Rate of investment return (ROI)

Some of the most important ideas to be investor to understand that it is expected to return. Return Return, is not guaranteed, but investor who does not have the future range of the future recession may make big mistakes in investing.

A regular error is too small to save. For example, investor who expects money to recover only 15% when 5% will save too little to reach their goals. Another common mistake to buy high and low sales. This happens when an investor cannot see that a dangerous property class may dispose of 40%, 50%, or more in a short period of time. Investor’s panels and sell investment in a patient who is truly a more realistic view.

How to rate the refund of money

How does one measure the future return? It is probably the best place to come forward. If you expect investment to return 20% annual but 10% annual return, you may be disappointed. The world’s full-time stock market in the world last century, has been a return 100 years ago of 10.46%, about 6.51% in the identification of pricing. That number is before inflation, taxes, investment costs. Mali drop is 3.18% a year from 1925-2025, so the “Real” return (after prices) is 7.28%. You can extract taxes and charges from there. You can quickly see that any counselor suggests you depend on the “10% of investing investment” access your purposes has already set a failure.

Although that is normal, some would lead to believing that even the higher refund is possible. For example, Dave Ramsey, for example, is doing a good job that helps people get out of debt. Unfortunately, as long as they run out of debt, commend them to get into “the growing fare of stock growth,” which will then restore “12% a year.” About ten years ago, there was fullness of the platform program in my area where investors were admitted to 18% of reform promises annually. If investment promises a long-term return of the stock market (which is one point, has lost 90% of its value), you can bet at least three times as a risk.

What is the refund from?

Making matters worse, many investing gurus warn the people that future expectations of the future US market is much lower than last returns. To understand why, you need understanding when returning comes from. John Bogle, in his old investment in general investments, teaching that returns from three parts: Gravity, income of funding, and consideration. Last time, the consideration of consideration becomes non-factor. Occasionally, people hope to be the greatest hope for the stock market, such as 1999, and bidding put funny prices. At other times, as in the late 2008, people have a very great hope, and stock shares are discount. But in time, this passing on.

Therefore, long-term proclamation comes from only from confusion in the separation and the growth of the receivables. Remember that from 1925-2025, about 40% of return from construction (3.95%). Now, think about the crop of current market division of US stock, 1.2%. Taking the income income of companies that make up the US stock market remain close to the same in the future as a past, long returns. Is that reasonable reasoning?

Yes, US economic predictions for several years next year costs 1.5% -2.7% growth annually. Fortunately, that is the number after inflation. If the current division yield is 1.2% and expected to grow for 2,5%, real restoration of the original US stock area will be 3.7% forward.

In the meantime, the current yield of the US Bond market is 3.8%. Unfortunately, that is the forational number, folder. If you release 2.4% expected, you are left with 1.4% real return. Therefore, a portfolio is partly integrated with shares and in part of the bonds may have lower return than 3.7% noted.

More information here:

Some surprises I have learned in 20 years of investing

Expected to return to investment in each classroom

What is the investor to do? There are only a few decisions. First, you can save more and for a long time. This is probably the safest of the options. As discussed with the value of the Vuilual Fich Function Post, we can see that if you lower the return level, you must increase the amount added to the portfolio annually or portfolio portfolio should be returned to the same place. Second, you can take a serious investment risk. There are parts of the risky asset than US General stock market. Usually for investing, the higher risk takes root returns. Asset classes are like small stocks, price stocks, emerging market stocks have more higher refund than the total market.

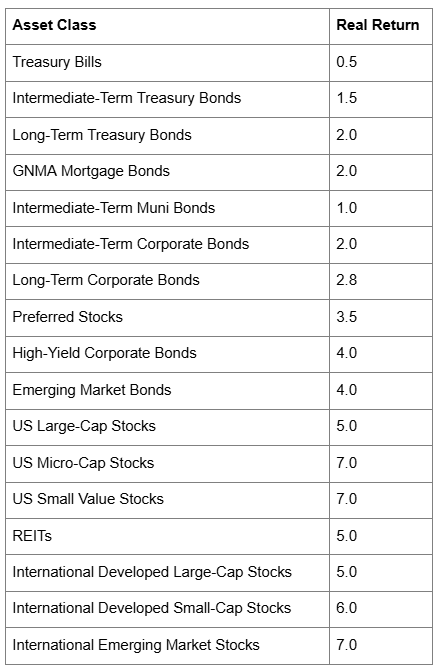

Rick Ferri, in his best book, all about the allocation of asset (2006), the following accounts for the return of various assets:

While many would move at the real prices in this chart and the wise investment in many classes of lists, point is clear. If you have a portfolio with a large number of small stocks, price shares, and international recruitment, your expectations (and the risk of temporary loss (and permanent loss) is only higher US market fund. Also, add a percentage of bottles forbottfolio, higher repurchaser.

Naturally, a full-formed portfolio of the shares of an emerging market bringing problems, and is not recommended. Finally, investor can hope “Alpha” can be added to their return. This further refunds is possible from high selection of safety and market time. The number can be positive or poor, depending on the ability of the manager, and, to all investors, is Zero before the cost (and under the zero afterwards). Unfortunately, the information shows that this skill is rare, and maybe should not be counted so that it can add a lot.

More information here:

The best investment portfolios – 150 portfolios are better than yours

1 better portfolio than your

A lower row

For many of you, the expected restoration I have discussed above seems to be very low. I know that it can be frustrating that can disappoint you. But hope is not a plan of investment. As given to how low money is to be restored, everything is very important that the wise investor decreases taxes and cost investment costs.

A lower line? Have a realistic view of what you can expect of a long investment. If you don’t, your investment plan will probably result in failure due to your behavior. Whatever 2023 and 20% returned over the stock market, remember that when it measures your portfolio return, use the inflation, after tax return, as a 2% -6%.

How do you expect the stock market to do the next few years? Do you hope more than numbers in this post exhibition? How will your investment plan affect you?

[This updated post was originally published in 2011.]