Animal Spirits: It is heard of 1999

Today’s animal spirits are brought to you by hearingfulness of Advisor Solutions and Vanguard:

This episode is supported by better advisor solutions. Increase your RIA, your way by visiting:

This episode is sponsored by the vanguard. Learn more in:

In today’s show, we talk:

Listen here:

:

Suggestions:

Tweets / Bluesky:

According to Challenger, renting speed falls on a rock. It is very weak in September for creating jobs since 2011. Pic.Twitter.com/hyyumfhsphd

– Joe Weisenthal (@TheSTalt) October 2, 2025

This takes the level of level.

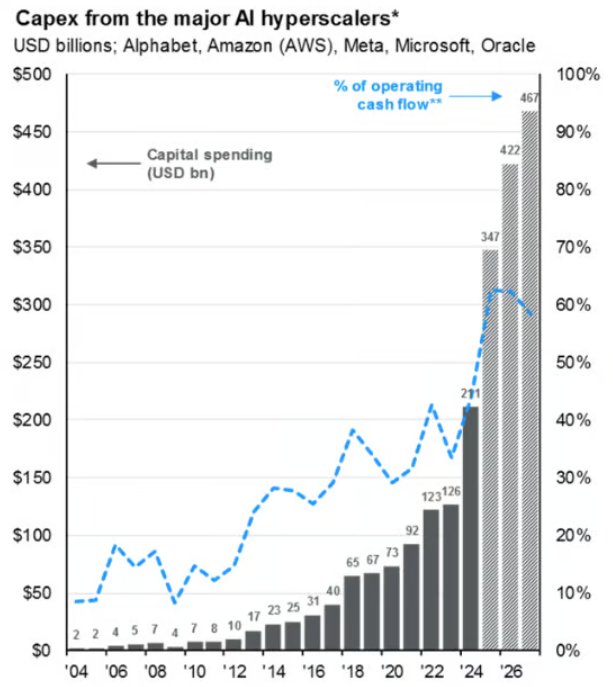

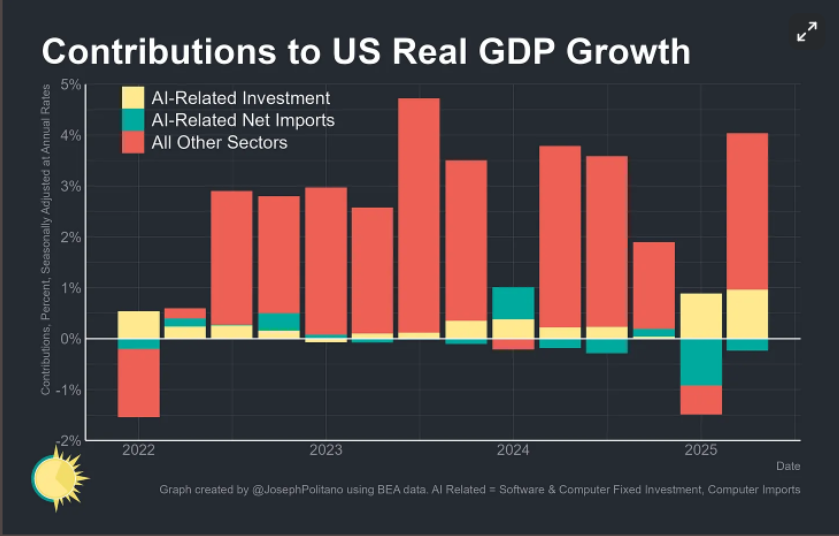

Most AI CAPEX (meaning that comes from hypererscalers) spending against the current demand for future income.

Let’s hold deep.

– John Shedlletsky (@shenttsky) October 3, 2025

The Revenue has been clearly straightforward since the date of the Freedom. Nasdaq never seen 3% fix since. The streak is now in 115 market days, the longest returns to 1971. Comparison, the index has raised 3% fixes every 20 days. Pic.Twitter.com/9mapdedi9fo

– Rob Anderson (@rob_anderson) October 3, 2025

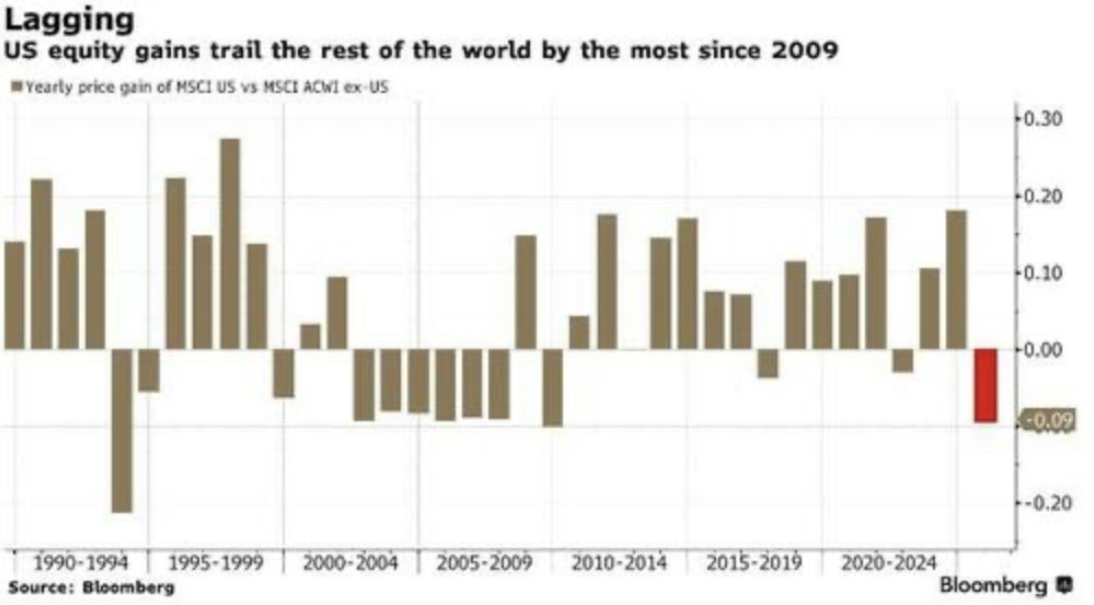

For international information the measurement question does not include a lot of problem. MSCI EAFE index is not only the fair value of the 16.5x expected amount, but its payable growth (and payment rate) has become us. International … Pic.Twitter.com/37f0jiaio

– Jurrien Timmer (@timmerfelyle) October 1, 2025

– Martin Chkrli (@martinhkrkler) October 3, 2025

Everyone is a clutter of bull mkt Pic.Twittestster.com/3kn/vvnjimr

– TTI (@TiktokinaPons) October 5, 2025

Now there are 19 shares in Russell 3,000 more than 400% from taxes 4/8. Pic.Twitter.com/NWVEFV5FWC

– Bespoke (@BespokeInvest) October 3, 2025

– A better suggestion (@ Modifroposal1) September 30, 2025

Paul Tudor Jones said just said CNBC that he thought the ingredients were in the largest stocking area before the bull market

“My guess is that I think all the ingredients are in a certain place of some form of beating” … “History in the Best, so I will think … Pic.Twitter.com/fkzzzboxk

– Evan (@stockmktnewnewsz) October 6, 2025

There’s a bubble in the news of the financial stories that lead to the bubble image

Saw all this in news last week Pic.Twitter.com/udr7ya0zmk

– Ben Carlson (@AnialFCS) October 6, 2025

The past 6 months have been lower.

Junikier upgrades! @Agurinfinity

Stocks in companies of technology are more than doubled from April 8. pic.twitter.com/geuvcuidjx

– Mike Zaccardi, CFA, CMT 🍖 (@mpaccardi) October 3, 2025

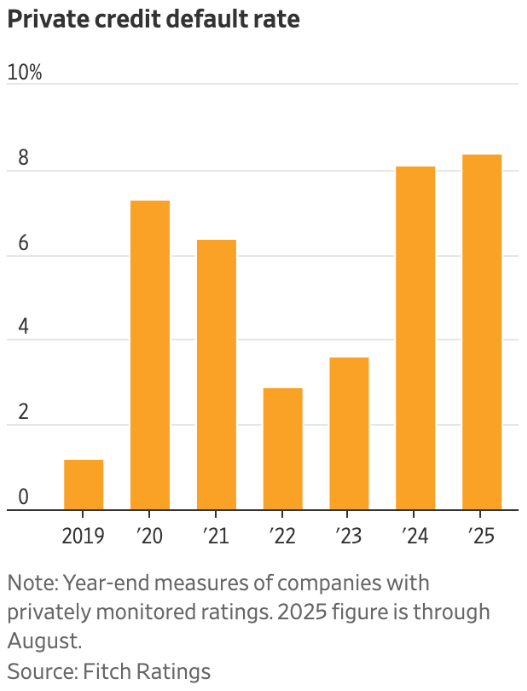

I don’t have all all BDCs, but the BDC group lit a warning mark. All the toilet names this year, along with the BDC’s BDC’s BDC’s Like HSBD, CGBD, the OBDC, the OBDC will completely find. Pic.Twitter.com/wetic9hipd

– CluseaA Investments (@blenesstonney) September 30, 2025

We followed Facebook, Instagram, and YouTube.

Check our T-shirts, coffee mugs, and other swag here.

Register here:

Nothing in the blog involves the investment advice, work data or any recommendation that any particular safety, security portfolio, transaction or investment strategy should belong to any particular person. Any references to certain security data and related operating data is not a purchase or selling such protection. Any opinions were heard here none or means synchronization, support, or recommendation by the Ritholtz of Ritholtz Welice Management or its employees.

The compound, Inc., the Ritholtz’s resources facilitator, received compensation from the sponsor of this ad. Such ads installation does not do or be allowed to sync, support or support, or any of its encounter, is the content conductor or its employees. Safety investment includes the risk of loss. Nothing in this website should be treated like, and may not be used in relation, offering sales, or requesting to sell or hold, interest on any safety or security product

This content, containing security related ideas and / or information, provided for information purposes only and should not depend on specialist advice, or allow any services. There can be no guarantee or guaranteed that the views expressed here will work at any facts or circumstances, and should not depend on any way. You must contact your counselors in respect of the Law, business, taxes, and other matters related to any investment.

Comment in this “Post” (including any flowers, videos, and social media) reflecting personal opinion, opinion, and analysis of such comments, and should not be considered by the comments of Ritholtz Welply Management LLC. or contacts or as description of the advice services provided by Ritholtz Welpz Welice Management or Refund of any Kitholtz Welp Welice Management Clever.

References in any defense or digital goods, or operating data, for display purposes only and they do not recommend investment or donate funding services. The charts and graphs are provided within the information of information and should not be honest where he makes the investment decision. Past performance is not shown to future results. The content only speaks from the date indicated. Any assumption, display, foreclosure, guidance, prospects, and / or ideas that have been expressed in the material can change without notice and may vary or contrary to the opinions.

Comound Media, Inc., the Affilory of Ritholtz Wealth Management, receives the payment from different organizations to find ads on the integrated podcasts, Blogs and emails. Such ads installation does not do or be allowed to sync, support or support, or any of its encounter, is the content conductor or its employees. Investment in achieving involves the risk of loss. With additional advertising efforts they see here:

Please check the disclosure here.