Why Are Credit Card Rates So High?

A student asks:

Why are credit card balances a bad idea? What are some ways we can make prices less crazy?

President Trump recently floated a proposal to cut credit card rates by 10%.

On the face of it, this sounds like a good idea.

Most borrowers’ credit card rates are in the 20-30% range. The average balance for the 45% or so people who default on their balance each month is around $6-7k. Carrying a balance while paying high loan rates is a surefire way to crush your money and your score.

So why would capping these prices be a bad idea?

JP Morgan CFO Jeremy Barnum explains:

Our belief is that actions like these will have a completely different effect on what management wants from consumers. Instead of reducing the price of credit, we will simply reduce the supply of credit, and that will be bad for everyone: consumers, the broader economy, and yes, at the margins, for us.

Basically deposit rates will cause banks to withdraw their lending in this space. Only those with strong credit scores will be able to borrow. Those who rely on credit cards to support their lifestyle may be forced into payday loans or other more stressful borrowing arrangements.

I don’t think capping credit card rates at 10% makes sense but I also don’t think the current system is fair to those stuck in debt who meet you faster than the world’s best investors. It just didn’t make sense to me that credit card rates stayed so high even when other lending rates were at record lows in the 2010s and early 2020s.

To understand why credit card rates are so high and how we got to this point it’s important to go through a brief history of credit cards with some help from Joe Nocera in his book. Action Episode, which accounts for the growth of consumerism in the latter half of the 20th century.

The first consumer credit boom came during the Roaring 20s. The freewheeling attitude from that time was quickly ended by the Great Depression, which turned an entire generation of people into thrifty slaves.

People didn’t want to spend money and it wasn’t until after World War II, when everyone wanted to borrow money to finance their middle class lifestyle. People wanted to buy refrigerators, televisions, new homes, and the latest models of cars. And they didn’t want to wait.

Many banks were not equipped to handle this new consumer. There was no real difference in consumer financial institutions at that time. No one paid interest on checking accounts and passbook savings account rates were regulated. Most people just choose the most convenient bank near their home or work.

Many banks have focused more on business loans than consumers. In fact, banks were reluctant to give loans to buyers because they wanted to protect households from the risks of over-lending.

Bank of America was the first financial institution to recognize the growing importance of consumers in the new economy. After seeing significant growth in mortgages, they began exploring BankAmericard in the late 1950s.

In 1958, Bank of America mailed 60,000 credit cards to households in Fresno, CA. No one asked them. They just arrived at the mailbox. By 1959, 2 million cards had been circulated and were out of the races. Chase and American Express were right behind them with their offerings.

So how do they charge such high interest rates on these cards?

Joseph Williams was the founder of BankAmericard. Williams set credit card interest rates by examining how companies like Sears set theirs. Nocera explains:

Williams had friends at Sears and Mobil Oil, and those friends secretly allowed his team to monitor their credit operations. From this latest research, fortunately, many common features of credit cards emerged, features that have remained remarkably unchanged to this day. The idea of a one-month grace period, a time when customers could pay off their balances without being charged interest, came from that research, as did the idea of charging 18 percent per year on credit card loans—a figure that would be seen in the works for the next thirty years, as all other interest rates were highly variable. There was no black magic involved: The bank simply figured that if a one-month grace period and a monthly interest charge of one and a half percent (roughly 18 percent annually) was good enough for Sears, with its fifty years of credit experience, then it was good enough for Bank of America.

They also needed to find vendors to push these new projects forward.

That was an easy sell.

The bank will act as a broker’s office, guarantee payment in a short period of time, collect payment from customers, and make the process easy and convenient for the buyer to use the money. The initial cut was 6% on all transactions.

The first release was a disaster.

Fraud was rampant. Too many people did not pay their balance on time. In fifteen months, Bank of America lost more than $20 million, a huge sum in those days.

One of the reasons why higher rates are delayed after the discharge period is because fewer people pay off the balance each month than expected. The delinquency rate is over 20% (they estimate it will be 4%).

So they cleaned things up, demoted users who failed to pay, added some penalties to the system and strengthened fraud prevention. By the late 1960s, credit cards were a new profit center for banking.

Consumer credit use exploded, from $2.6 billion in 1945 to $45 billion in 1960 and $105 billion in 1970.1

The rest is history.

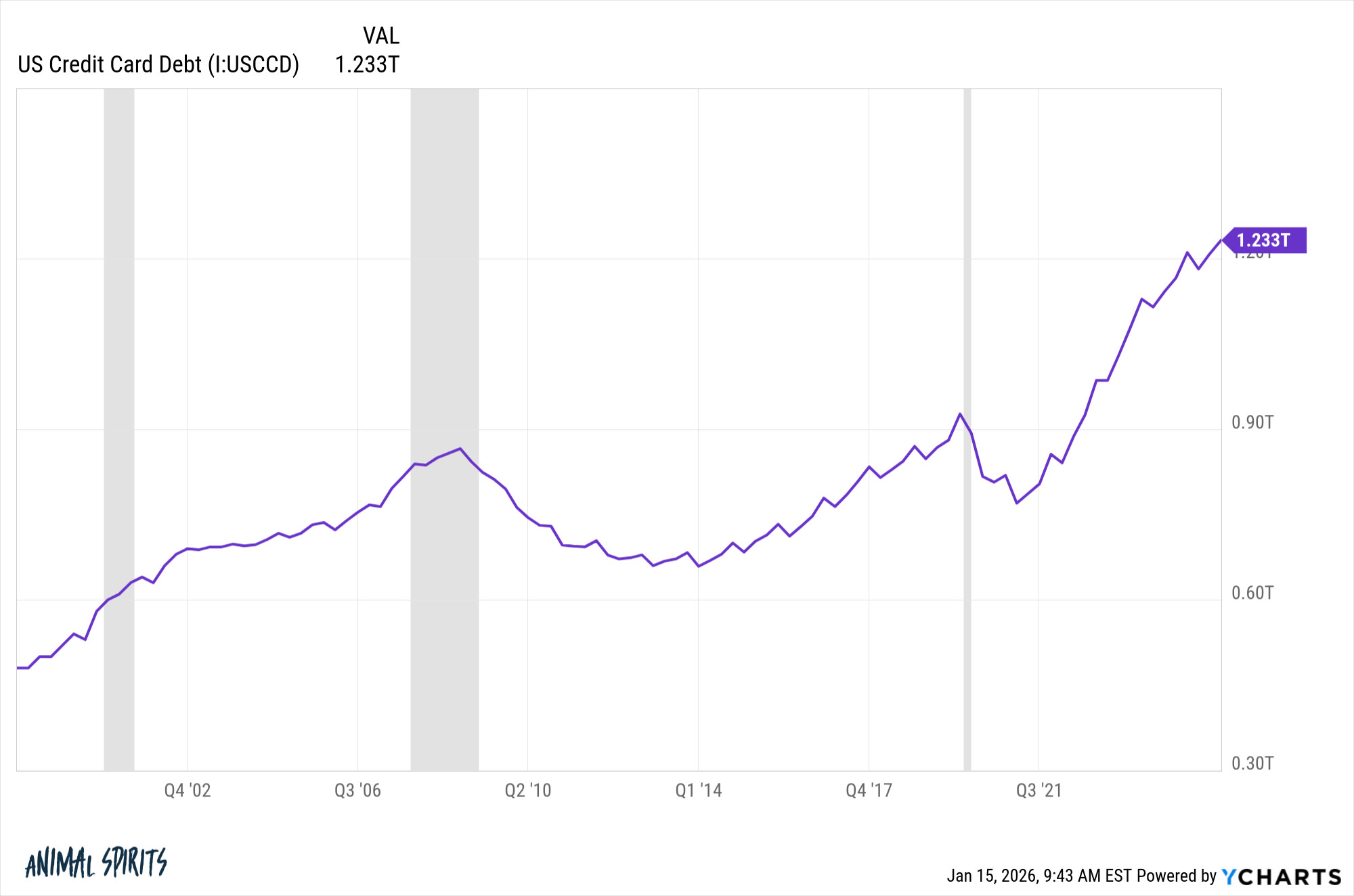

We now have over $1.2 trillion in credit card debt in America:

Rewards credit cards are a business in themselves, where people who pay off their balances every month are effectively funded by those who don’t.

Last year alone, American Express paid Delta more than $8 billion for its credit card/mileage rewards relationship.

So the main reason there are such high rates and high fees on credit cards is because we’ve always done things this way. This is not a system you can design if you are starting from scratch today.

How do you help people who are struggling with credit card debt?

Financial education can help.

Right or wrong, the best way to lower credit card rates is probably the most demanding credit standards. These loans are not backed by anything, which is another reason why the rates are so high.

I don’t know if there is a system-wide solution that you can wave a magic wand at to fix this.

If you have credit card debt, don’t rely on the government to fix it for you.

Talk to the credit card companies if you can’t repay the loan. You can also try to negotiate ridiculously high late fees. Or you can combine at a low level.

But carrying a balance is one of the worst financial decisions you can make. The rates are so high that it is a negative effect of the merger.

Barry Ritholtz joined me on Ask the Compound this week to answer this question in detail:

We also answered questions about stock market valuations, 401k contributions, the best sources of financial information and buying vs. renting.

Further reading:

How Bad Is Credit Card Use In America?

1In the 1950s Bank of America had a $60 million loan portfolio made up almost exclusively of $200 refrigerator loans.