Bills grow, but thus engaged in the equality – a retirement research center

Do the participants understand their exposure?

It is always interesting to look at the most recent Vanguard’s latest Vanguard for “How Amerith saves,” summarizes the past 401 customers (K). Of course, work on any one company does not provide a complete photo of retirement. People may have more than one 401 (k) account that has more than one metal, and the measurements usually ride in IRA, which financial services are not followed. In addition, for a demand, estimates are given to a person, rather than the household.

While the full picture comes only from the domestic study, the Vanguard report always offers food. This year, something I hit was about 401 percent (k) approximately 80 percent of the less than 65 percent. I was negligent, and that this amount hit me too high. But before checking the Equality Problem, let me give an update to 401 (k) in measurements.

Since the year 2024 was a beautiful second year of economy and stock market, it is not surprising that participatory prices, contributions, and middle estimates are closest to all times. Malies increase up to $ 148,200 in 2024 from $ 134,100 for $ 134,100 in 2023 and between $ 35.300 for $ 35.300 in 2023 (see Figure 1). The central measurements are very common for rich participants, with some rich, and the median representing normal participants.

As noted above, the percentage of these investments are invested in equity appears on high. For those who work for age, the percentage is more than 85 percent of the less than 45 percent – Rated 64 percent just before retirement (see Figure 2).

In fact, the equivalent of the current high is 2000, shortly before the Dotcom Bubble population from 61 percent in 2008. Many increase was intention of the investment information of the Day, which increases the relevant annual budget and reducing extreme distribution. In addition, many homes can be greater if one considers all their invested goods – not just (k). That means, those with household income is less likely to have other financial investors.

Despite the crisis case, guide the day, it is difficult to worry at this time. Hazardous shares. Yes, they are the highest lumps for sale, but the flexibility of their return – as measured by the general deviation – it is also a table (see Table 1).

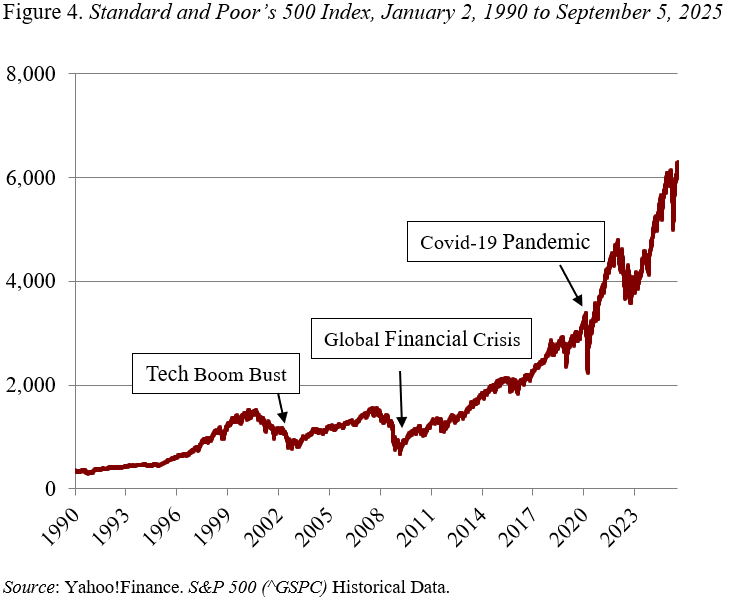

And it is not true that the danger comes down later. Even if the shortback restoration changes to the expected prices of expectations later, flexibility increases the distance of the effects of possible wealth. In addition, participants near retirement after returning the risk as they begin to withdraw their property. That is, the lowest restoration in the first years of retirement – at a time limit to withdrawal – can lead to low-life income. Finally, look where 500 index is there (see Figure 4).

Visual equality has been a good investment in the last three decades and the target design funds develop investment patterns. But it took a lot of work to make people feel free to save their retirement. How do they know how to disclose to the stock market? Will they be happy if they knew?