Dave Ramsey Warns Against Making These 3 Costly Mistakes

It is important to have a financial plan at any stage of life, but when you are about to retire, it is even more important to prepare your money. It’s also important to avoid financial planning mistakes that can be detrimental to your long-term goals.

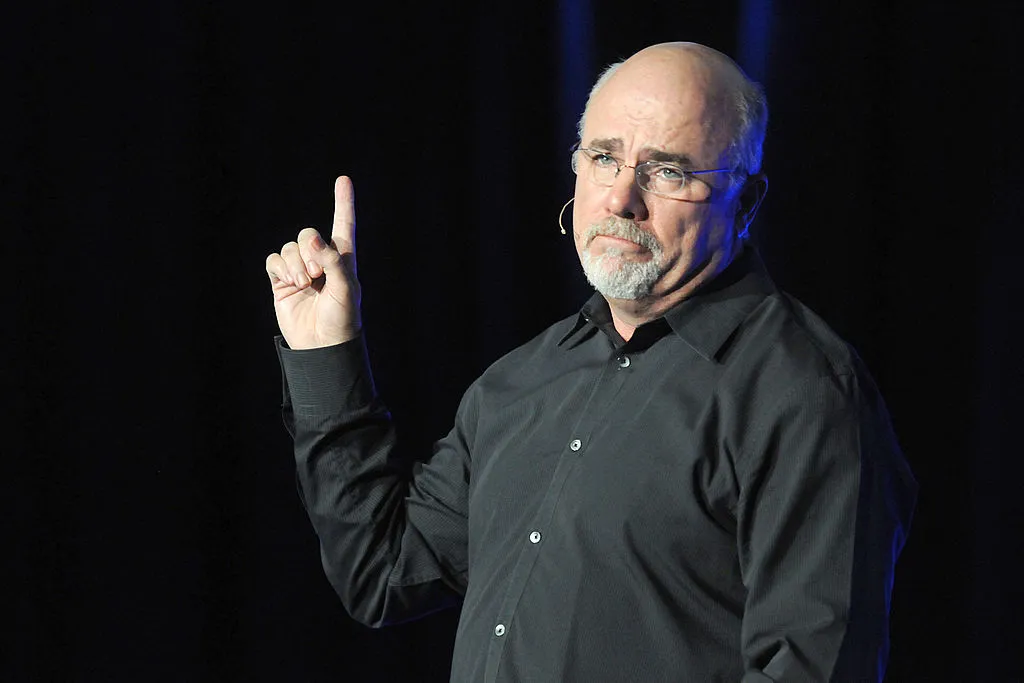

Famed financial guru Dave Ramsey, known for his aversion to debt and focus on budgeting, has given plenty of advice over the years on how to set yourself up for success in your 50s. Here are three mistakes to avoid when planning for retirement.

1. Retirement and debt

Ramsey emphasizes that leaving your job with debt can be a big mistake. He suggests paying off your mortgage, car loan, credit cards and other types of debt before you retire. While a nest egg may make debt feel manageable, a medical bill or other unexpected expenses can put you in a situation where you fall behind on your debt payments.

Ramsey recommends attacking debt aggressively before retirement. That way, you also have time to let your money accumulate before retirement. Those extra few years of asset benefits can give you more flexibility in retirement so you don’t feel tied down and can spend on what you enjoy.

Gold Offer: Sign up with American Hartford Gold today and get a free investor kit, plus get up to $20,000 in free silver on qualifying purchases.

2. Living without a budget

Creating and maintaining a budget isn’t just a solid financial step for people thinking about retirement. It can help you keep your spending in line with your expenses and goals no matter how old you are – and doing so can help ensure you’re saving enough for retirement.

People who are not on a budget can end up spending a lot of money on houses, cars and more. Some people buy larger homes than they can afford or opt for a luxury car if a used car makes more sense for their long-term financial goals.

Ramsey views the budget as a “permission to spend” rather than a punishment. Once you’ve taken care of important expenses, paid off bills and invested some of your money, the remaining cash can go towards guilt-free spending.

Save Smartly: Manage your money with Rocket Money’s budgeting app, one of Money’s favorites

3. Exceeding Social Security

Social Security is a retirement safety net, but it won’t provide you with enough money to cover all of your expenses. Some people underestimate their monthly expenses and quickly find that Social Security is not enough to cover their essentials. And remember that taking Social Security as soon as you’re eligible reduces your benefits compared to extending your payments, which increases your payment rates.

Ramsey advises savers not to rely solely on Social Security in their retirement years. As the cost of living increases — and health care costs in particular balloon — it’s important to build a nest egg that can help cover your living expenses and retirement goals, such as travel. In that way, Social Security provides additional income rather than being the basis for financing your lifestyle.

People looking to retire shouldn’t be the only focus when they can retire. They should also consider How they can retire, and calculate how much they will need as expenses rise.

Extra Money: See how you can get up to $1,000 in stocks when you fund a new SoFi investment account