Bonus!

He ran a rent for the class advertisement “on the latest” phone, however, still.

I have caused goods (graphics), a copy, and I decided. And I ate. It starts with $ 250 / Day budget. (Client pays for spending.)

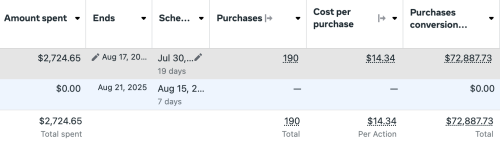

So far, I have made them more than $ 72K with a $ 2.7K ad using a $ 2.7K. For mobile phones for all $ 2 to all $ 1 used. Not very shack.

To be honest, it is a simple product that you can sell, and I know the audience. I’m fine. So the Psychology Sending and finding the right audience was simple more easier than the campaigns I charge.

Today I received a call from the company’s CEO. You gave me a bonus – where our phone is finished. And agreed with an elasticity of my contract. Or rather a new contract that has a new delivery.

It’s been a few years since I found a bonus of my work. As far as I know, it is not common in the world of contractors.

Program

Now what will I do about it? I knew you would ask. (It is $ 1,000 so I have to finish $ 600-700.)

Without taxes, Gov, the complete will go to save. My dad and I was speaking. My self-defense companion. And who I certainly am my ideas. It is good to have one of those after ten years to do things in your own.

You liked to get to $ 10K to my savings account, $ 1K in my EF (readable account, and focus only on payment of my left debt.

What do you think about all this program?

If everything is fine this month, I think I might hit those goals for savings. Then answer my attention on my own credit (without automatic transfers to save and investment for $ 125 per week.)

Thoughts?

Postage Bonus! It originally appeared in blending credit.