Household Getting – Bloging Credit far from Credit

hope

We have now done the second urgent time. Test updated and accepted. Analysis is done. Day of closing at just a few weeks away. I’m sure you all know I’ve been playing with numbers for months now.

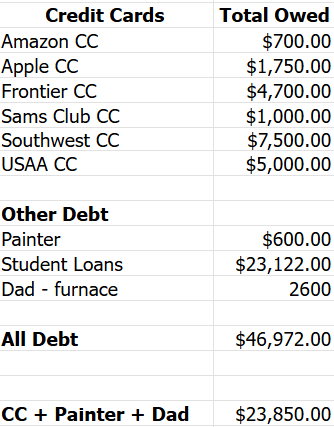

But I don’t know how much I’m going to take away from the sale of the house. However, I have a solid plan for what money will go. Obviously, the house will be paid. The total of the paid of the paid will be about $ 127,000.

First, the artist will be paid $ 600 left remaining.

Second, I will repay my dad to my dad from January, 2024 with a new love.

Third, I will pay all my credit cards. Everything without three of them will be closed. To end the temptation. I will be leaving my Apple CC, SAM’s Club CC, and the USAA CC is open. Have been locked (and released so the lock doesn’t really matter.)

Among, these three things, $ 23,850 will be used.

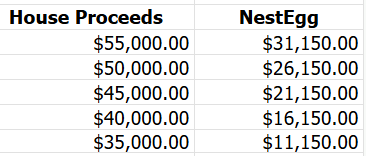

Based on my guests, which will leave me with the Siltrest egg …

I’m not planning to hurry to pay my student loans. During this time, they will only be my credit, and I am comfortable starting to make monthly normal payments.

I have many other things that I would like to do, but I think the best thing can be:

- Enter at least $ 7500 in EF. That can be three months of living expenses should happen to me / my work.

- Pay my car insurance at this 6 months. My Auto insurance is my highest monthly bill. And while no interest to make monthly payments, I would like to be paid. Then I can “afford to pay for” a monthly time to revive in September, I can pay all at the same time. This is just quiet peace item vs a financial item.

- Fossils will be used to overcome my Mov Fund Fund in the account saver account.

I certainly is open to the reply.

Hope is a smart and operational business manager who spend about two decades help their clients and grow their businesses for project management, digital sales, and technical technology. Recently the conversion from his role as a single growing mother / adolescent children in a blank NOter, hope is roaming emotional and efficient challenges.

Living in a small tiny city in northeastern Georgia and three dogs, hope loves the peace of the sea because of the busy sea. Although his children now receive their feet in national education, jobs, and independence – he remains a great deal of support in the next chapter, just as he faces the bittersweet tugt to allow travel.

Since Joinine’s blogging society Ages Cards cards in 2015, the hope has clearly shared its rising financial journeys and times. Now, with updated focus and the clear route, it is ready to deal with its finances with the same zeal and insistion to bring his life and his work. In his writing, he continues to encourage others to cope with their financial challenges and to strive for a bright future.