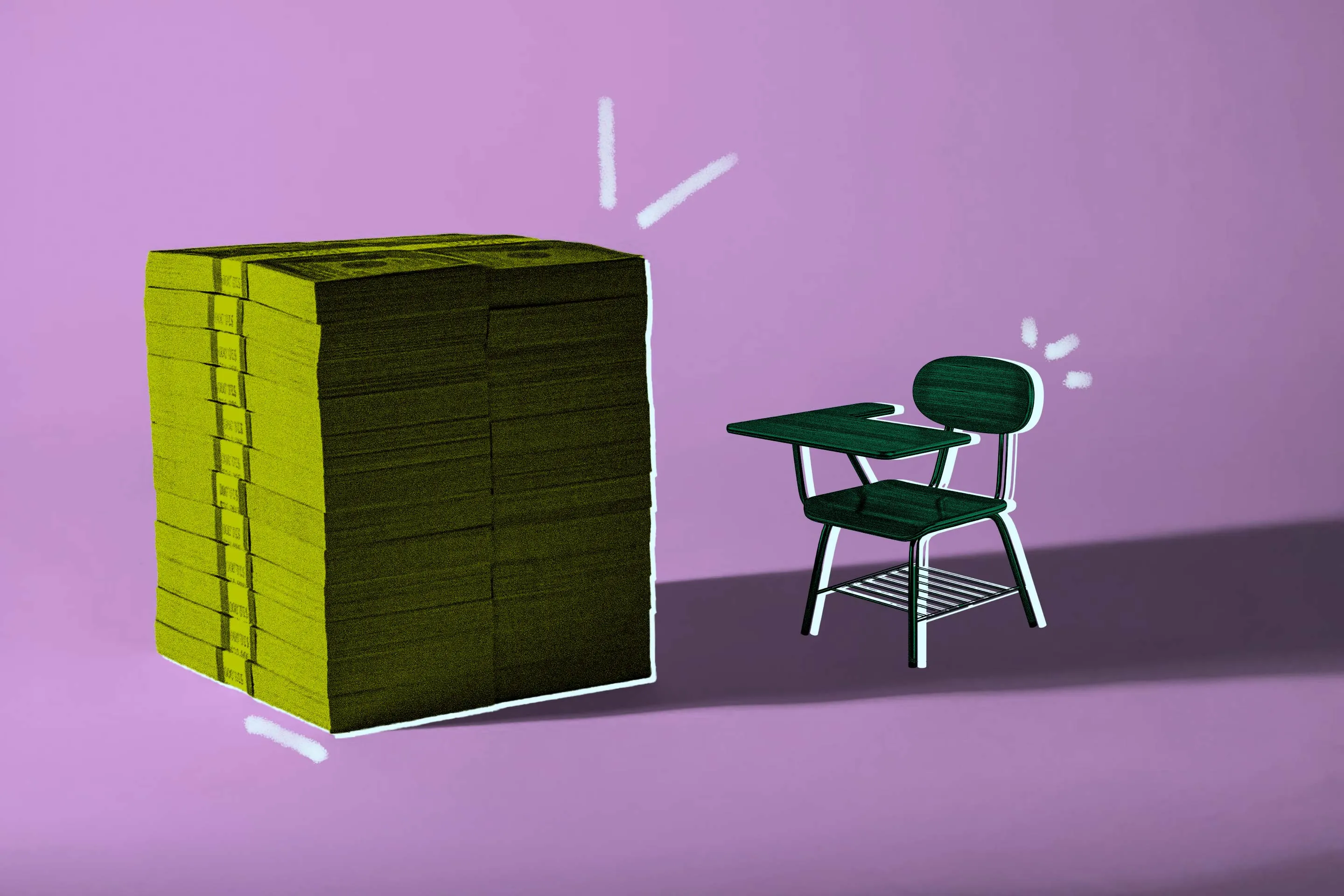

Senior actors underestimate the future loan debt

The senior level understand that they may need to rely on student debt to make college levels available, but they still undermine the loan amount.

Students expect the graduation of $ 17,000 in the loan, in accordance with the recently released 2025 and consuming student debt. The actual number of familiar lenders vary according to which source you are. But it is safe to say that it is too high – about twice – what students in this study are waiting for.

For example, the College & Success Center (TICAs) is using government statistics from 2020, reporting that 61% of the public year in borrowing their identity, graduates have been graduated by $ 27.470. Residents, 67% of the students were debted, graduated on a rate of $ 33,673. Measurements are based on the reported data in the Postsecovary Studecondary Student, which is done every four years.

Student’s debt gap, as honesty disclosed, and the parents are, who reportedly expect students to expect $ 16,000 after graduation. Regarding the parents of their disciples, the measurements were the same. Students expect their parents to borrow about $ 13,000; Parents expect them to borrow $ 15,000. In fact, parental debt has passed over ten years ago or more. Since 2022, a common parent and Purused credit burdens, according to the help of Federal students.

How clear the disciples and parents come to their balances. The survey reports that more than half of the respondents said “used their own guess.” Results are based on 2,008 respondents in 10 to 12 grades in high school or student parents in those grades.

Because educational data, including student loan statistics, often fully, may have been registered for college students to show decrease. The research results of the National Learner’s 2024 of the National, is not eager to date. But it is not too impossible to get down to be enough to match the expectations of what they do in a reliable study. After a firm growing between 2000 and 2012, the low loans have always been last several years ago. In the 2012 National Student Relief, for example, the Bachelor’s Degree Degree Degree from all types of colleges were $ 29,412. Eight years later, a 2020 translation, that number was only about $ 1,000.

Costs continue to play a major role in student colleges

Without their expectations around the student loan, the crafty surveys also requested students and parents about the cost of the college. Forty and seven percent of the expenses are ‘very important’ when choosing where to register and 40% over the past four years. The emphasis on learning prices are very high as students are approaching the request in college: 54% of the leaders named as a very important word.

The findings are relevant to other recent studies that indicate that the cost is one of the limited forms of postsecondary student programs. In the latest Salie Mae in the college, and the respondents have come to be close to home, accessible, and academic contributions such as three top priorities. About 80% of families claim to remove at least one college due to cost, and 72% should take a loan without a non-accident. Among those borrowing, 35% say that access to the students allowed them to consider expensive schools.

One bright spot on both surveys? Parents and students are in contact with college cost and what can pay for it. More than two third parties and students in Fidelity’s Survey said they have discussed how they will save the college. That is usually experts’ first piece of advice – talking first how much your family can spend your pocket so students look at colleges in their budget. As research writers put, conversations help families focus on “real techniques and techniques to manage college costs.”

However, Sallie Mae writers report that there is an opportunity to improve. While six families in 10 families have made a bachelor degree plan before registering, few families reported to talk about clarification. For example, 40% are discussed regular salaries in their learning field – the key component of finding how much you can lend – and less than 3 has said to be willing to pay the student loan.

Much from money:

Paying for College soon? Here’s how you can protect your 529 system between the market

Sync values in Federal Loans are already released down

9 important steps to take before selecting student private loans