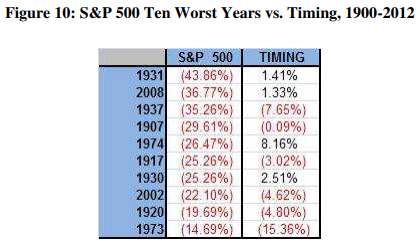

Now look at the performance of the worst years in the stock market against the trend line:

This type of strategy is designed to shine a light on the worst areas in the stock market.

There is nothing magical about 10 months or a monthly indicator in these things but the point is you want to have a period that allows you to better define the ups and downs.

Bad things happen more often in DownReng markets because investors tend to panic freely when they lose money. That’s why both are so good and The worst days happen during bear markets.

Downsizing is a broad set of possible outcomes, and not always in a positive way.

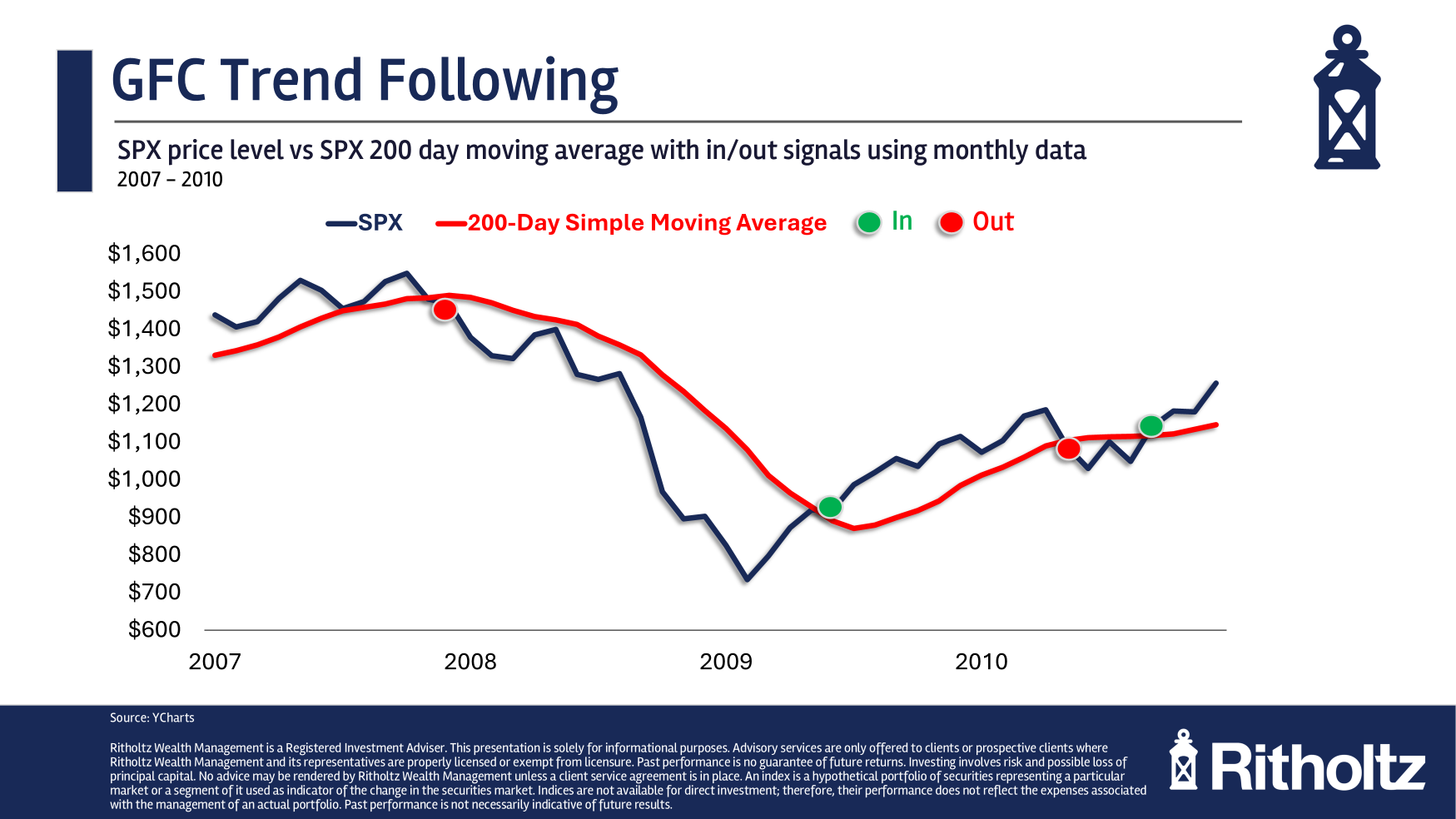

Here’s a look using a simple 200-day average on a month-by-month basis during the 2008 financial crisis:

A sell signal was generated 6% or more below the peak which was the best time. After that he came back about 20% out. That’s good considering the size and duration of the 2007-2009 crash.

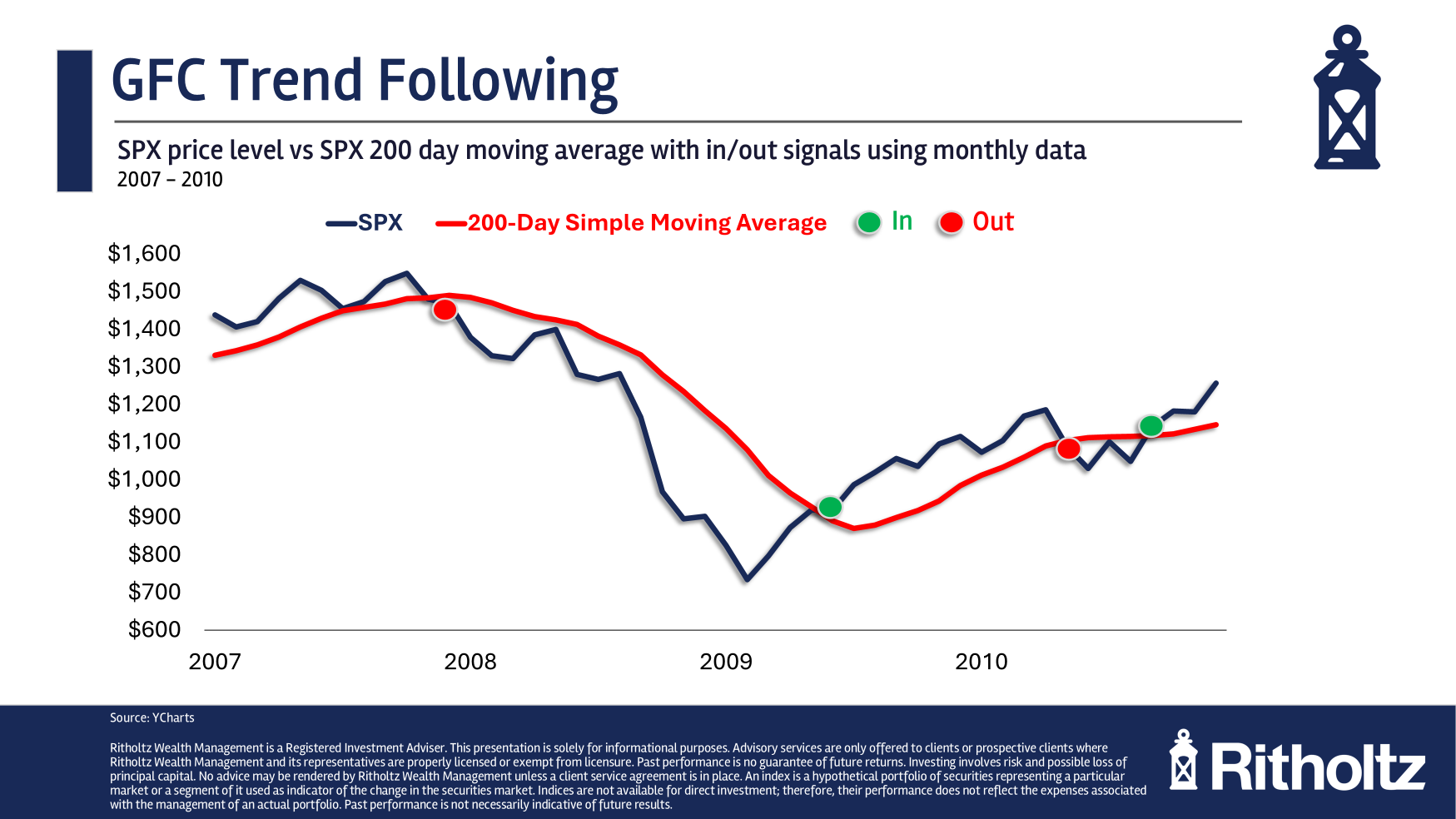

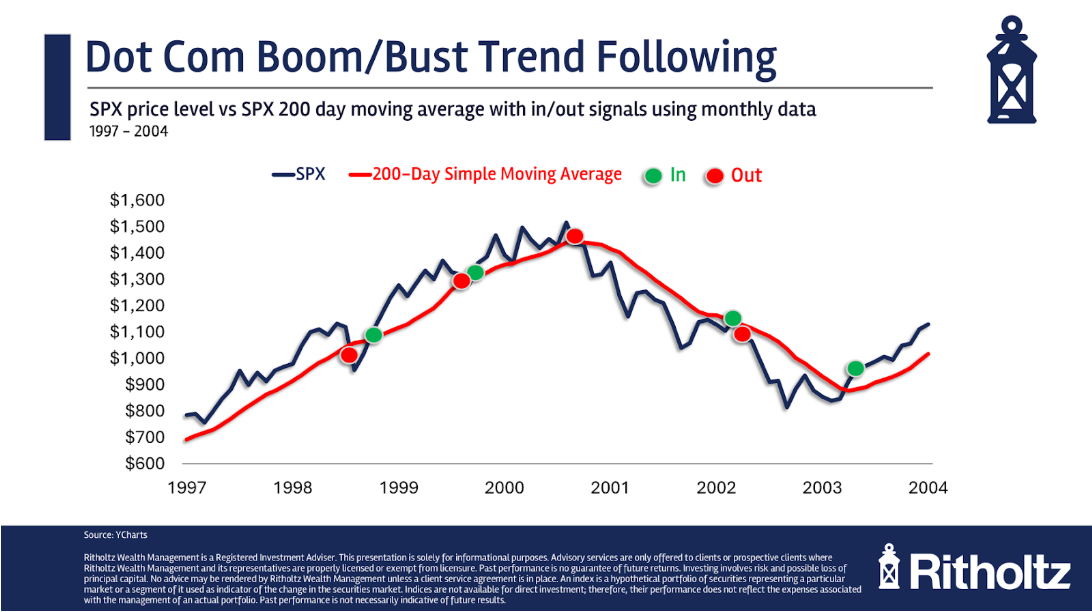

Now here are the signals during the dot-com bubble:

You can see that there were some false positives on the way to the top of the dot-com bubble. He sold and moved back during the 1998 recession. There was also a whippitaw in 1999 where a moving average triggered a sell signal followed shortly by a buy signal.

But then there is a sell signal that ended the month 6% below the 2000 Peak which saves you a maximum of 50% risk. One quick whippise in 2002 but also the following procedure helped you survive the big exit.

So why would you ever invest in anything else?

Yes, trend following is a good hedge against bearish market risk. But big market declines don’t happen very often. Crashes are rare.

Drawdonds are not always drawn in a waterfall fashion. If there is a flash crash situation the following practice will not save you. And at Choppy markets you can find whipkaws.

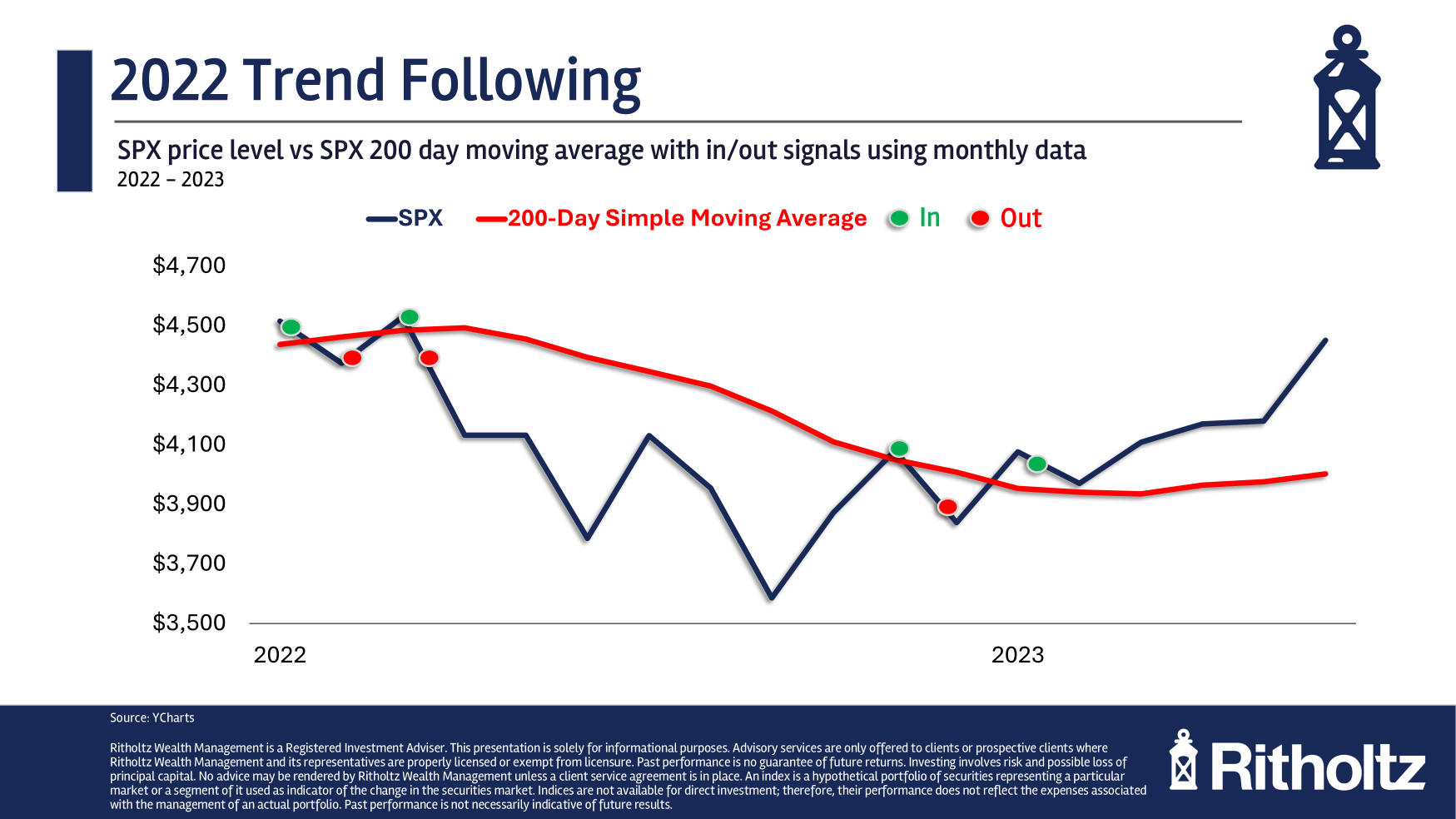

Look for a 2022 bear market:

You bought high, sold low, bought high and sold low again. You still miss a good amount of pull-downs but those whipkaws can test your patience.

You can see a month of 10% of 10%, sell and see that followed by a month of 10% where you buy after getting profit. Now, you have already eaten all the losses and missed all the gains in short time windows.

Here’s the thing about a trend plan – you have to follow the rules for it to work. There is no flexibility. There are no emotions involved. You can’t buy and sell when you feel like it because no one knows if a 15% correction will turn into a 50% drop or not. Most of the time 20% down doesn’t turn into 40% down but nobody knows that yet.

The following TRENT is an insurance strategy where you are sometimes forced to pay a premium without protection. Most of the time when you wake up a buyer the stock market won’t completely fall out of bed but you don’t buy insurance on your house hoping it burns down.

Sometimes the stock market gets burned down, but those are rare occurrences.

You also have to consider taxes. When you raise a sale balance you may be forced to pay short-term benefits. Even after a long bull market you may be forced to pay long-term gains. That eats into your recovery. The following practice works best for a tax-managed account rather than a tax-deductible one.

Stock markets are another good option for this strategy.

Most clipping techniques provide low intensity protection without targeting. The beauty of trend following is that it stays invested as long as the stock market stays in balance. And when the breaks break, there is an off-ramp.

This type of plan is not for everyone. I’ve had many conversations with people over the years who don’t want or need a flex / handicap valve.

Others want something that will allow them to stick to their entire long-term plan. That’s why I think it follows a good allocation of the reserve asset for the overall purchase of the asset.

These strategies can work differently in different areas and at different points in the cycle.

The opportunity for reduced volatility is great, but it’s the benefits of diversification that helped me understand the point of trailing in a portfolio.

I don’t know if following the trend will protect you when the next big light comes on.

But this type of strategy where you need to understand trading before investing.

If you want to learn more about how we’ve done this for customers, go here.

I did a deep dive into this question this week asking Compound:

https://www.youtube.com/watch?v=uwujxyk5hxo

Bill Speety joined me to discuss questions about Roth IRAS before retirement, downsizing your dreams, downsizing your dreams, 529 strategies and buying a vacation home for estate planning reasons.

Further reading:

My evolution in asset allocation

1It’s also a good example of the Sudiform Efterged Inters trend in the 1990s bull market with a wide margin. You have to expect that with a plan like this.