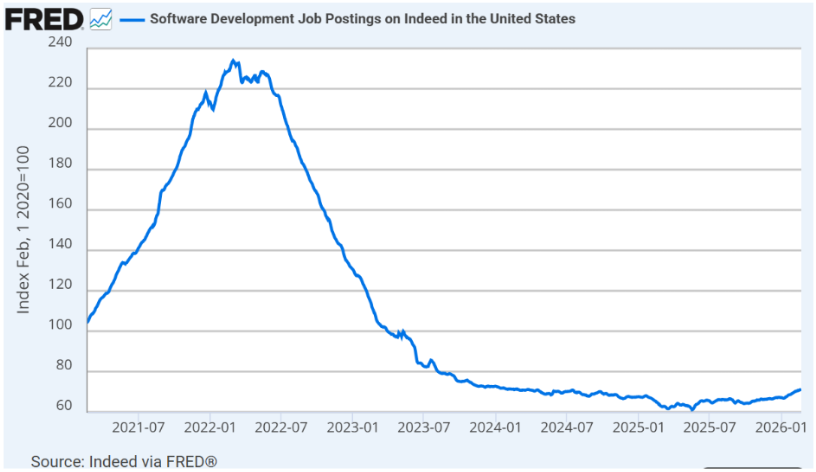

Restricts of the new IRS system contributions [Including 401(k) & IRA]

![Restricts of the new IRS system contributions [Including 401(k) & IRA] Restricts of the new IRS system contributions [Including 401(k) & IRA]](https://www.whitecoatinvestor.com/wp-content/uploads/2024/09/The-2025-Retirement-Plan-Contribution-Limits.png)

(K) restrictions s, 403 (b) S, 457 (b) S, Ras, Roth Iras, HSAS, FSas, FSAs, easy IRAS, and SEP-IRAS is all identified in inflation. While retirement limits do not increase every year, and while all accounts are not using the same formula where they will increase, you will usually see an increasing contribution every year or two.

Although inflation erupted in 2022, meaning the 2023 contract restrictions increased in a very important way, it is spoken three years ago, as a result, an increase in 2026 restrictions returning to normal. If you know the latest numbers to increase the decline, calculating increasing even before the IRS declares October or November (2024, the IRS issued its statistics in November 1).

Note that the Act 2022 is safe 2.0 has changed hosting contributions. 401 (K) / 403 (b) catching those 50 or more years has been identified by inflation. But the law said, since 2024, if you have a social security for $ 145,000 + (shown inflation), those holding donations will now come to a piece of grain. In 2026, social security limit will arise from $ 150,000 +. That means tax deductible devices will not be allowed for the highest earners.

Finally, the IRS announced that it returned that arrangement until 2026, so unless there is a change in the next few months, white white investors will have to arrive with a roth [in September 2025, this provision was moved back to 2027].

Remember, too, starting in 2025, holding offerings when it is higher than 60-63 years old (will be $ 10,000 or 50% over normal catch-catch offerings).

All that is said, here are the restrictions of the retirement program offering 2026.

202 (K) and 403 (b) the employee contributions

Complete providing limit for all 401

But if you are 60-63 at the end of 2026, your catch-up offer will be $ 11,500, meaning you can contribute to $ 36,000. [FOUNDER’S NOTE: Still researching this, it may be as high as $12,000, 150% of $8,000.]

(K) / 403 (b) / 401 (a) the value of the contribution

The total of all employees’ contributions and ten employers will increase from $ 70,000 at 2025 to $ 72,000 for 2026 in 2026 for the under 50. If you are 60-63, the contribution is increasing at $ 83,500.

Note that the limit of 401 (a) is different from 403 (b) limit. So, you can get $ 72,000 to each of them.

(B) the contribrary limit

457 (b) the resolution restrictions will increase from $ 23,500 for $ 24,500 for $ 24 500 in 2026. 457 (b) have uniquely restrictive restraint laws, so speak to your plan administrator if you are interested in putting many in your 457 (b).

2026 Details of Guaranty and Roth IRA Limits

Restrictions of IRA contributions will increase from $ 7,000 in 2025 to $ 7,500 in 2026. The Catching Contributions will increase from $ 1,000 in 2025 to 20,100 in 2026.

2026 Limitations for SEP-IRA Donations

The restrictions of the SEP-IRA Donations will increase from $ 70,000 a year by 2025 to $ 72,000 in 2026.

2026 simple IRA and 401 (k) to donate limitations

Simple Donations Limits and 401 (k) will increase from $ 16,500 in 2025 to $ 17,000 in 2026.

Health Account Account (hSA)

For single people, the HSA donation limit will increase from $ 4,300 in 2025 to $ 4,400 for $ 4,400 in 20,550. An offer for $ 1,000 to hold of 55+ remaining similar.

2026 Flexible Savings Account Account Account Account Account Account (FSA) account

Healthcare FSA’s ends will increase from $ 3,300 in 2025 to $ 3,400 in 2026 in 2026. Note that there are other types of FSAS (such as reliance care) with different limits.

Another exciting increase

The limit of 401 (a) the amount of compensation (the amount of cash may be used to calculate the Retirement Accounts) will increase from $ 350,000 for $ 360,000 in 2026. This is always 5x 401 donations limit.

The Patration of the revelation of the IRA of the RAILs who have a retirement program from this increase in the increase from $ 79,000- $ 826 in 2026, and from 2025 in 2025 in 202,000 in 202,000 in 209,000 – $ 149,000.

The Roth IRect Age of the Limit limit of $ 150,000- $ 165,000 in 2025 to serve $ 153,000- $ 246,000 for $ 246,000 for $ 242,000. If your Magi is more than that, you will need to contribute indirectly through the Backdoor Roth IRA process.

While social security benefits rose by 823, 2024 and 2025 bumps were more modest in 3.2% and 2,57%, respectively. Number of 2026 is not known.

The description of the most compensation worker will always be like 2026 at $ 160,000.

While it sounds like all of this is increasing, they are actually accompanied by inflation. According to the actual (after prices) on the basis, it is basically the same as this year.

Need help on your financial journey? Over the years, a white coat investor also carries the recommended list of experts who have been well spent and trusted by thousands of students. Check our hand-made selection today, and get a different support you deserve.

What do you think? Are you awe about this? Are you happy to be identified in inflation?