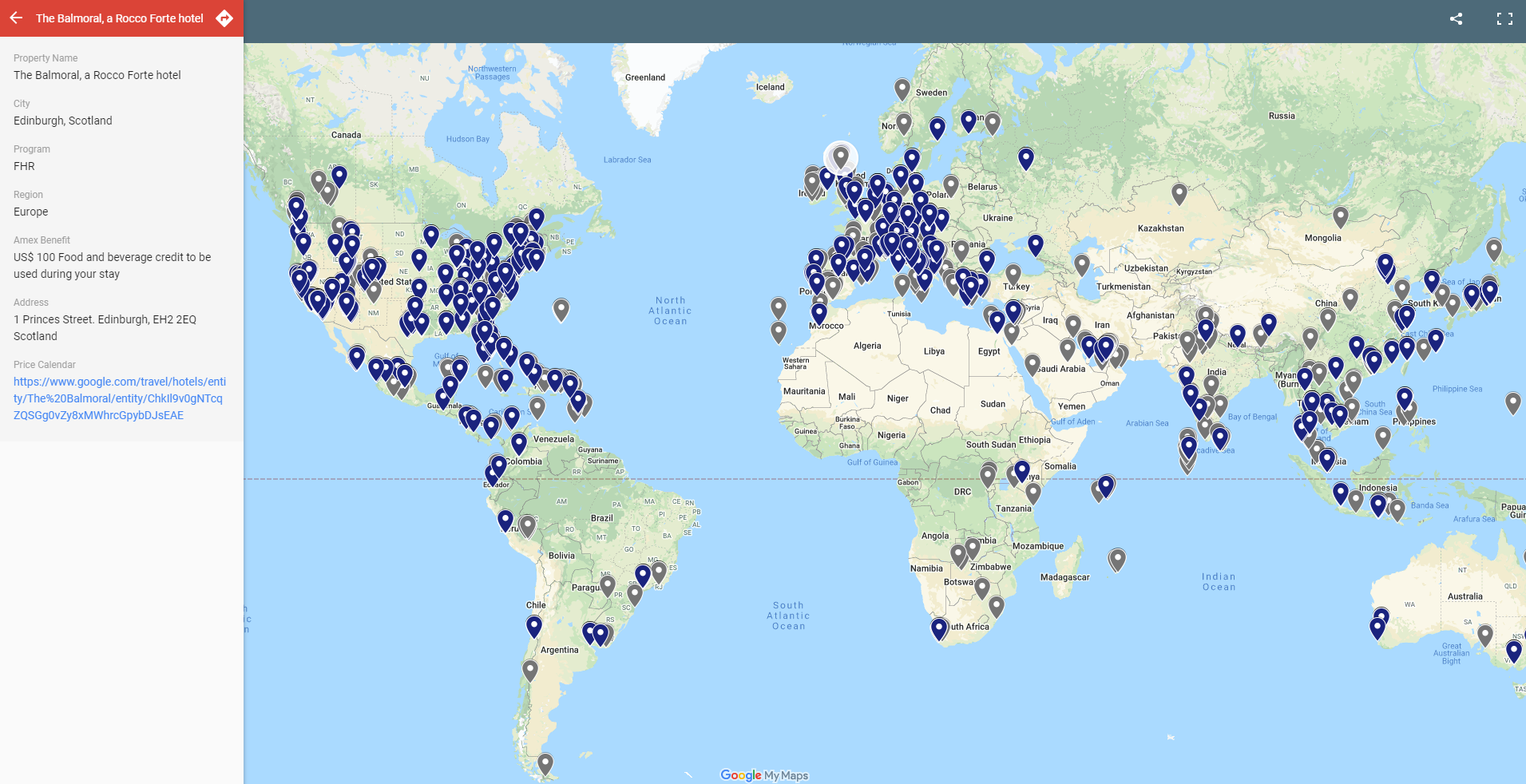

Amex FHR & THC map

[Update: December 2025] In an important structural move, American Express has announced a major overhaul of its Platinum Card incentives. From September 2025, the previous $200 annual credit for its selected hotel programs will be replaced by a $300 semi-annual subsidy. This increase in the total annual agreement, to $ 600, is a clear decision to include its premium customers within its high marmin environment that goes deep.

And just in time for this amazing upgrade, our favorite map tool is updated with the latest data from November 2025. Amex luxury hotel portfolio.

- FHR and THC programs have expanded to include miracles 1,807 buildings FHR and 1,299 THC Properties Around the world. That’s a big jump from 1,545 and 740, respectively!

- We are seeing the complete addition of hundreds of new hotels, with the THC collection approx Doubling in size Two years ago. This is a great practice, giving you more options than ever before to use your credits.

- Best of all, the pins are improving! In 59 buildings, restrictions on prohibited food and beverage bills have been advanced to be changed significantly. “PASPE CREDITS,” Giving you more freedom to enjoy your stay in your own way. Several THC hotels have graduated from the ELTE FHR program.

We developed a map-based search tool for Amex FHR and THC hotels. The map shows the price calendar, stay benefits, location, and other important features of Amex FHR and THC hotels. We believe that this is probably the most user-friendly platform for monitoring the prices of these hotel groups on the Internet so far.

1. What are FHR and THC hotels?

Fine Hotels and Resorts (FHR) is a hotel collection program operated by American Express. It offers ELITE-like Perks at select luxury hotels worldwide when you book through the American Express program using a platinum or centurion card. You can expect the following stays to be available with AMEX FHR bookings regardless of the length of your stay:

- Room upgrades upon arrival, where available (properties may exclude certain room types, and some may offer a room with a better view).

- A daily meal for two

- Confirmed 4 pm late check out

- Daytime entry, when available

- Compliment wi-fi

- Experience credit ($100 for accommodation, dining, or SPA credit at most locations)

Hotel Collections (THC) is another hotel collection program operated by American Express, with hotels distributed in a lower tier compared to FHR. It offers Perks similar to a select collection of luxury hotels around the world when you book through the program with American Express using a gold (platinum, or hundred rose) card. You can expect the following stays to be available with Amex THC bookings when you stay two nights or more:

- Room upgrades upon arrival, where available (properties may exclude certain room types, and some may offer a room with a better view).

- Experience credit ($100 for accommodation, dining, or SPA credit at most locations)

2. Why does this search engine seem useful?

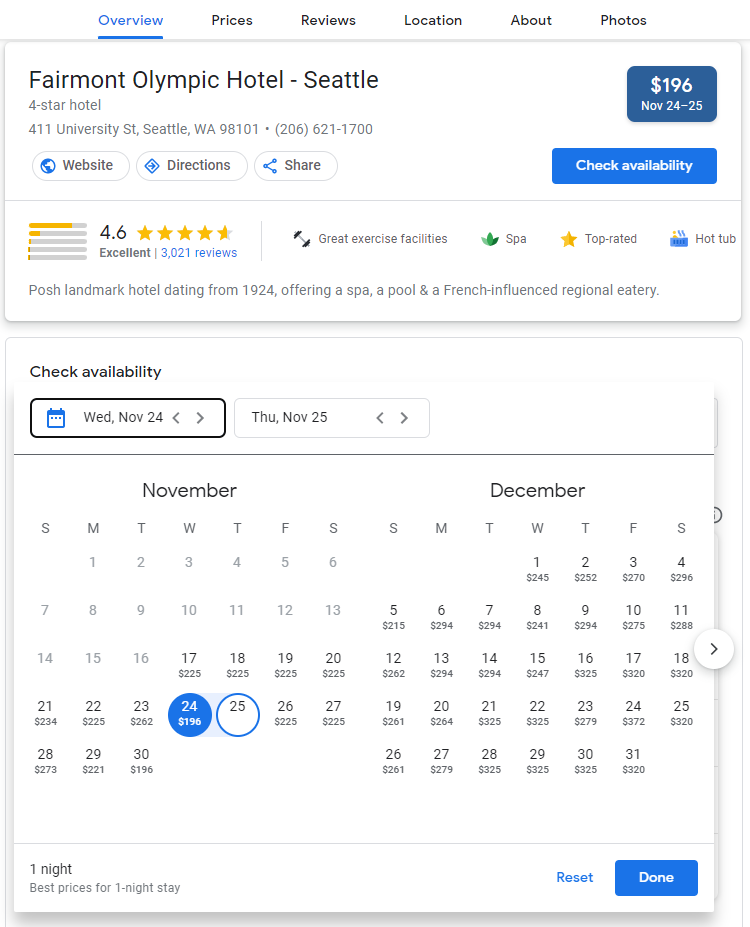

Starting in 2021, the Revised Platinum membership benefits have added a $200 Hotel Stay Credit per credit for the calendar year. Such credit can only be redeemed when booking a stay and preparing an Amex for the FHR and THC property, including the cost of the booking itself.

However, it seems that it is not easy to spend this $ 200 bill on a hotel seat that is really worth its value, especially for those travelers who are guaranteed money. This is because most FHR and THC hotel nights are taken up, and also because the AMEX FHR and THC hotel booking system is not easy to use. This program supports searching for a specific date / time. There is no price calendar available, and the visual links are deep. Therefore, making the right hotel stay at the right time and place seems difficult.

Recently, the idea of developing the AMEX FHR and THC search engine has come up in tandem. Many thanks to Thunderfat for providing a complete list of FHR & THC hotels (including hotel names, addresses, and Amex benefits). On this basis, I use Google Map and Google Travel, a logical simulation of the Marriott map to search for a flexible date, and this search engine for FHR and THC was successfully developed. In this program, you can find all FHR and THC properties on the map, including hotel name, address, AMEX benefits, and a link to its price calendar, hotel review.

3. How does it work?

We officially launch the English version of the search engine today, including information on 1,264 FHR and 636 Properties worldwide. I am grateful to the people who provided help and comments on this project, including Thunderfat, the authors of US Credit Card, and many users of the Credit Card Forum.

I present the map below; You can hold down the Ctrl + Mouse wheel to zoom or click on the top right corner to open full screen mode. Please do not operate this map link without permission.

A few points may draw your attention:

- The price in the price calendar is the lowest price Google takes from the prices of several third-party booking platforms (except Amex). Sometimes there is a bug price. In addition, the actual final booking price of AMEX is usually 20-30% higher than the price calendar price (after all, there is tax, and benefits are not free).

- Some hotels, casinos (such as those in Vegas) and a few resorts will have a certain amount of hidden fees to pay for the property.

- The data is mostly compiled using an algorithm, while some is obtained manually. There may be bugs left. Please leave a message in the discussion below this post if you find any.

- Very few hotels can book only by phone, so there is no price list (usually the cheapest ones).

- When including global information, some countries, due to confusing street information and characters, Google map information, and the location of the hotel is not true, so the links on the map are discriminated.

4. Access the map through the mobile app

The URL to this map is:

- https://www.google.com/maps/d/u/1/view?mid=1hygpppp9ttntttstnnpupd_c507mq_fhec&usp=sharing

To access the map through the mobile app, here are the instructions:

- Run the “Safari” app

- Enter in the address field the above URL of the website. Tap “Go.”

- Tap the icon that shows a right-pointing arrow coming out of a box to open a drop-down menu.

- Tap “Put on home screen”

- Open the “Chrome” application.

- Enter in the address field the above URL of the website.

- Tap the menu icon (3 dots in the upper right corner) and tap Add to Homescreen.

If you like this post, don’t forget to give it a 5 star rating!