How to Teach Your Clather Brand Hustle on Etsy at Zero Upfront Case

Have you ever thought to start your clothing mark but felt a shaped at cost? Maybe you thought you needed thousands of dollars to invest in inventory, hiring space, or buying machines before making more money in this way. With demands for wants they want to print and print, and simplify the market …

Have you ever thought to start your clothing mark but felt a shaped at cost?

Maybe you thought you needed thousands of dollars to invest in inventory, hiring space, or buying machines before making more money in this way.

With demands for printing and printing, market such as Etsy, you can now start your clothes business for $ 0 more.

Yes, really.

You don’t need to hold the inventory, you don’t need to send anything yourself, and you don’t even need to be a designer.

This guide will go about how you can start the clothing brand or side of Etsy using print-on-looking, even if you do not have any experience or budget.

What is printed in searching and why works very well with clothing products

Before we start, I want to talk why the printing-demand is a good way if you want to start a clothing business without money.

Print-Forge (Pod) is a way to sell products – like t-shirts, hoodies, and sweatshirts – without purchasing inventory or sending anything on your own.

Here’s how it works:

- You create a design (even a funny rate or simple words).

- Uploaded that pod platform design like printing or printing.

- When the customer purchases an item (such as a shirt with your design), the platform prints and passes right to them.

You do not have to keep the stocks, pack boxes, or go to the post office. Pod company handles all that after scenes.

This is good if you ever dreamed about looking at a piece of clothes but it was heard to be attraction or objects. It removes all difficult parts – no orders, no inventory, and no investment required.

You can start today, or no experience and no money.

If something doesn’t sell? No worries – you didn’t waste money for money order. Just try the new shape and continue.

How to start your clothing shield in Etsy without money

Here’s how you can start your Clether Brand Hustle on ETSY for $ 0.

Recommended reading:

1. Choose your niche clothes

Before you start designing anything, it helps to choose a niche.

Your niche is a certain group or theme of your clothes to look. It helps you to be outstanding in etsy and attract buyers who are looking for something straight.

Here are some of the printed printing clothes:

- Animal lovers (dog mother, cat father, etc.)

- Teachers

- Returning mothers’ quotes

- Bachelorette team shirts

- Fitness and Gym apcel

- Encouraging Quotes

- Local Pride (City or State Body)

You can always grow more, but you select a niche helps you stay focused and consistent.

Tip: Making it easier, you may want to choose a niche you like most! For example, if you are a teacher, start with funny teachers. If you are a dog’s mother, design for dog mothers too.

2. Sign up for Etsy

Etsy is one of the best places to start selling printing clothes.

- There has already been millions of consumers who want a custom dress.

- First – a friendship.

- You don’t need a tech skills or skills.

I purchased the most printing of the prints in Etsy over the years, everything has fun and old designs in them that made me happy (things you can’t find the store!).

To get started:

- Go to Etsy and click “Sell On Etsy.”

- Create a merchant account.

- Choose your store name (you can change it later!).

- Enter your payment and tax information.

That’s all! Your store is open.

Note: Etsy charges for listing and purchase fees.

3. Choose your print in a Demand partner

You will need a printing platform for printing to print and send your clothing orders automatically.

Two popular and friendly options are:

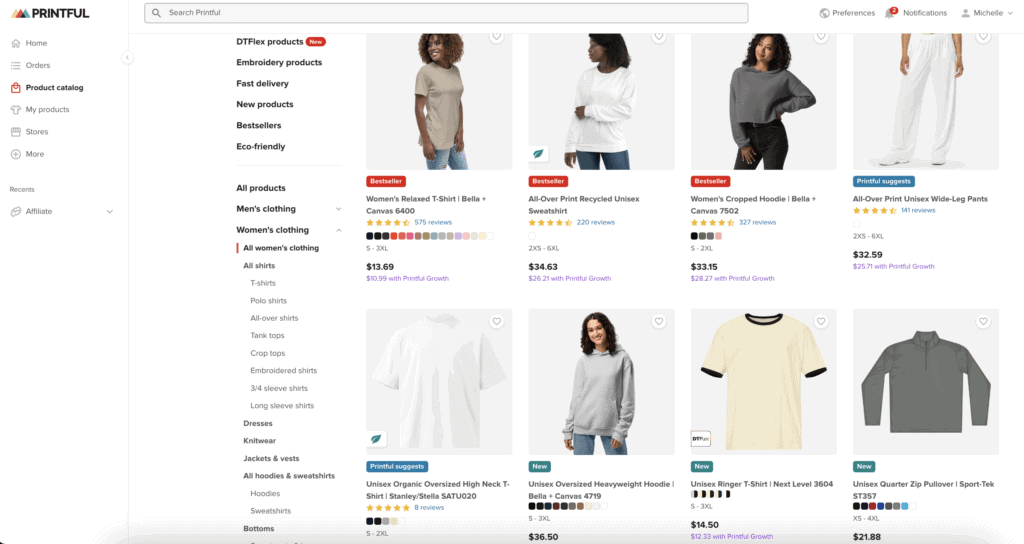

Print:

- Having 1,300+ products like bricks, baby clothes, hoodies, jackets, long sleeves, swimmers, pants, pants, and more

- Lowly low amounts

- Allows you to compare local providers, price, and rate

Please click here to try to paint.

Printing:

- Treats all in-house fulfillment (so, quality is normally high because it does everything itself)

- Can add custom sign as labels and packaging

Please click here to try printing.

Both platforms are free to join and mix right with ETsyy.

You can check both and see which works best for your products, if you are unsure.

4. Design your first products

You do not have to be an architect to create sales products. In fact, some of the most transactions in Etsy are simple techniques of the text.

You can use tools like Canva create designs to put your clothes, easy to use for beginners. Or, if you have less money to use, you can find templates that are ready to edit your creative markets.

Some of the ideas of the first designers can be:

- Funny quotes (“Hair of dogs, don’t care”)

- To match family shirts (holiday themes, holidays)

- Small designs (simple words or thumbnails)

- Local pride (“girl in Colorado” or “made in Brooklyn”)

After creating your design, uploaded it to print or print, and will automatically install to product mockups such as T-shirts, hoodies, or sweatshirts so you can see what it can look like for potential customers.

You don’t even need to take your product photos!

5. Connect your pod platform to Etsy

When your construction is ready and select the product to sell, it is time to connect your pod platform to Etsy.

Both print and print Allow one single combination with Etsy.

Once you are connected, you can press your product directly to your ETSY store.

You will just need to fill information like:

- Product title: Enter clear keywords (for example: “funny dog Mama T-Shirt”).

- Description: Tell buyer what they are getting (worth, cloth, who).

- Tags: Use Etsy tags to get better visibility of visibility (this is not able to buy your ETsyy list easily).

- Price: Calculate how much you want to enter your body price according to your basic expense, ETSY fee, and how much money you want to spend.

Example Pricing:

- Basic Cost (Print): $ 10.50

- ETSY FEES: EVERY $ 1.50

- Your sales price: $ 20.00

- Profit: $ 8.00 per shirt (no high cost)

6. Share your ETSY store free

When your list is live, it’s time to get a traffic!

You do not have to work ads if you don’t want to. There are many free ways to encourage your Etsy shop, such as:

1. Pinterest

- Create pegs using your product mockups.

- Link each PIN to your ETSY list.

- Make sure you write the main quality of Pinterest and keywords.

2. Instagram or Tiktok

- Show Sneak Peeks for your designs.

- Record to present your store.

- Submit coment or appropriate content.

3. Facebook groups

- Join groups related to your niche.

- Share your store or formation (if group rules allow).

4. ETSY SEO

- Use strong keywords to your product articles, marks, and descriptions.

- Imagine a consumer: What will they type in search bar to find my clothing item?

7. How fulfillment does the fulfillment work (and how paid)

Here’s what is happening when someone puts the order:

- Customer bought your shirt on Etsy.

- Your PODY POD platform (Print or Printer) automatically receives the order.

- Printed, packing, and sending a product to your customer.

- You are paid (after Etsy releases its money).

You will never need touching Inventory, send packages, or submit tracking numbers. Everything is automated.

It is one of the simplest ways to start a side sthle.

Why this applies (even if you don’t have experience)

This business model is ready for beginners because:

- You don’t need money to get started.

- You don’t have to be a designer.

- You can do this in your spare time.

- You don’t need tech skills.

- You don’t have to have an inventory or shipment anything.

All you need is the Internet, computer, and time!

Frequently Asked Questions

Below are answers to the general questions of how to start the clothes in ETsyy without money.

How can you start a line of clothes without money and no experience?

Use ETSY and platform for the demands like printing or printing. You can design for free using CANVA and sell without storing any inventory or pay for ahead.

Do you sell clothes in ESSY profit?

Yes! Many sellers make hundreds or thousands of dollars a month and simple designs. MARGINS of profit around $ 5 to $ 15 per item, depending on your price and provider.

Do I need a business license to start?

Not right away, and Etsy is not required to start selling. As your business grows, check local rules in your area to make sure.

How much can I get a real print in the print print in Demand Business?

Some merchants make a few hundred dollars a month, while others found thousands. Depending on your niche, how many lists you have (extra!), And how much you have encouraged them.

What if no one buys my products?

That is normal when you start out. Keep test new designs, improve your SEO, and encourage your store.

Can I sell some things without getting dressed later?

Yes! You can grow into the Tote bags, mugs, stickers, and more.

Is this allowed on Etsy?

Yes. Just disclose your production partner (printing or printing) in your list settings. Completely allowed by Etsy, and people do it all the time.

What is the best product you can start with – shirts, sweatshirts, or something else?

I recommend you start with T-Shirts. They are very expensive, easy to sell a year, and popular things you can buy.

How to start your side of clothing in Etsy without money – a summary

I hope to enjoy my article how to start the side of the garment, or no money.

You don’t need the storage place. You don’t need to establish. You don’t even need business loan.

You just need the design opinion!

Printing-Inspiration and Etsy Made Happen to anyone Starting a Line of Clothes or Side side of Home – without spending any money before.

And if you introduce your dress type, send me a link! I would like to see the old and support your new hustle.

Do you have the first side of the printing side of clothes?

Pumass

The freebie will teach you print-in-the-touning and give you a list of 17 selling the heat products you can print in the demand.

Recommended reading: