Inflation is not reversible

A student asks:

The historical inflation rate over the past 75 years is still 3%. The Fed’s target is 2% inflation. What do you think is the right goal and at what level do you think it can go forward?

Here is an average price increase since 1950:

The average rate of inflation has been 3.5% but you can see in the chart there has been a wide range around that long term rate.

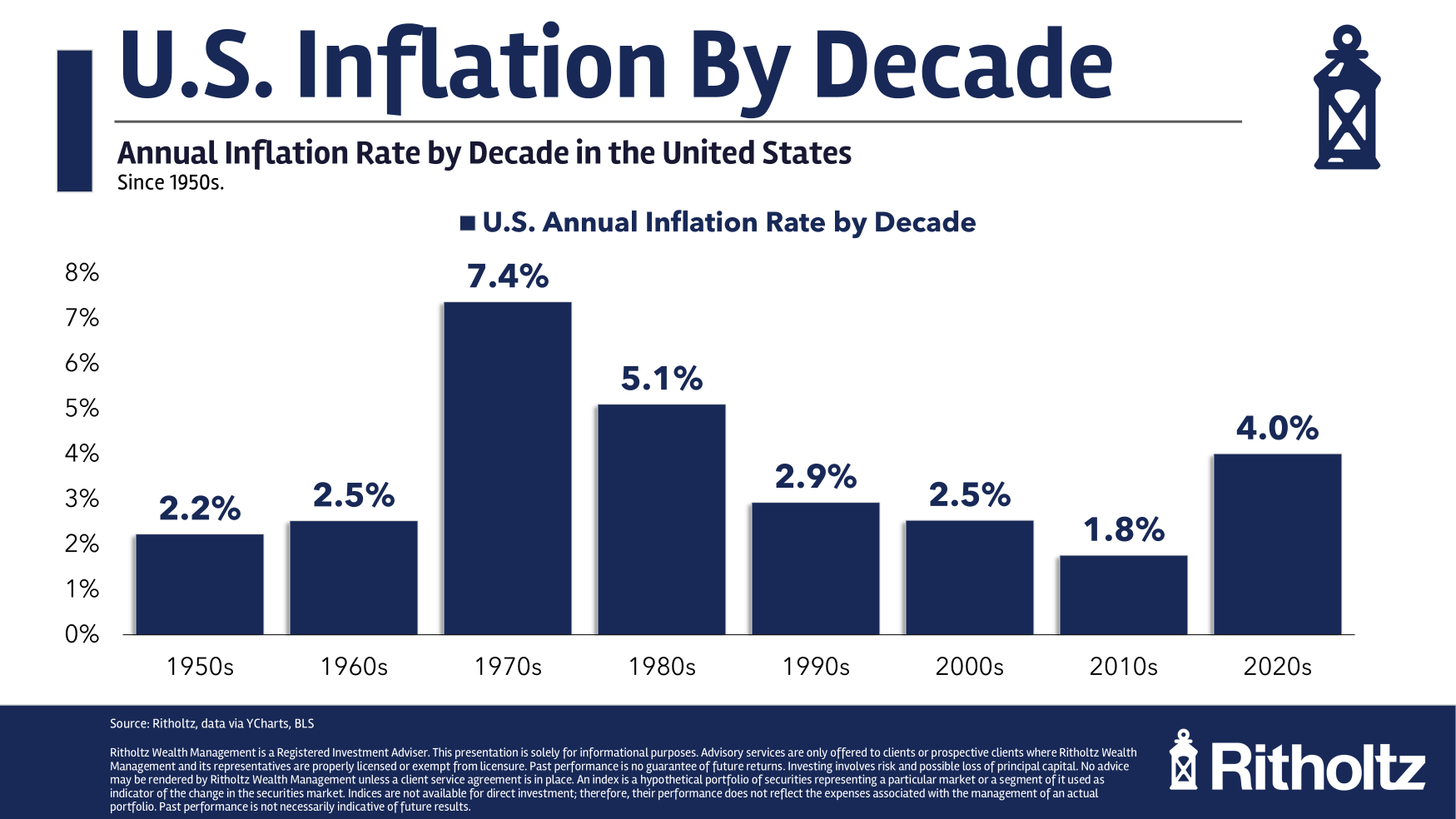

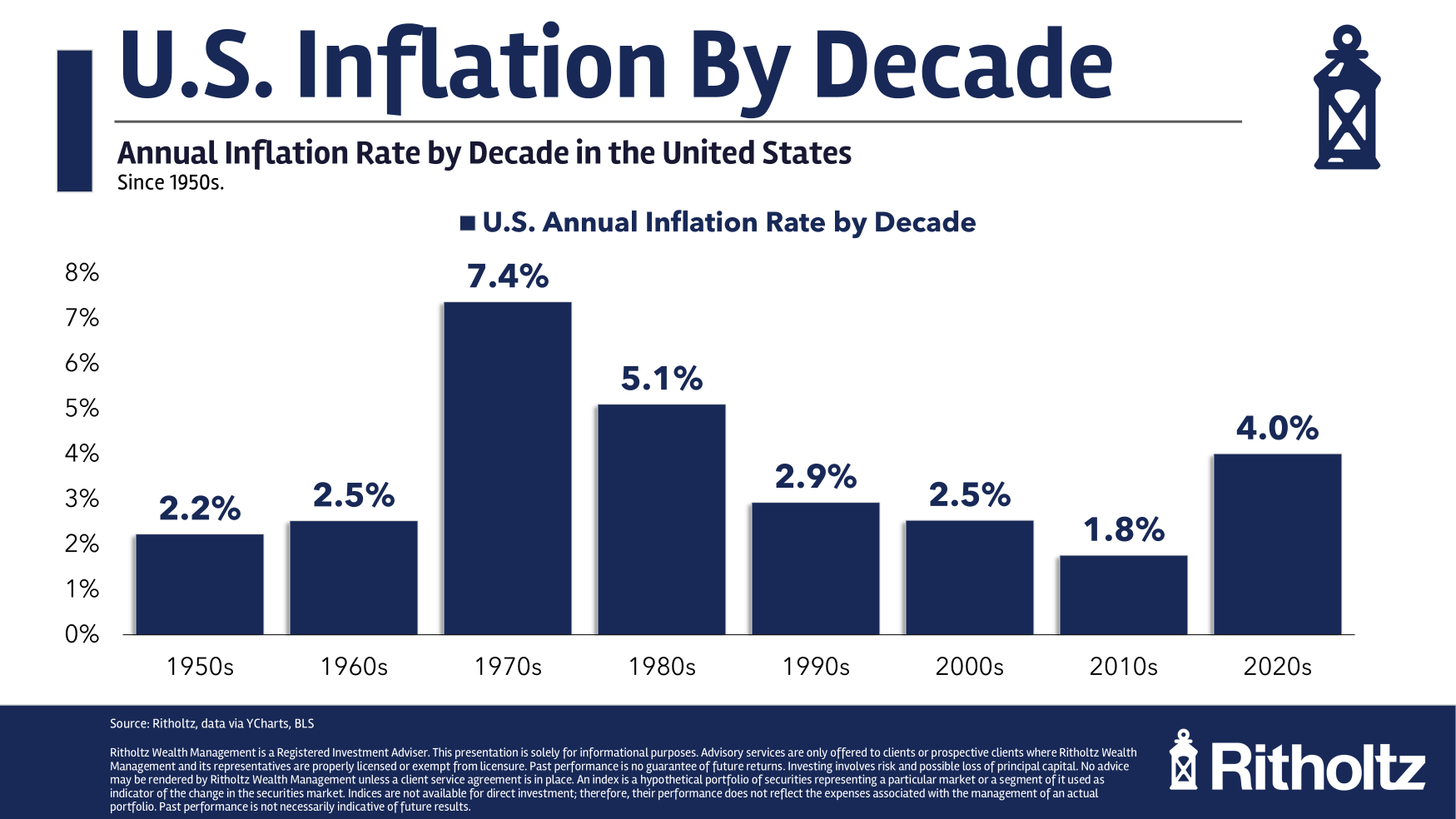

Check out the rate of inflation by decade:

Inflation was below average in the 2010s which is one of the reasons higher than the already painful inflation in the 2020s.

Apparently, the low inflation in 2010 came as a result of the overhang from the great financial crisis.

It’s amazing that we he didn’t Get a recession following a 20% inflation by 2022 is one of the reasons inflation has remained high in this decade. In fact, this was the beginning of the price hike more than 5% out leading to recession.

We cannot live in opposition to this the fact that we are not entering a recession, we are not giving people a sense of freedom as the ups and downs of this decade have angered people.

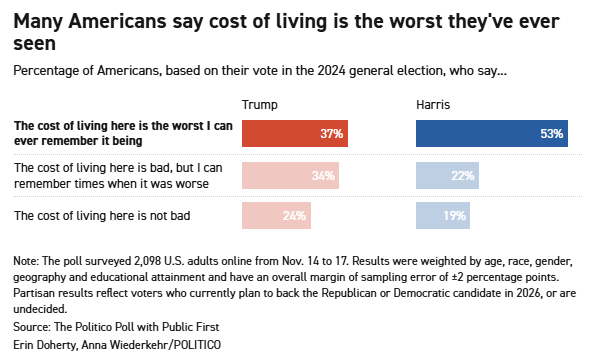

And people are really upset about the high prices.

Politico has a poll showing nearly half of Americans polled say the cost of living is worse than ever:

Gallup has been asking Americans for decades what their financial concerns are:

Undoubtedly, inflation has been at the top of the list since 2022.

People really hate inflation.

Interestingly enough, inflation is just above the average for almost two years. It first went above 4% in April 2021 and has been below 4% since May 2023. Things have settled down since then and are back to “normal.”

But we all know that it is not the measure of change that matters; It is an interactive change.

The consumer price index is about 26% in the 2020s overall. That’s why a $16 meal at Applebee’s is now $20. That’s why the average new car costs $50k.

On average, wages have kept up with inflation but sticker shock doesn’t go away when you get price changes like this.

I’m not as good at predicting inflation but someone else is. How could they?

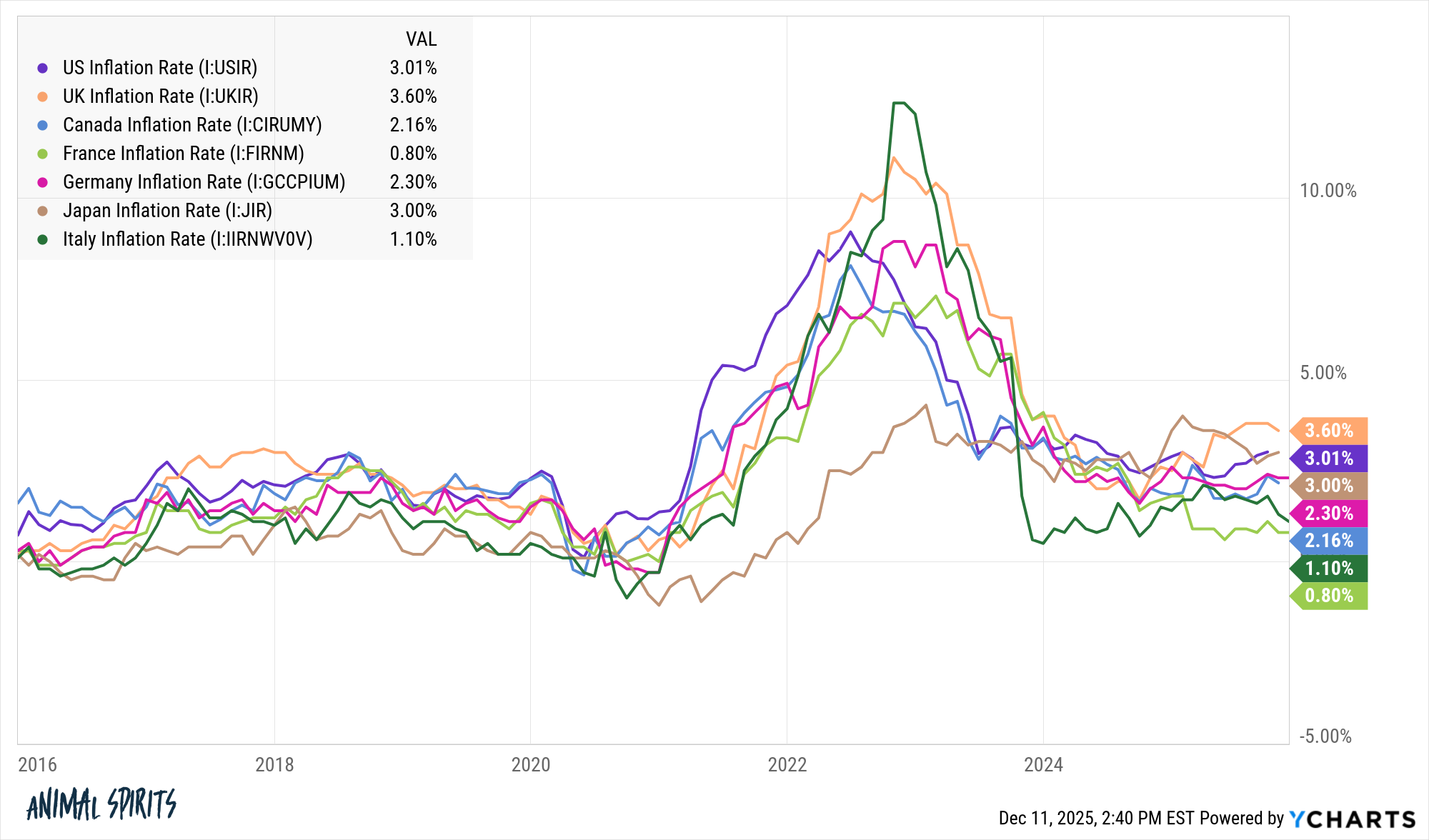

The authorities to be introduced tried to get more inflation in the year 2010s but it is not possible. Then handweleng hits and inflation will be measured around the world:

I think consumers should get used to higher inflation rates.

It certainly sounds like nothing can stop the government spending train, regardless of which party is in power.

The difference between 2% and 3% inflation doesn’t seem like all that much, and it’s not more than temporary. But over a decade 2% annual inflation is 22% inflation while 3% annual inflation is 34% inflation.

Maybe AI will be deflationary.

Perhaps we will experience a recession that slows the pace of inflation or causes pollution.

Maybe something will come out of left field now to change our economic trajectory.

Short of that, for the time being, it feels like 3% is the new 2% and there’s not much the Fed can do about it.

If you are offended by the new prices of goods and services prepare to stay angry. We are not laughing back at previous price levels.

Jurrien timmer of Jurrien joined this week’s Ask Compund to answer questions about inflation, how long is the stock market, ai bubfoli, the bond market and more:

https://www.youtube.com/watch?v=vnoniripbju

Further reading:

The relationship between income and inflation

This content, which contains security-related opinions and / or information, is provided for informational purposes only and should not be relied on in any way as professional advice, or endorsement of any services. There can be no guarantees or assurances that the views expressed herein will apply to any particular facts or circumstances, and should not be relied upon in any way. You should consult your advisors regarding legal, business, tax, and other matters related to any investment.

Comments on this “Post” (including any related blog, podcasts, videos, and social media) reflect the personal views, opinions, and analysis of Ritholtz Wealce management staff who provide such comments, and should not be considered the views of Ritholtz Wealce Management LLC. or contacts or as a description of consulting services provided by Ritholtz Wealce Management management or the return of performance of any Kitholtz Wealce Management Management Cless.

References to any security or digital assets, or performance data, are for illustrative purposes only and are not intended to recommend investing or offer to provide financial advisory services. Charts and graphs are provided for informational purposes only and should not be relied upon when making an investment decision. Past performance is not indicative of future results. The content speaks only from the date indicated. Any assumptions, projections, predictions, guidance, expectations, and / or opinions expressed in these materials are subject to change without notice and may differ or be contrary to the opinions expressed by others.

Compound Media, Inc., an Affiliate of Ritholtz Wealth Management, receives payment from various organizations to receive advertisements in compound podcasts, blogs and emails. The inclusion of such advertisements does not constitute or permit its endorsement, sponsorship or sponsorship, or any association thereof, by the Content Creator or its employees. Investing in real estate involves the risk of loss. For additional advertising incentives see here:

Please see the disclosure here.