Revenge your relevant amount in 5 years

A student named Andy asks:

I am 25 years old and live in Belgium. I make € 2000 / month in a factory worker and save € 500- € / 1 € / month (living at home). My relevant amount ~ € € € 67,000. I am free to credit.

My goal is to raise this 4-5%. That would allow me to move to Southeast Asia (well the Philippines) and start the business.

If you are like me at 25, which is not a credit for ~ € 67K with the net, what investment or investment strategies can you prioritize € 400- 400-40000 € 4000 years old?

I totally love this question.

There are numbers. Has the end policy. And has meaning after that end result.

I wrote about trying to build a nest egg in a short time of my book Everything you need to know about retirement savings From the perspective of the people who receive late retirement.

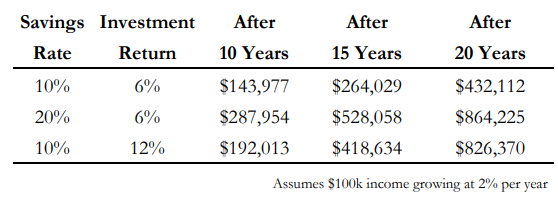

I told the Carl and Carla Carlson’s story, 50 years of life in retirement. Carsons want to know if they are better to shoot a month for investments or to save more money to make a lost time.

These are the numbers I come with a simple analysis of the situation:

This was my ending from the book:

Even if Carl knocked on his park at his chaked-chaked account he repeated twice 6% of 6% of 6%, higher conservation rate would have resulted in better results. Double Carlson’s maintenance standards from 10% to 20% lead to a better charge than twice 6% investing to 12%, even more than two decade, even within two years. And Carl opportunities are not a second second time warren buffett about how increase their quality savings is much easier than increasing their investment return.

Belgium has a short time even at the time but he wants a great increase in his / her net in order of 3-6x. This is a big leggy in such a short time, meaning that it is compiled from your investment.

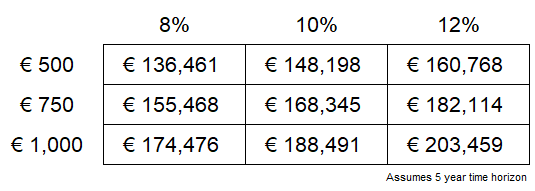

I have done the same job using the provided data and different monthly restoration returns and investing (and yes I received the euro sign in Excel):

This is the growth of her worth 5 years using the various thoughts.1

It is like an example from my book, increasing your maintenance level has a major impact on your total rating than increasing your investment restoration of the program.

Good news, if Andy can beat a higher ending of the current month, you are in a good position to approach the average number of Net.

The bad news is that if he wants to beat € 40000, he will have to get a big deal or be Jim Simons next night.

At his current maintenance level, you will need something such as 30% of the year back to 5 years. To the proper rate of return, you will need as much as € 3,500 to € 4,000 per month to arrive € 400k.

I can give you all kinds of allocation and investment ideas in 5x your wealth ages 5 years, but you may not hit the highest cost of your goal unless you start making a lot of money.

My advice can be trying to hit the top of your savings distance at € 1,000 / month or find out how to get a separate fee.

There is another consideration:

What holds you to move to the Philippines now? Why wait?

You are 25 and living at home. You have already shown that you have a savings skill. Why not try to do it in a dreamer?

Consider set your goal at € 100K to get there soon.

Life may be quite different from 30 than 25. You have the ability to be skilled at 25. If you want to move to the Philippines do not allow the Spreadsheet calculation to prevent you. You can always go home when things don’t work.

There are life events when you will never be fully ready when it comes to your finances and you should take a jump of faith and get it as you go.

This can be one of the times.

I discussed this question in the latest piece of Associate:

https: /www.youtube.com/watch? v = uzfaz-xq6cu

Callie Cox joined me to the exhibition and to decide on AI which prevented the economic downturn, investing in combined markets, pulling your senior winners and pays auto loan from the consumer account.

To learn more:

Everything you need to know about retirement savings