Do we need a long bear market?

Spencer Jakab at the Wall Street Journal makes the case that we can use a long bear market:

He explains:

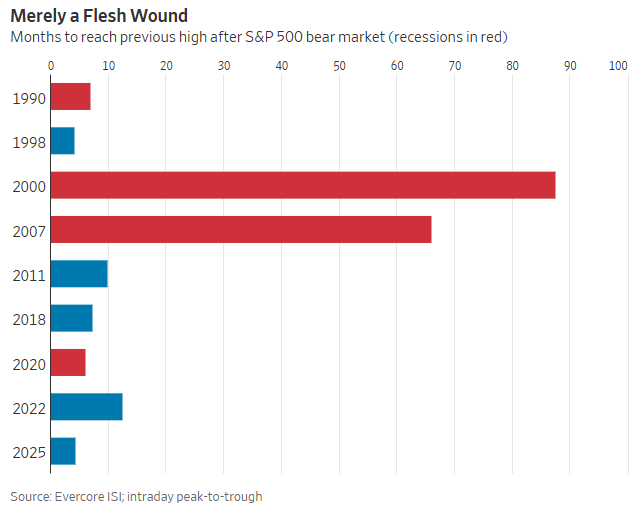

The average duration of the previous peak when a bear market coincided with a recession was 81 months. It took just 21 years without a recession. In the last 16 years, the decline lasted less than eight months before reaching the Old High.

No one younger than 40 now had a 401(k) during the 2007-09 medical period. Most of Wall Street’s pros haven’t graduated from college yet.

Bear markets teach, but demand is a happy person.

This chart shows how quickly markets have recovered in other countries:

So while investors have lived through many ups and downs, the magnitude of those DowTuns. For those investors who have not seen a long bear market, they may wake up.

William Bernstein and Edward McQuararie recently wrote a piece calling for these ideas:

More than a generation ago, the financial historian Peter Bernstein (unfortunately, he did not meet Bill) wrote about the memory banks invested in, “market experience that accumulates in their investment strategy and shapes their investment strategy. When he put it, looking back at the 1990s: “Many participants in the market had no memory of what the bear market was like.”

Most investors should have their memory banks removed based on the current stock market.

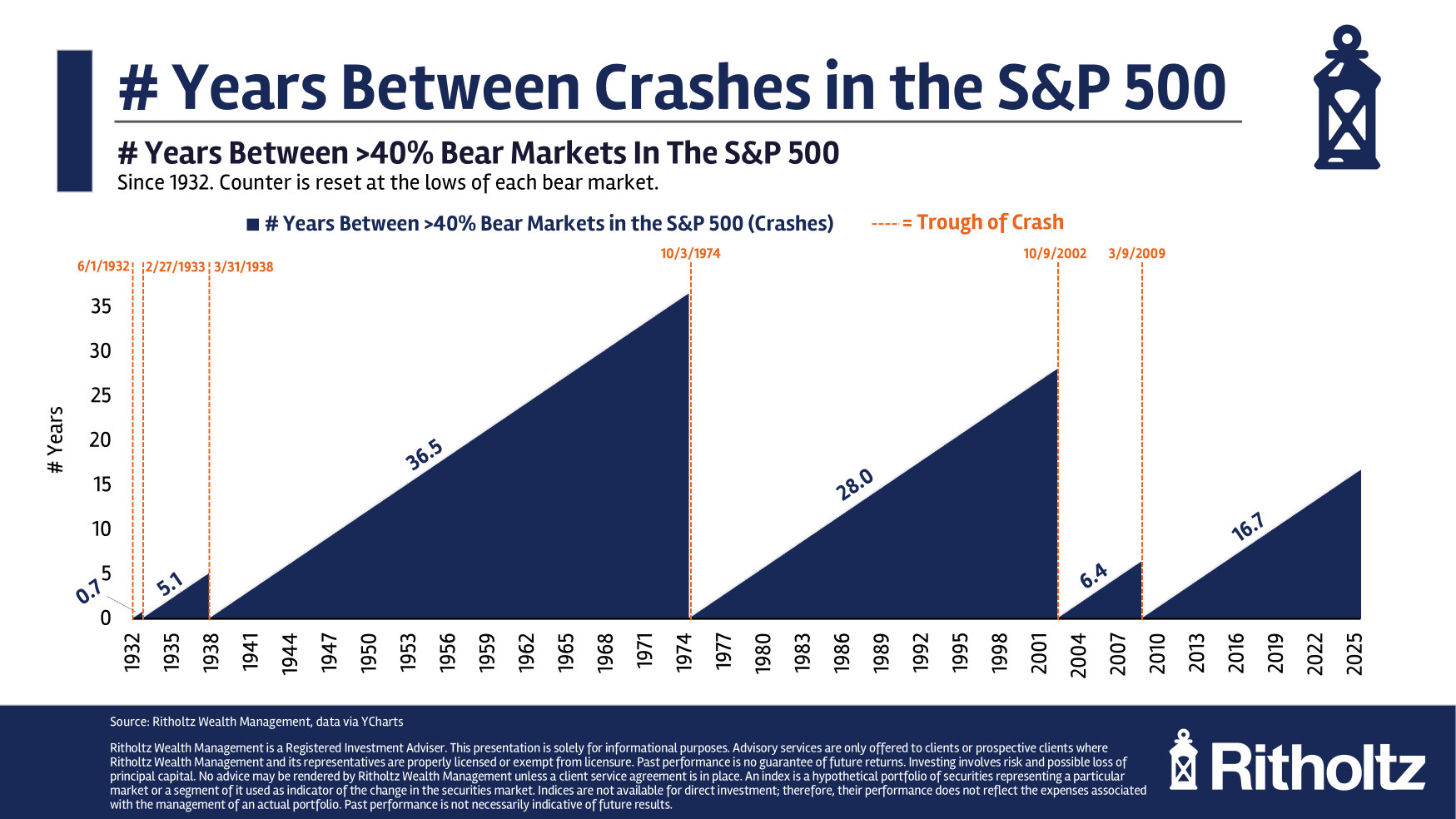

I’ll take a 40% premium or worse is the definition of market risk. By that definition, it had been some time since the last accident. This is completely normal based on historical data:

There have been long stretches of time without an accident. There were no long markets between the Great Depression and the Great Inflation of the 1970s. There was another long period of calm from 1970 through the dot-com bubble without a market crash.

That was followed by a real jolt to the system with two accidents in less than a decade.

We’ve had a few bear markets but none of the most prolonged crashes since the 2008 crisis.

Now there are more people invested in the stock market than ever before. Of course, a long bear market can be difficult for new investors to manage. But it’s not just new investors that I can care about in this situation.

I well remember the great financial difficulties.

I started a new job the day after my heart failure in the summer of 2007. The banking crisis was already underway at that point. Managing money with that problem was learning for me but it was also nerve wracking.

But from investing itself was easy.

I don’t have much money. My stock investment was 50-60% lower but it was a very small amount of money. I have to keep pulling my exploits from the market at fire sale prices. The capital of the people lit it by accident.

The people I saw coming out and making mistakes were young people but those with more portfolios. Why? They had a lot of money to lose!

I know many retirees who worry about stock market risk. This can be a new experience for middle-aged people like me.

I have more money in my portfolio now than I did in 2008. Even if the percentage drop was lower than at the beginning of 2008, the loss of the dollar will be more painful at the risk of 40%.

Losing 40% of your money if you have $100K is $40k. Losing 40% of your money if you have $1 million is $400k. This is an obvious statement but to see that much money is just too painful.

Now there are many wealthy investors who have never had this much money at risk.

Listen, I might not live with an overly negative downturn and a long bullish market. But I know those risks exist. The market will collapse at some point. Maybe it comes back very quickly but that is not guaranteed.

That’s why I’m breaking up. I do not use leverage in my portfolio. I have no consolidated positions.

The name of the game in the long-held market is heavy, both intellectually and financially, to survive another day in the markets.

Predicting a market disruption may or may not be difficult but you should prepare for one because it will happen eventually.

Michael and I discussed long bear markets and much more in this animal video this week:

https://www.youtube.com/watch?v=efta7xtpk

Subscribe to the compound so you don’t miss an episode.

Further reading:

Go all-in on MSTR

Now here’s what I’ve been reading lately:

Books: