The most amazing bubble ever been – the treasure of the general mind

A few weeks ago, announced that Opelai would invest up to $ 300 billion in Flocf computer.

In this week, Unvidia makes $ 100 billion investment in Opena.

Oracle spends billions of dollars in GPU Kanvidia.

NVIria includes Operactian investment in Oractia in ORactia in Nvidia and Finkle

We have reached a certified Ai bubble stage when Tech Giants decided all in this together. If a person will take risks in a large capital spending, all will take risks.

And yes, I’m ready to call this bubble based on an excessive investment history in removal.

During the DOT-Com of the 1990s Bubble, Telecom companies set more than 80 million fiber-optic cables. After five years after a bubble explosion, 85% of these fiber-optic cables remain unused.

NaskAq cleans over 80%.

The 1800s rail bubble also remember. Here are some facts and figures I have received while researching Don’t cross:

- There were new 500 new companies with trains in 1845

- That same year, the board of business processed 8,000 miles[8,000 km]on a new track in Great Britain, about 20x Length in England.

- Construction costs were more than the National Weal of the whole country.

- There were 14 bi-story books about the train industry in distributing.

- Charles Darwin was arrested in bubble, losing 60% of his investment.

Good news both of these bubble webs were ready for a new invention.

In 1855, there were more than 8,000 miles of train tracks, giving a british largest track of the world tracks, measuring seven times long after France or Germany. Telecomm The YouTube Power helped the power of YouTube, social media, movies, video calls, and everything else dreamed of the 1990s and more.

There is something similar to AI Makes current AI but many different variations.

The DOT-Com Bubble was developed to investor’s guessing from unwary companies that have not produced profit. Modern technology firms print cash flow with maxins madly margins.

Almost all roads are from people. The shop investors were raising bubble.

AI boom appears inside the house. Lead by Pech CEOs that make these decisions for the allocation.

In 1990s, Bill Gates said:

Gold Rushes often promotes difficult investment. A few will pay, but when the frenzy is behind us, we will look wonderfully back to failed work and amazement, ‘sponsors those companies? Would it continue in their minds? Was that a mania working? ‘

Here’s Mark Zuckerberg say the conversation recently:

If we end up missing a hundred million dollars, I think that will be clearly unfortunate. But I can say that I really think the risk is high on the other side. If you are too slow and higher wisdom.

In other words – we will not continue under this. If it turns mania, so be it.

Supervised technical leaders. They know the history of excessive investment. But they say the risk comes from getting enough waste.

So the case has been closed? This is a sure bubble to appear?

If this is indeed this in the Epic ProCble Prouptions is one of the most old ones in Hi.

According to Wall Street Journal, now $ 7.7 trillion Staying in cash market investors:

It’s a bull market with money.

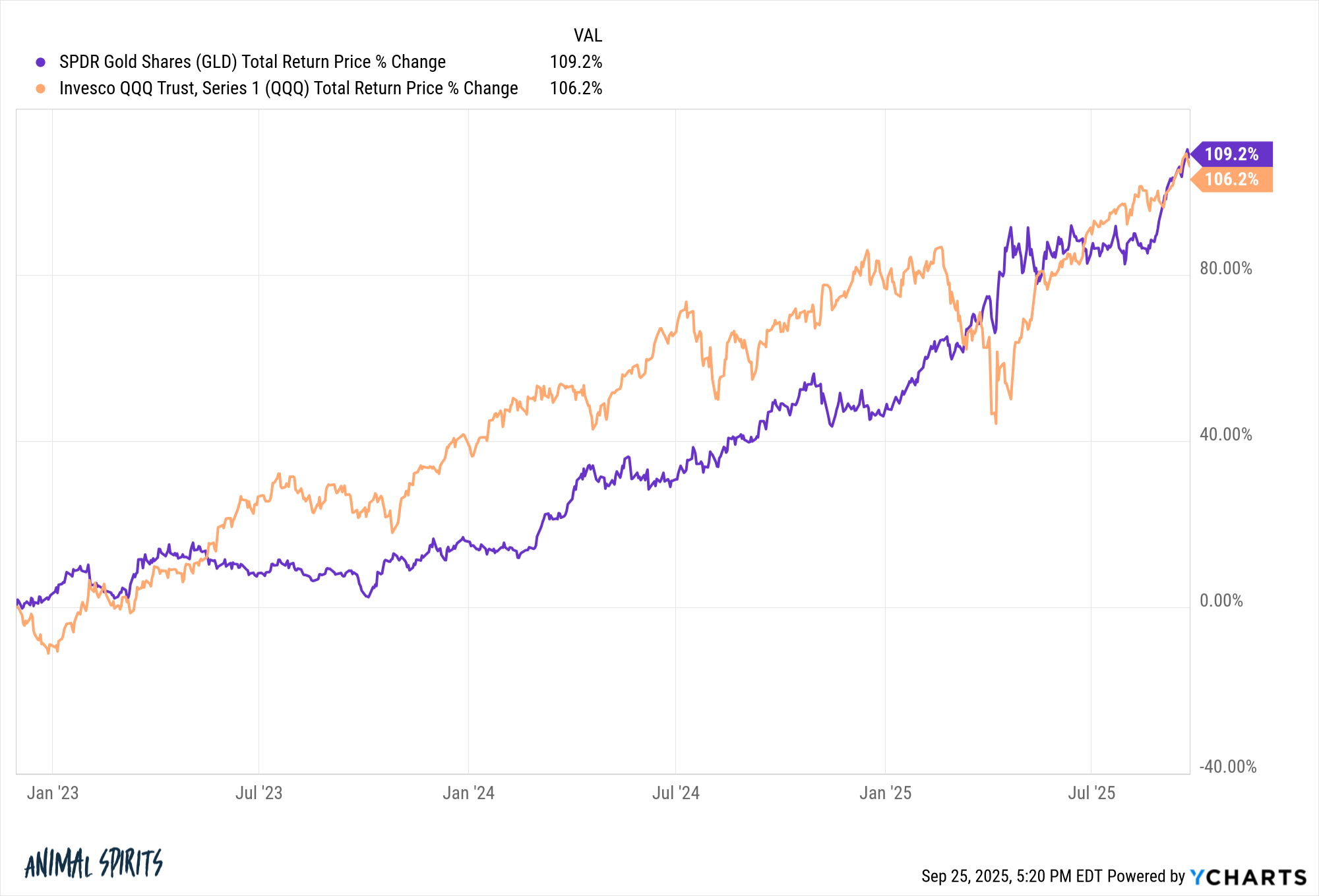

Gold is higher than 40% this year and is a new new hit during a healthy one. As Chatgpt was released in November 2022, Gold actually removes NASDAQ 100:

How can the Relic be used for thousands of years thousands of the largest, long technical companies we have seen when AI is using?

Another part that makes the current situation deceive to understand the trading companies in the AI bubble they have found backs. JP Morgan’s Michael Clemboel shares the following in the new study team this week:

The shares related to AI records 75% of ES & P 500 Returns, 80% of receivables and 90% of the income income from November 2022.

These companies spend like a drawn sailors but they are all able to pay for booze!

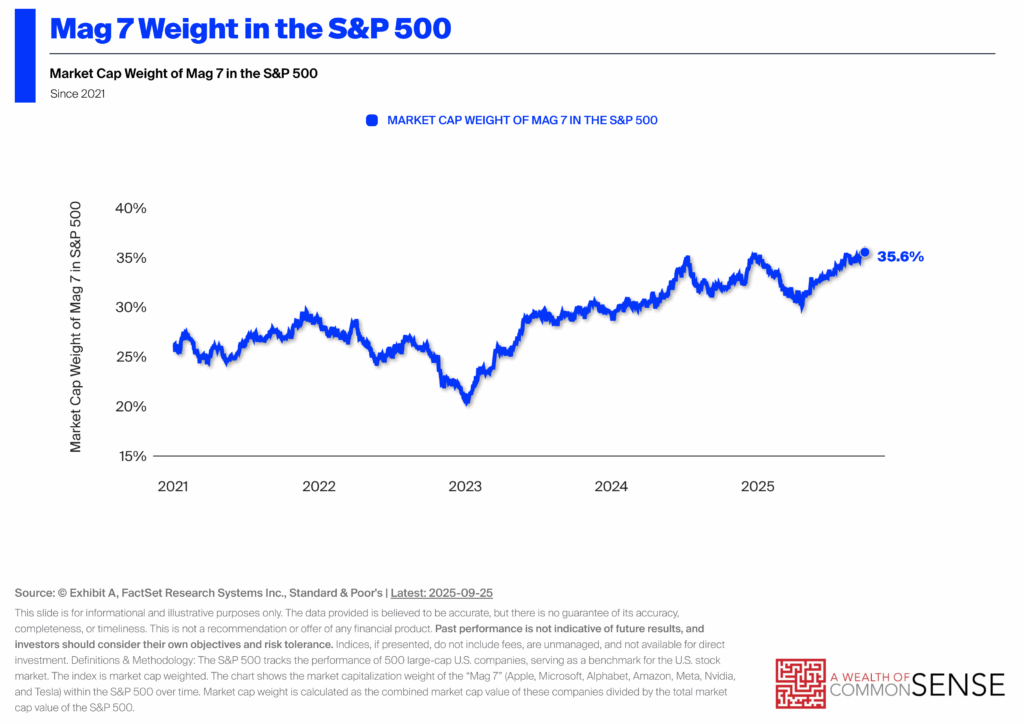

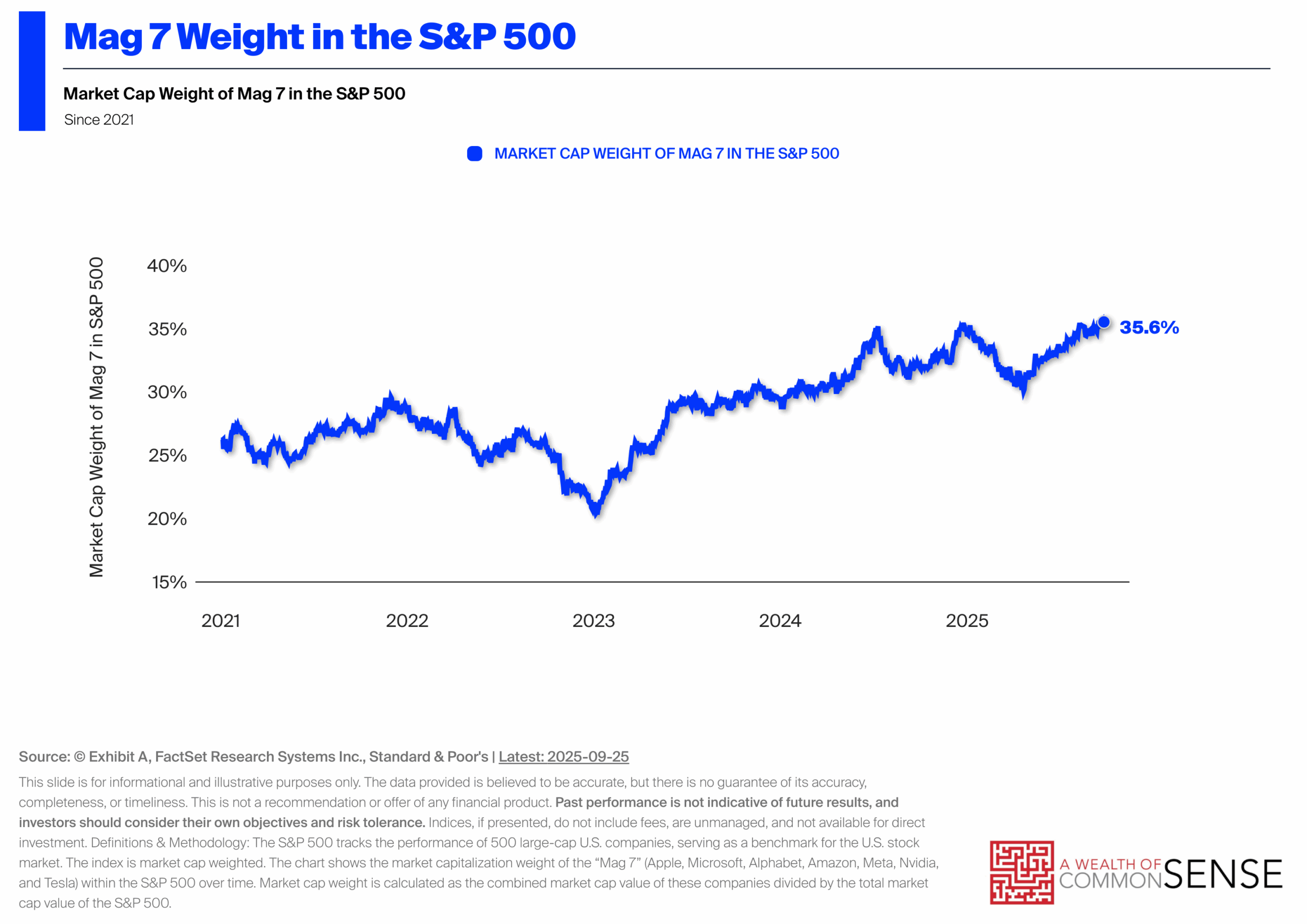

I understand why many investors are worried about bubble hopes. When they explode they are usually painful. If you are planted in the market, you have a lot of exposure to Gigantic Tech stocks:

Because this sounds like some major bubbles of history do not make it easier to grow.

The most worrying thing is now that everyone who has studied the market history now calls this bubble. It looks very obvious. Markets are rarely easy.

So what if you believe in a bubble? What actions should you take?

I will share the thoughts about this article next week.

At that time, Michael and I talked to ai bubble from all angles and much of these animals of the week:

https: /www.youtube.com/watch? v = Mzayabegto

Sign up for a compound to miss the episode.

To learn more:

Is this 1996 or in 1999?

Now here I read it later:

BOOKS: