Is it a time to raise some money?

The student asks:

I know that it is not exactly a market talk but I can thank you all talking about how you view your own emergency money. I find it very difficult to keep money on the market that keeps up increasing. I know the law of 3-6 sixth month but I want to know how you treat the emergency money.

I agree that your emergency bag should be a decision to invest.

Personal financial decision. These are the features that you should consider when it comes to creating a relevant emergency fund:

- Lowness

- Diagnose

- Other financial sources / access to credit rows

- The variety of your income

- The risk of work

And the most important variable is your lever at night sleep. Some people will not sleep at night without any 9 to 12 months of cash in cash. Some think that that is an unrealistic purpose that leaves a lot of money on the table.

No correct or wrong answer. This is about one’s love.

Personally, I fall to short climbers because I have various revenue source and have many sources of tap in PINCH (HELOC, seller account, etc.). If our emergency balance goes beyond some limit, I set you in working in the market.

However, part of this question should be made of market. You find it “difficult to keep money on the market that keeps up climbing.”

This is actually question for the allocation of property. In addition to your level of emergency funding is a classified property section.

Some people hold a lot of money on their portfolios to have opportunities. Some catch extra money because they need to take withdrawal from their portfolio and do not want to sell where the shares are down. Some hold a lot of money to get onto the rising interest rates and / or inflation. And some people hold extra money because they need it like a shock Absorber touching the flexibility.

Money is not a great deal of long-term investment because it continues to continue the drop loss over the long haul. But if you need to keep the budget as emotional fence I have no problem with it.

You just have to understand the trade.

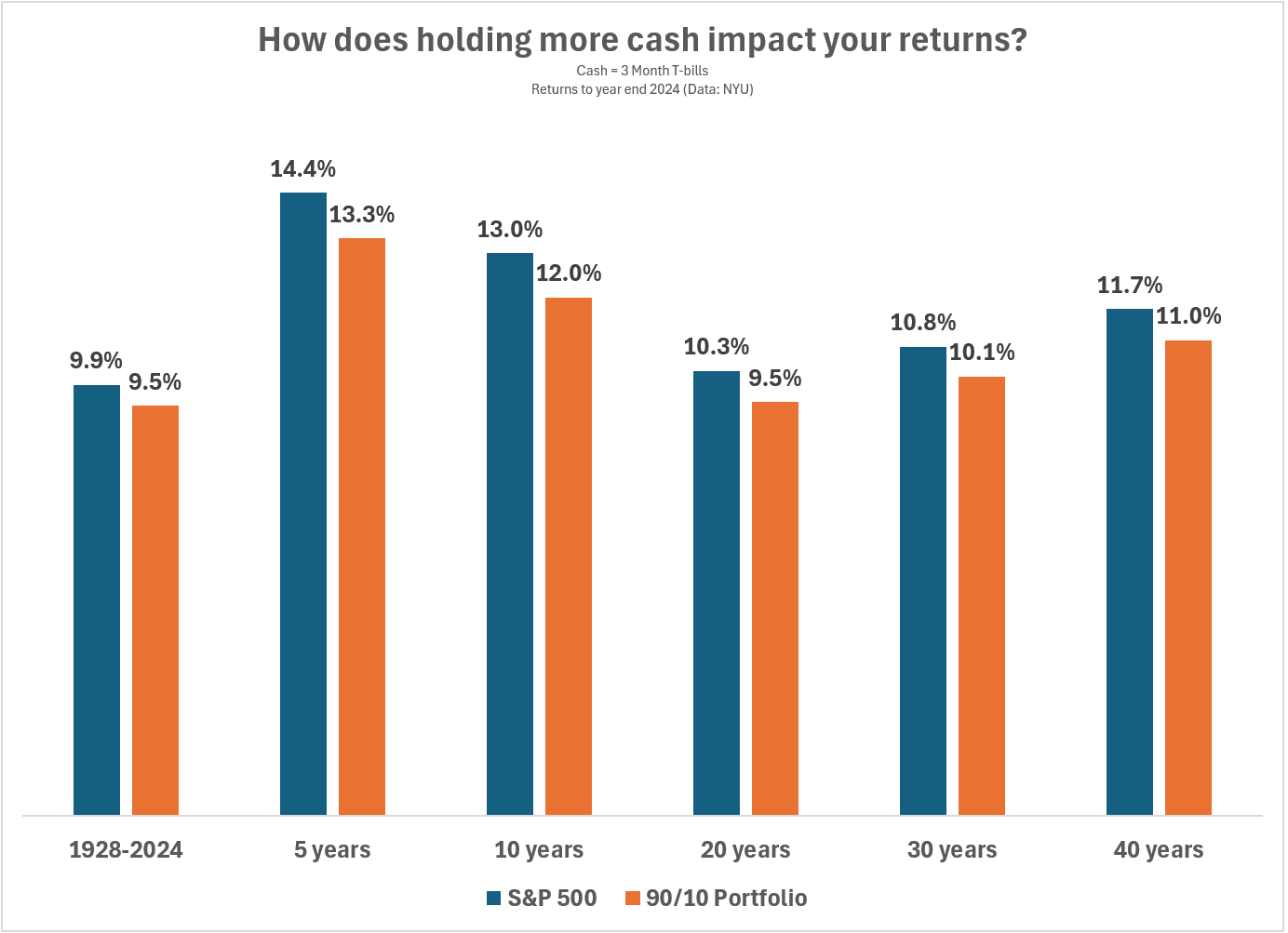

The allocation of small strategies in Cash does not impact your return. I look forward to the annual returns above various time frames using 100% of the 90/10 / 10 portfolio made of 100% (T-billing t):

Of course, you will be leaving some money on the table but is not a major difference in return.

I don’t know that 10% is too big or enough to help you sleep at night. But hold more money from your portfolio because you are afraid of the stock market or you simply do not want to hear all 100% portfolio flexibility is not the end of the world.

However, I did not enter the practice of trying to do this regularly because sometimes you get panic about the stock market. There is a big difference between strategies in CASH that is revised from time to time to get used to compare and try to guess what to raise money and when will you use it.

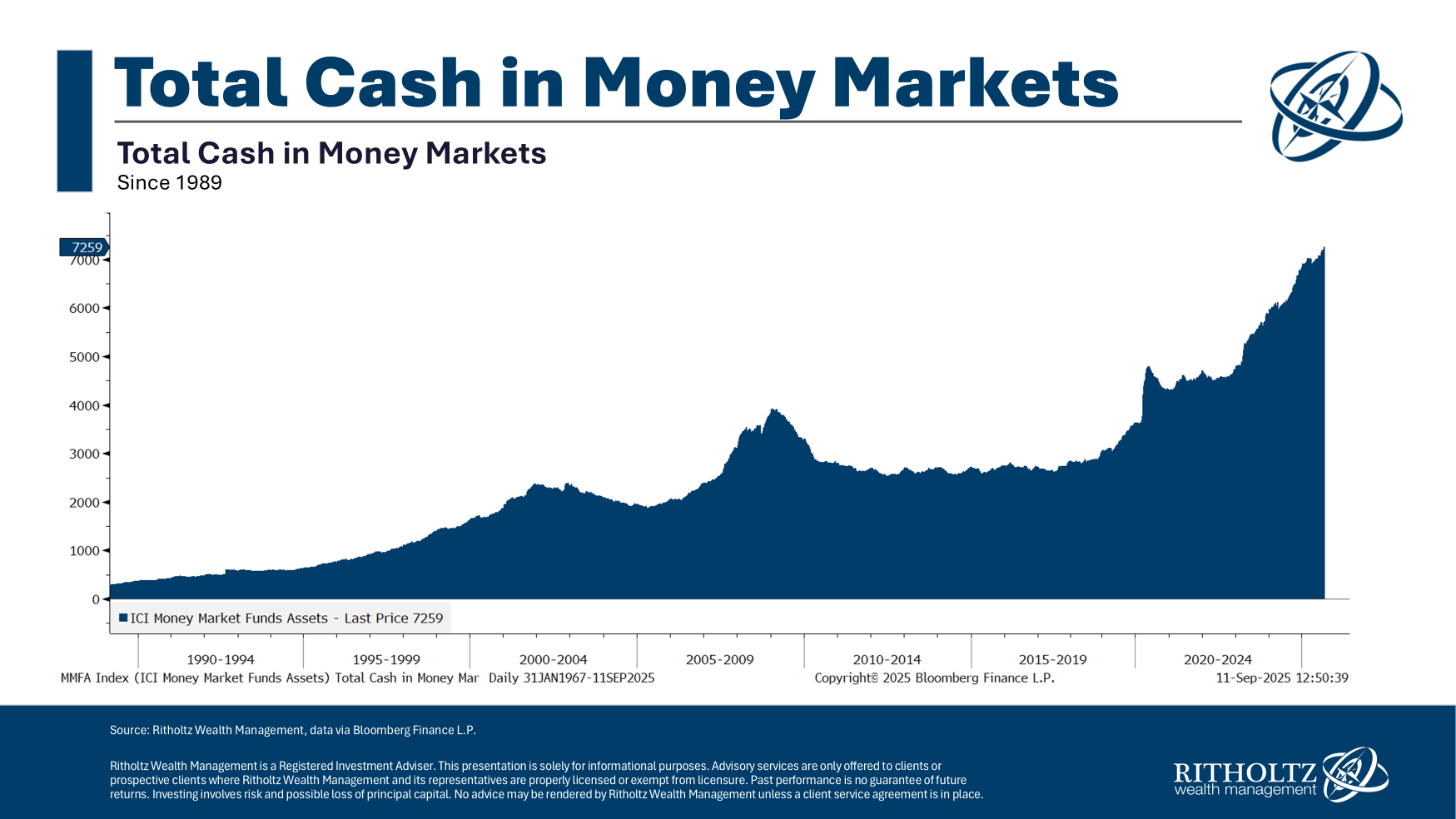

There is a lot of money sitting on the money these days.

That is more than $ 7 trillion in the financial market bags, from $ 3 trillion or more before the epidemic.

CASH may provide a single and protection from temporary changes in markets but predicts when temporary changes will take place as difficult as it can be heard.

Investing based on your feelings is usually a bad idea. Investment based on the set of laws gives you very high potential opportunities for later.

Successful investment in captivity processing process, not a guessing game.

I’ve talked about this question with a new episode of a compound:

https: /www.youtube.com/watch? v = 3d9t8yspzzem

Siphendule nemibuzo mayelana nokuhlukahluka okungaphezu kwamandla okuqashwa, lapho kunengqondo ukusika emuva ekusindisweni, ukuthi ungacabanga kanjani nge-rsus (ngosizo oluvela kuJoey Fishman) kanye nokudluliswa okuhle kwengcebo) kanye nokudluliswa okuhle kwengcebo) kanye nokudluliswa okuhle kwengcebo) kanye nokudluliswa okuhle kwengcebo) kanye nokudluliswa okuhle kwengcebo) kanye nokudluliswa okuhle kwengcebo) kanye nokudluliswa okuhle kwengcebo) kanye nokudluliswa okuhle of wealth) and the best transfer of wealth) and the excellent appeal) and the best wealth transmission) and the excellent transfer of wealth) and the excellence of the best of wealth) and the excellent transfer of wealth.

To learn more:

84 trillion elephant in the room

This content, containing security related ideas and / or information, provided for information purposes only and should not depend on specialist advice, or allow any services. There can be no guarantee or guaranteed that the views expressed here will work at any facts or circumstances, and should not depend on any way. You must contact your counselors in respect of the Law, business, taxes, and other matters related to any investment.

Comment in this “Post” (including any flowers, videos, and social media) reflecting personal opinion, opinion, and analysis of such comments, and should not be considered by the comments of Ritholtz Welply Management LLC. or contacts or as description of the advice services provided by Ritholtz Welpz Welice Management or Refund of any Kitholtz Welp Welice Management Clever.

References in any defense or digital goods, or operating data, for display purposes only and they do not recommend investment or donate funding services. The charts and graphs are provided within the information of information and should not be honest where he makes the investment decision. Past performance is not shown to future results. The content only speaks from the date indicated. Any assumption, display, foreclosure, guidance, prospects, and / or ideas that have been expressed in the material can change without notice and may vary or contrary to the opinions.

Comound Media, Inc., the Affilory of Ritholtz Wealth Management, receives the payment from different organizations to find ads on the integrated podcasts, Blogs and emails. Such ads installation does not do or be allowed to sync, support or support, or any of its encounter, is the content conductor or its employees. Investment in achieving involves the risk of loss. With additional advertising efforts they see here:

Please check the disclosure here.