Budgeting and cars

I got a very big response with my long savings program per month or past. Directly to use my “buckets” in my Ally Account makes me tend to find these funds. And that was completely listening to me.

So I’ve also increased my ALY account to be my long account for a long savings account. And left 3 buckets there. (I did not remove any money, I just moved everything that made various buckets in the emergency bucket.)

Saving Program

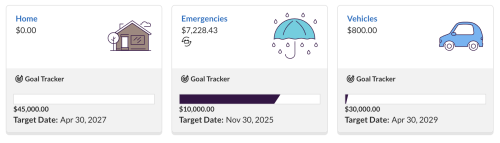

Here are my buckets in this account, goals and hope for times:

Purpose # 1: $ 10K in my emergency bag. I have to hit the next month or in the latest October.

Purpose # 2: $ 45k in April, 2027 Looking at home. Or instead of the world in my next home. My dream is to build a small home, flowing money. And by building, I mean my two hands and some help from family, children, etc. My sister has the same plan. But this first amount will be used to buy land in cash, fully paid. No credit.

Purpose # 3: $ 30k in April, 2029 towards a new car. I don’t see the reason for my car’s reason to have to be replaced before preventing anything that is disastrous. This is preparing to pay the money by my next car.

To drop money there?

I have a large number of other saving categories in my budget. Now I have to get the best car for those. Suggestions? (And yes, I work in a revised budget now, I will share the answer next week or more.)

The comments were still there I would make me recommendations to separate the long-term buckets in those I will need to sink. But is there keeping some buckets? I would like your thoughts about that.

Post Sabings Arocations & Vehicles appear in the credit bureau.