Today’s Young Workers May Not Have Home Equity For Today’s Retirees – Institute for Retirement Research

Without home ownership, it is difficult to save.

When thinking about the future of Social Security, one thing to worry about should be whether future cohorts will have the same assets as people retiring today. Today, a large part of a retired family’s portfolio is their home. In fact, a house is the main asset of many families. But today’s high housing prices and high interest rates make it difficult for many small households to buy a house.

Historically, families bought homes early in their lives, financed with low down payments. Then, they build equity in their home during their working years by paying down their mortgage and enjoying great benefits. Even though they may have traded up to a larger home as their families grew and perhaps took on more debt, their goal was to end up with no mortgage in retirement (see Table 1). Although many families did not reach the equity in their home to meet normal living expenses, they saw the house as insurance for long-term care needs and a way to leave a legacy for their children.

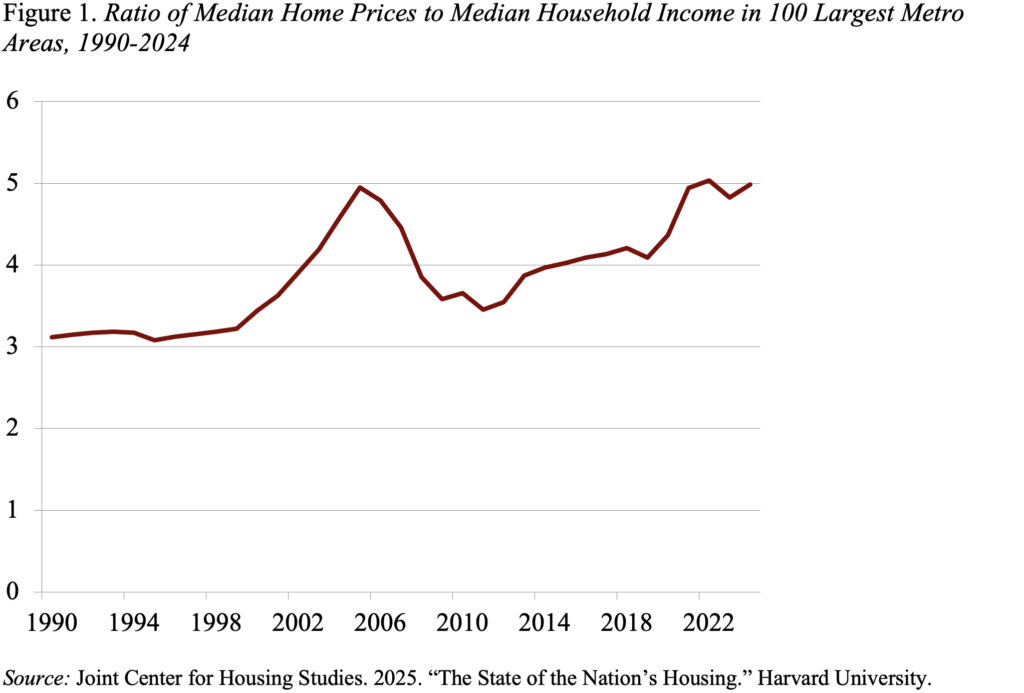

With today’s high home prices and high home prices, however, many young people do not see how they will ever own a home. The 30-year mortgage rate fell slightly from 6.8 percent in the second quarter of 2025 to 6.2 percent today, but mortgage rates remain at 30-year lows. The real culprit is housing prices, where the median price now stands at five times household income (see Figure 1).

In dollar terms, the average home cost was $412,500 in 2024, meaning a homeowner would need $26,800 in cash to cover both closing costs and a 3.5 percent down payment. (If the down payment were 20 percent, the required amount rises to $95,000.) Using the average debt-to-income ratio of 31 percent of income and assuming a 3.5 percent down payment, the new owner would have to earn at least $100,000 for half of the 100 largest municipal properties. In addition, the new owner will face significant increases in insurance payments and property taxes.

Higher prices indicate a greater shortage of available housing. Many owners who were lucky enough to take out a mortgage when rates were 2 percent are reluctant to sell, and supply has been reduced by natural disasters such as hurricanes and fires. In addition, investors in the rental market have been buying up a large portion of single-family homes, leaving out — for money and faster closing times — potential homeowners. In the future, some factors may loosen supply as the “2 percent” runs out, baby boomers die, or builders decide to build more houses — though one estimate suggests the new rates will add $12,800 to $25,000 to the construction of a new single-family home.

Meanwhile, many young people – who often carry student loans – will end up renting. Of course, if they simply invest their savings in stocks and bonds, they can end up with a wealth of assets in retirement. But that theory reminds me of the advice I got from a colleague when I left the Federal Reserve Bank of Boston at the age of 50 – take your profits now – they say – you can invest them better than the boring guys who run our pension system. Two mistakes in that way firstly my investment skills were not good, and secondly – more related to the issue of rent – I spent my pension payments eating out in nice restaurants – not saving them in the account!

One amazing feature of owning a home is that it acts as an automatic savings mechanism – a feature that the rest of the future retirees may not have. This pattern will leave them more dependent – not less – on Social Security.