Cash app adds lakes to help users separate payments

Separating the check, or even a group holiday, it is a very simple thing.

Cash application, a famous peer payment system, excluding “Pools,” which allows people to separate checks, liabilities and other payments without everyone that needs to have an account of the financial system. It does this, first, accepting third parties payments from Google Pay and Apple Pay.

“With our customers, our customers now have a dedicated, easy-to-use group of group payments,” said Cameron Worboys, the Head of a product construction for the CASH, matters. “They can start the lake to collect money in seconds and transfer their balance to the Cash App Balance where it is time to pay.”

Money is usually “WORBOYs compliment, that many people use billing apps to separate costs, gifts and group holidays. However, a large headache is that everyone is usually downloading the same app to use the separating features. Or someone should come before costs and receive paying in a group in different ways.

“People used the money system to cover these group cases, but it was kind of cleanliness,” Kristen Anderson leads a product that helps to build a new feature. “Together on different payment platforms.”

In ponds, he says, the financial system aims to make a problem of the past action ‘includes the experience.’

Currently, feature is available at “cash use users in cash,” the company said, adding that it aimed to release a worldwide feature “in the months to come.”

Anderson says about this driving, only debit card payments from Google Pay and Apple Pay are supported, but the “very bad credit card skills.

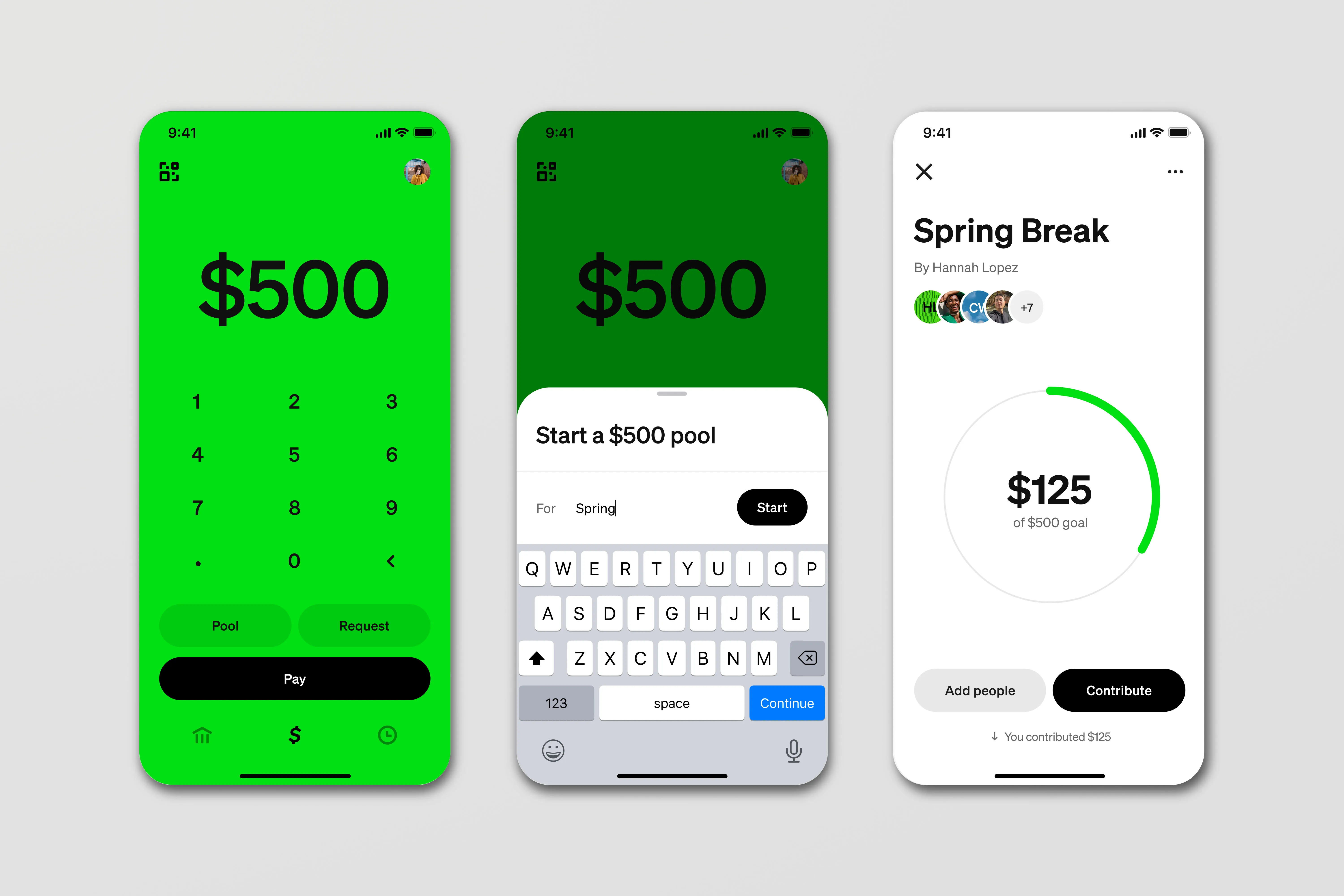

Cash App Pools: How New feature works

Lakes can be used to distinguish the spur-of-the-man group, such as dinner tabs, and capital expenses, organized. The underlying feature applies equally.

Fast cracks, a person with an application for the financial system can collect payments from the group by building some of the transfer of the financial system or payments connected to Google Pay or Apple. The user app user invites Google Pay users and Apple pay for making payments in link in the text.

Best purchases, such as a group holiday, pond can be set in advance and can help everyone continue to save and contribute to specific costs. The company says that important Parks for lakes is that one member of the group is still no longer a large cost and seeking a return later.

In either case, when the policy is achieved, the lake facilitator can close and receive the transfer fee to their own financial system.

Cash app wants to be the ‘whole life

When the financial system begins in 2013, its intention was to send peer payments, which were made by email at the time.

While speed peer transfusions are still in the main session of the financial system today, the company – the block company and my sister and others – feveling block’s floath all more trading sectors.

“We are looking for a Cash app for the next generation,” Jennings, Business head in Block, “referring to the CNBC app,” It is actually a financial system where the customer can drive their life. “

Anderson emphasizes that view, adding, “All of our financial life is clearly wider than” Peer-to-Peer to pay. Today, financial system users can now save and invest in the app, buy a Crypto and enter their taxes.

He said the app aims to have a service “to help people meet all their needs, from lending when times are strong when the times are right.”

Your financial data race

Cash App is not the only thing that wants to be all of you-money. Payment of payment apps are competitive, seeking to add additional financial services to their sources.

PEPPAL AND PAYPAL-owned by venmo, in recent years, added an addition to matters more than transfers, such as credit and debit cards and Crypto-Tards. At that time, Zelle, another popular sending app, focus on direct integration with banks.

For each new service, these apps have the prospect of drawing you from their financial library – and keep it there. It is part of a comprehensive, broad benefit between financial technology, or equities, united abbreviations for life’s lives to sell them to advertisements or even credit-scaring Beauty.

According to the National Consianan Conneral Legal Center (assistance against the growing habit), the Financial Finance industry costed $ 240 billion for $ 462 billion in 2031.

With a Cash App Pools, it looks like the company has found a smart approach to expand its access to a very hot competitive market – without you to download the app.

Much from money:

Efforts of the best female fees in the US

Tax breaks for a reason donations from 150 million Americans

Top picking of stock in August, according to AI