The best fence – a treasure of common sense

I’m sharing this chart of last week’s ten-week price increase:

I received the following question in my inbox about this from a reader:

What is the investment outcome of your inflation chart? Should I own more or less stocks when inflation is high?

Good question.

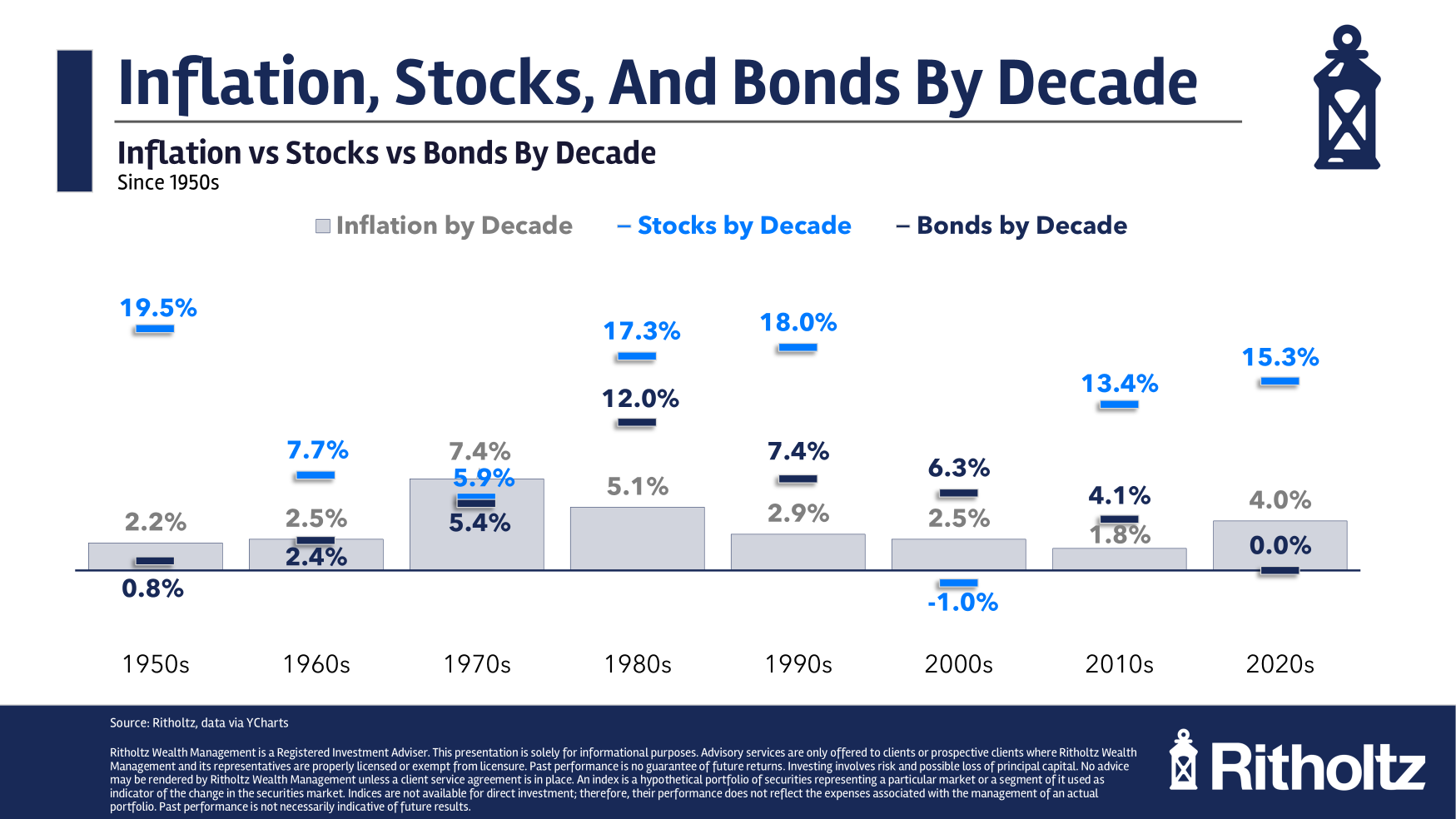

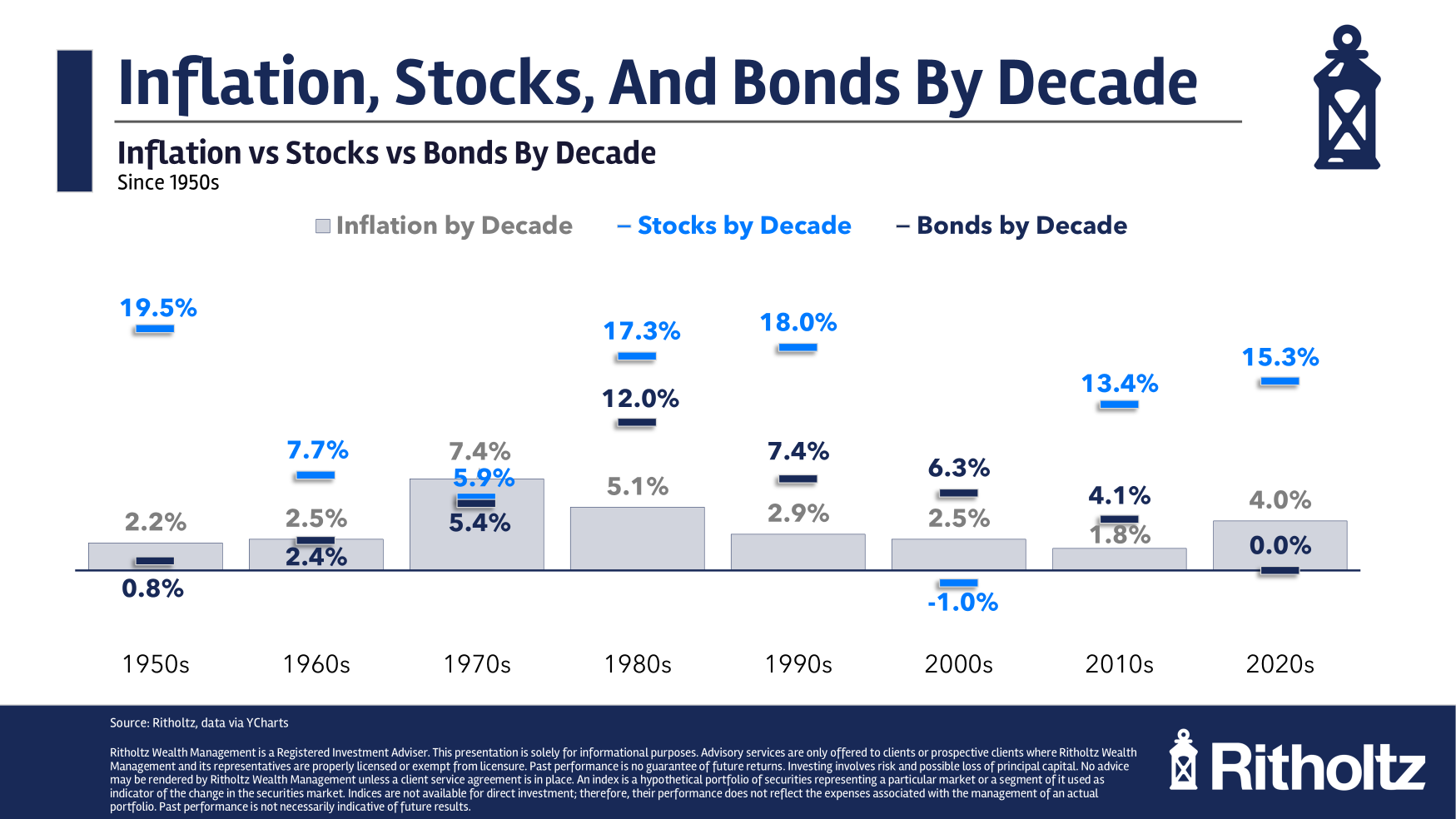

Here is the following sequential chart of annual stock and bond returns and relative inflation:

Higher than normal inflation does not hurt the stock market in the 2020s.

Of course, there was a bear market in 2022 but this is the highest rate of decline in prices since the 1980s and the stock market is compounding by 15% per year.

The stock market did just fine with the highs of the 1980s.

Inflation is up to 5% that decade but the stock market is doing more than 17% a year.

The 1970s is the night of the meteoric decline. Actual returns have been negative for this decade.

The difference is that inflation rose throughout the 1970s and fell to those high levels in the 1980s.

Bonds did similarly well in the 1980s but suffered in the 1970s like the stock market.

But bonds have softened on the chin in the 2020s.

Inflation is the biggest risk for government bonds in the long run but the return of income is also affected by starting yields and the direction of loan rates.

There is no simple formula here.

If you’re a layman you’ll look at my chart and you’ll notice that two of the last two decades have seen stocks fall behind their ten-year lows.

That hurts.

The Glass-all-Full version is that the stock market has compounded at 11.7% per year since 1950. Subtract the average real estate price over that period and it gives you a real return of 8.2% per year.

They’re over 8% better than average inflation which sounds pretty darn good to me.

I don’t know if that will repeat itself in the next 75 years but the stock market has always thrown in the towel for a long run, even if it’s not always on the run.

Further reading:

Inflation is not reversible

This content, which contains security-related opinions and / or information, is provided for informational purposes only and should not be relied on in any way as professional advice, or endorsement of any services. There can be no guarantees or assurances that the views expressed herein will apply to any particular facts or circumstances, and should not be relied upon in any way. You should consult your advisors regarding legal, business, tax, and other matters related to any investment.

Comments on this “Post” (including any related blog, podcasts, videos, and social media) reflect the personal views, opinions, and analysis of Ritholtz Wealce management staff who provide such comments, and should not be considered the opinions of Ritholtz Wealce Management LLC. or contacts or as a description of consulting services provided by Ritholtz Wealce Management management or the return of performance of any Kitholtz Wealce Management Management Cless.

References to any security or digital assets, or performance data, are for illustrative purposes only and are not intended to recommend investing or offer to provide financial advisory services. Charts and graphs are provided for informational purposes only and should not be relied upon when making an investment decision. Past performance is not indicative of future results. The content speaks only from the date indicated. Any assumptions, projections, predictions, guidance, hopes, and/or opinions expressed in these materials are subject to change without notice and may vary or be contrary to the opinions expressed by others.

Compound Media, Inc., an Affiliate of Ritholtz Wealth Management, receives payment from various organizations to receive advertisements in compound podcasts, blogs and emails. The inclusion of such advertisements does not constitute or permit its endorsement, sponsorship or sponsorship, or any association thereof, by the Content Creator or its employees. Investing in real estate involves the risk of loss. For additional advertising incentives see here:

Please see the disclosure here.