My Newest Project: YouBots!

Hello everyone!

So I’ve been working on a new project lately, and it’s officially live 🙂

It has nothing to do with personal finance (*gasp*), but it’s something that can help you save a ton of money – and grow faster! – if you run a business. It also relies heavily on AI, so if you’ve been trying to figure out the best way to use it in this brave new world this could be the trick.

Introducing….

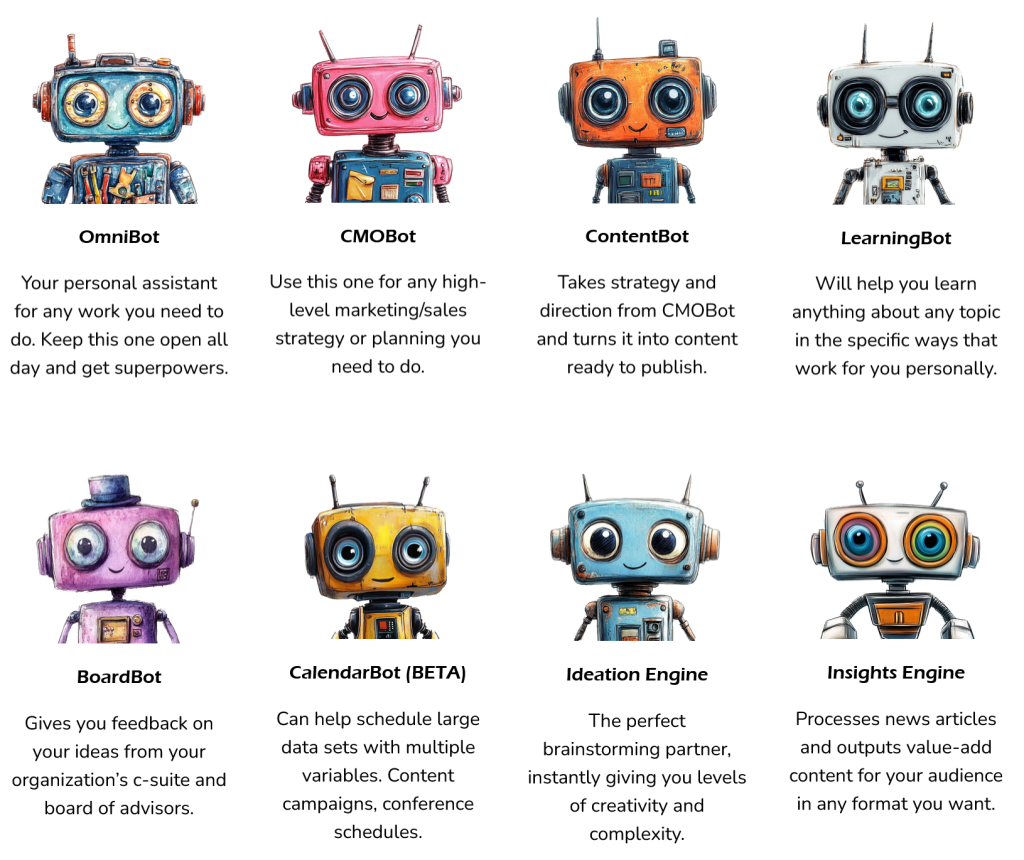

YouBots.ai – This collection advanced, powerful marketing tools powered by AI!

My partner in crime has been fascinated with AI this past year – he even switched his entire career to it! – and after watching him build custom “boats” for companies and sell them for thousands of dollars each, I asked him why he doesn’t package them all under one roof and give them away to *everyone*? Are you like the world’s first AI marketing agency, but at a fraction of the price?

He paused for a few seconds which led me to believe he was very stupid, haha, but to my surprise he finally replied, “this is the best idea you’ve ever had – we need to build it.” Lol… Okay!

And just like that YouBots was born 🙂

I can’t say I ever imagined myself doing anything around AI, but it was one of those moments where it just clicked and I knew I’d regret it if I didn’t. So we’ll see what happens! We already have a number of paying customers, and it’s been fun as we work on branding and building the site…

Just look at these cute robots!!

In any case, if you have a business and want to see if these bots can help you, take a look our place and let me know what you think. It’s designed so that anyone on your team can use it without needing to know anything about AI, agile engineering, or even software development.

Our target audience is small to medium businesses that wish they had a bigger hiring budget (both people and marketing agencies), so we’ve priced it with that in mind and one of our customers is already saving $4,000/mo. Good.

Check it out -> YouBots.ai

We currently offer a One week free trialthen 50% discount on subscription fee while we are in beta. No credit card is required for the demo, and you can unsubscribe at any time.

So that’s what I’ve been doing here! What about you? Anyone else dabbling in AI or working on a new project? I would love to read all about it 🙂

Your longtime, non-AI friend,

PS: I should be aware of that while the AI it can be do big amazing things to make your life and work better, I don’t believe it should replace YOU. To me it’s meant to *enhance* your work, not replace it.

PPS: If you came here today hoping for some financial tips, check out my newly launched personal newsletter featuring my favorite $$$ articles from around the community this month. There are some really good ones there, and you’ll find them at the bottom of that page (along with a current book that I really enjoy). Feel free to sign up for that newsletter here too!

[This post, My Newest Project: YouBots!, was first published by J. Money on Budgets Are Sexy]