Focus To Get Rich (or Poor)

Here are the latest highs for several major tech stocks:

- Oracle -46%

- Meta -25%

- Netflix -30%

- Nvidia -17%

- Broadcom -21%

- AMD -25%

Sans Netflix, these are some of the biggest names in AI trading. This is what everyone has been worrying about for a long time.

What happens when AI trades slow down?

These companies have a total market capitalization of ~$9 trillion. Surely the stock market falls well?

No (and don’t call me Shirley).

The S&P 500 is within spitting distance of all-time highs:

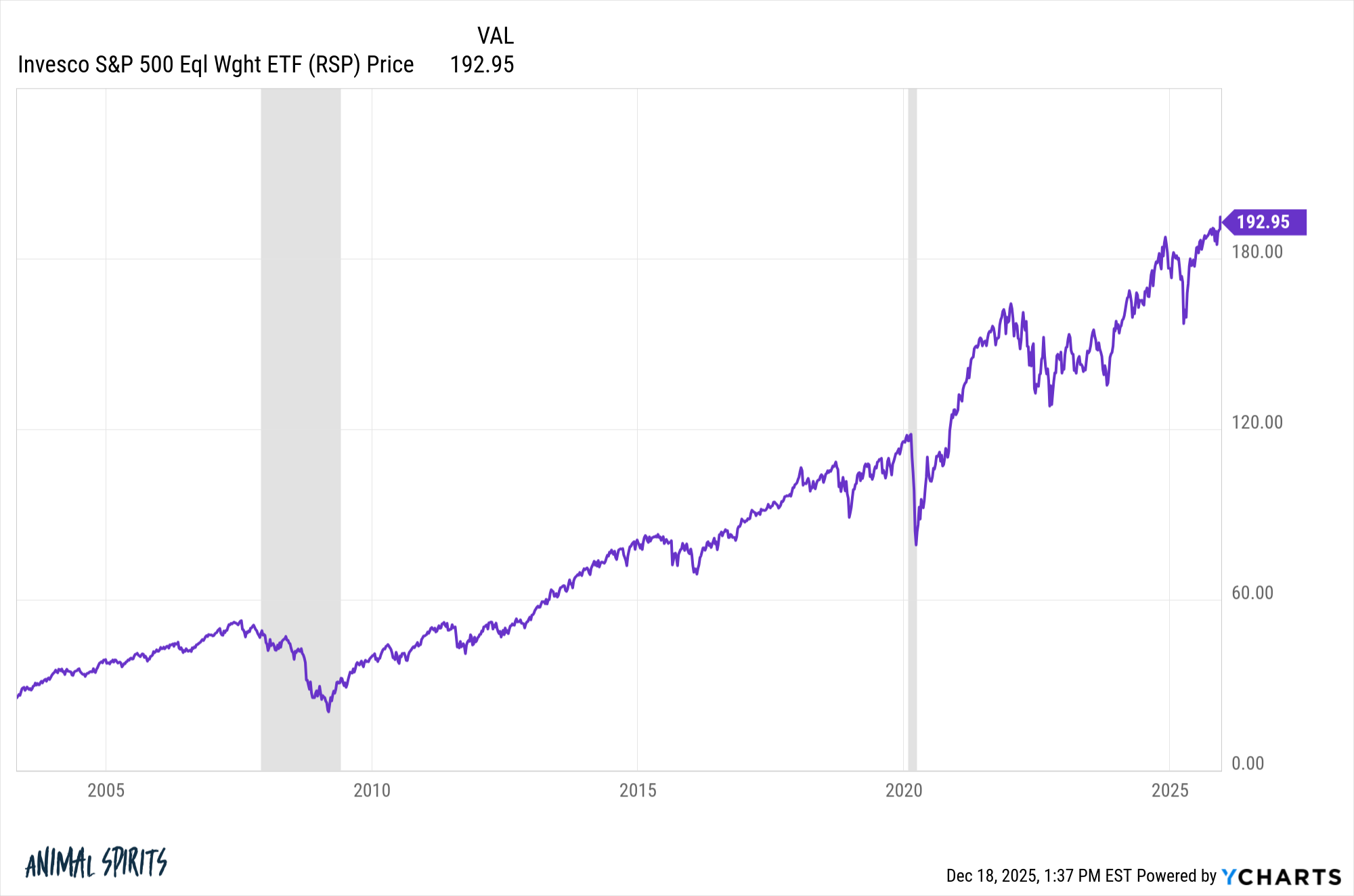

The equal-weighted S&P 500 hit its highest this week:

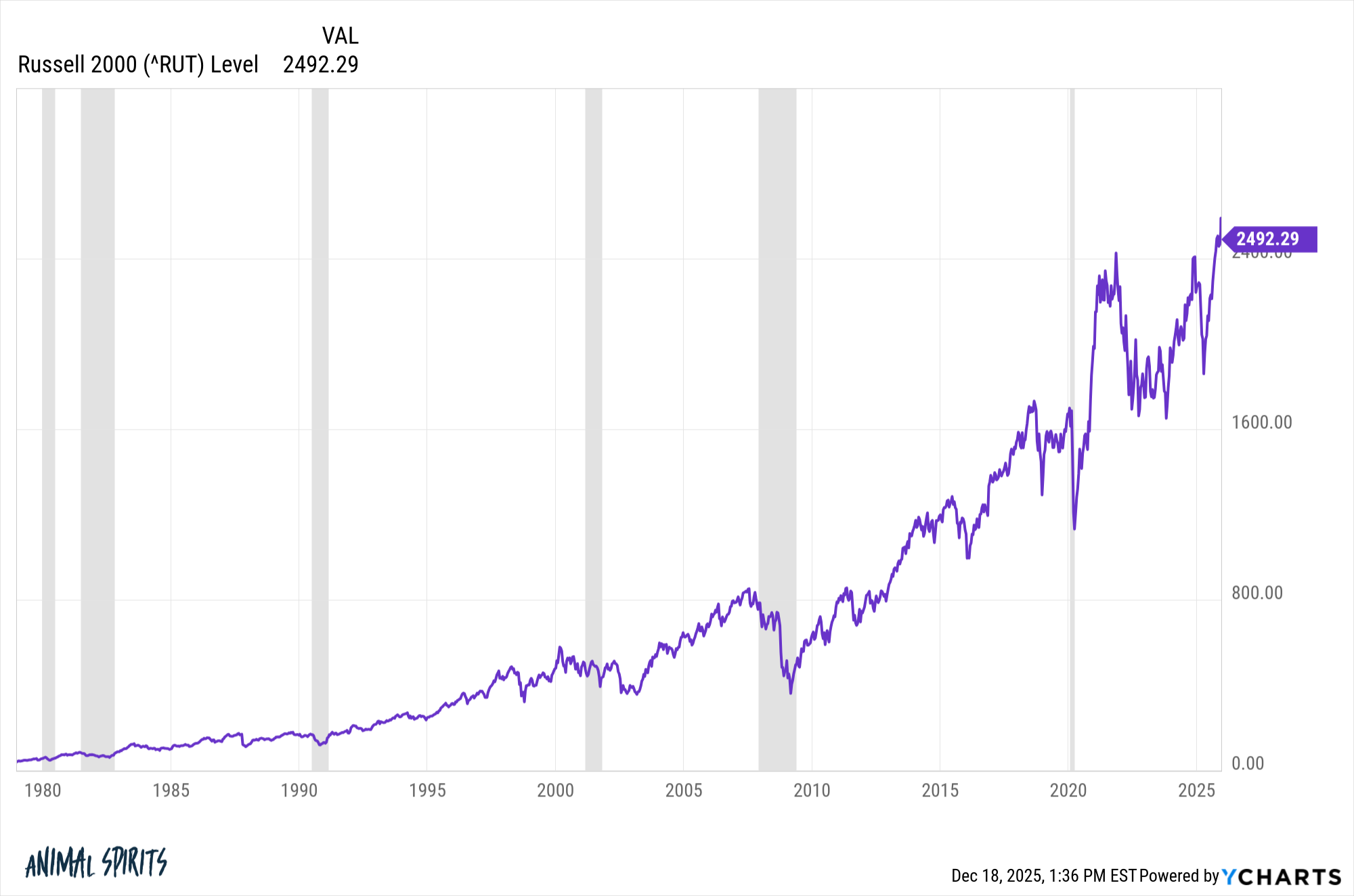

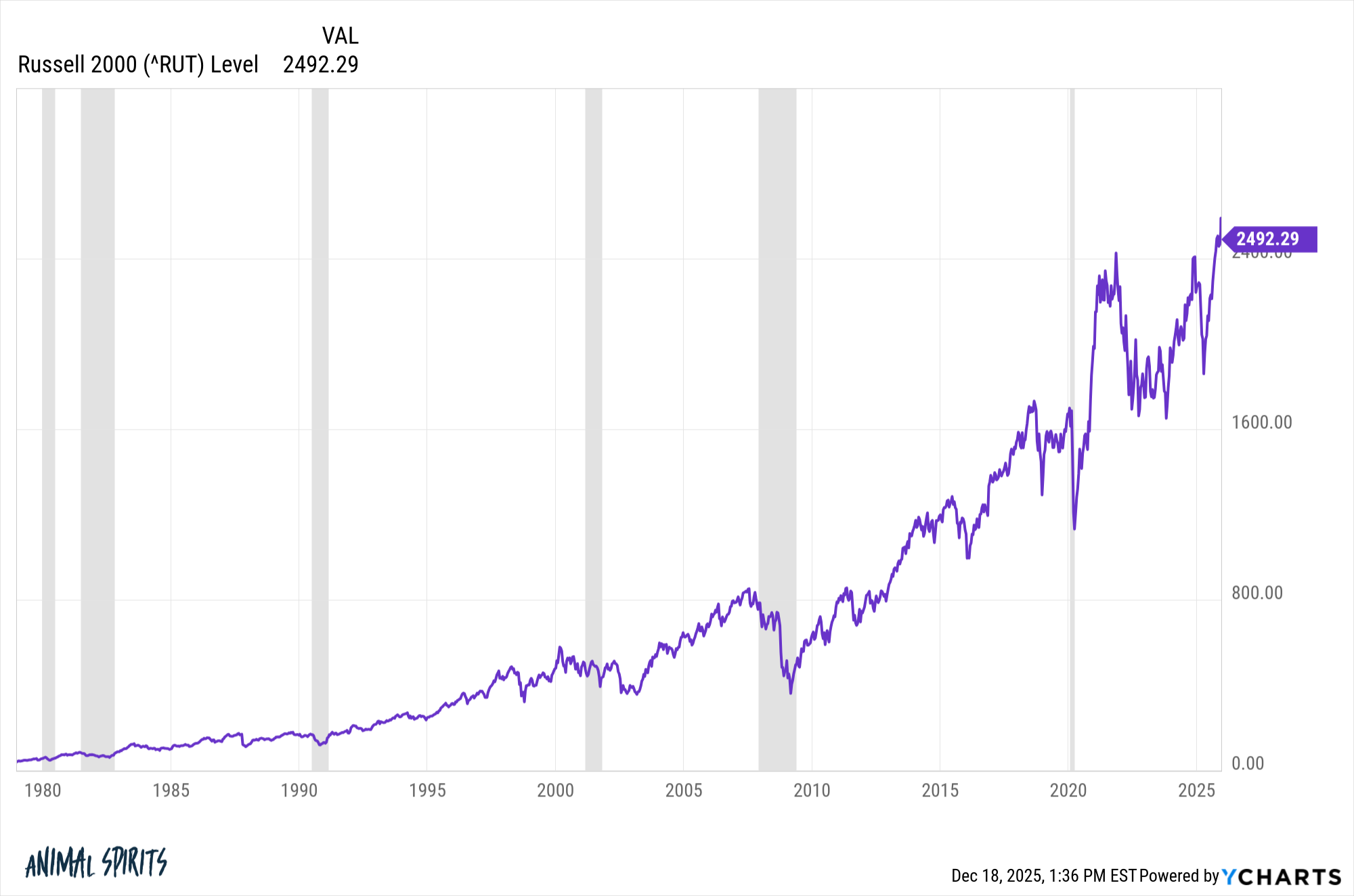

So is the Russell 2000 Index of small stocks:

Focusing on the stock market has been a concern of some market experts for years now.

Just wait until the tech stocks rollover. The market will be crushed!

Maybe that will happen one day, but these things are fluid. If tech stocks falter, other parts of the market are likely to fill the gap. That is exactly what is happening right now.

I don’t spend a lot of time worrying about stock markets because that’s how the stock market works. Long-term gains are often driven by a few winners.

I am very concerned about investors who have allowed their portfolios to become too concentrated during this famous bull market.

There is an old saying: concentrate to get rich, but diversify to stay rich.

I’ve seen that play out with many of the wealth management clients we work with at Ritholtz. There are many people who come to us looking for wealthy financial advice on business ownership, real estate investing, corporate stock options or buying and holding small amounts of individual stocks over time.

In the last 5 years or so the number of people with fixed income in the stock market has grown by leaps and bounds.

Here’s a story in the Wall Street Journal about an investor who concentrated his portfolio in tech stocks for the past decade and won:

Brian Hahn has had the bulk of his savings in tech stocks for ten years. As the growing frenzy of artificial intelligence this year sent markets to new highs, sell it all.

The 51-year-old math teacher had about 80% of his investments in technology, including exchange-traded funds and individual semiconductor companies. In October, he put most of that money into gold, which many see as a safe haven during major market downturns.

“It was a big risk for me to think that this would continue to go up,” said Hahn.

Good for him.

You probably made a ton of money in tech stocks and now you’re down to gold. Will this change work? Time will tell.

Here’s my concern with investors like these who have concentrated their money on a few tech names over the last 5-10 years and destroyed many professional money managers in the process – it can’t always be this easy.

Obviously, saying this is easy is biased, but all you had to do was buy a few of the biggest name companies in the world that create the products and services that billions of us use every day. And make a huge profit in the process!

Buy-what-you-know won’t work forever.

Dom Cooke wrote an excellent profile in Colossus about Henry Ellenbogen, former portfolio manager for T. Rowe Price has studied major compounders over the years. This section was interesting:

“We never felt that money would be free forever,” he said. “But we had made a simple assumption after ten years of free money.”

Ellenbogen is inactive. He trades his portfolio as little as possible. But at the beginning of 2022, it became clear that this was not a temporary removal. The regime had changed. He returned to his study of compounders. In a typical decade, about 40 stocks compound their wealth by 20% per year. In the period of free money, 120 shares had gained. There were fraudsters in his portfolio.

So many companies tripled by 20% per year than usual. This may be a once-in-a-lifetime cycle for great integrators.

In fact, I would be shocked if we ever saw a situation like this.

The stock market is focused on the upside but there are still plenty of other stocks that can cushion the blow when the big names stumble.

But if you have a portfolio that is heavily concentrated in stocks you have no cushion if things go wrong.

Focus can make you rich, and it has made many people rich in this cycle.

But it can also take away those benefits or make you poor quickly.

Diversity will be important again at some point.

Michael and I talked about stock market focus, the AI revolution, all-time highs and more in this week’s Animal Spirits video:

Subscribe to Compound so you don’t miss an episode.

Further reading:

The New Normal for Stock Market Concentration

Now here’s what I’ve been reading lately:

Books: