Financial Planning: A Test of 1,000 Boldn Planners Reveals 6 Powerful Insights

Year-end financial planning is not just a checklist or set of transactions. According to a survey of more than 1,000 boldin users approaching or living under retirement, it’s a tangible moment to step back, reflect, and make thoughtful decisions about the future. Respondents told us that the end of the year is a time to think about their strategies, resources and future decisions – and that this process leaves them feeling grounded, more prepared, and more confident.

Across all years and asset levels in the survey, one theme was unmistakable: When people participate in night age screening, their self-confidence increases.

About respondents to planning surveys throughout the year

Insights from this report emerge More than 1,000 boldin users who are actively planning for retirement or already living it. This group represents a financially savvy, highly engaged audience – the very people who understand how much money matters and are thoughtful about where they navigate the next phase of life.

Most respondents were in the heart of their retirement windows:

- 63% were aged 55-64

- 22% were 65-74

- Just 14% were under the age of 55

Many have retired or are preparing to retire soon:

- 51% they have retired

- 47% plan to restructure retirement, with 31% Planning to retire in the next two years with another 17% in the next 3-10 years.

- 2% plan to retire more than 10 years from now

They tend to have reasonable savings, reflecting years of work supervision and planning:

- Over 70% have between $1M and $5M in savings

- 15% be over $5m

- Only 14% be under $1m

For survey responses, editing is a common practice:

- 27% reinvest their money once a week or more

- 21% plan 2-3 times a month

- 25% check their status every month

- 20% quarterly update

- Only 6% updates annually (1%), biannually (3%), or when something happens (2%)

7 Powerful insights from year-round planning surveys

1. Almost all survey respondents participate in year-end planning

Ninety-nine percent of respondents reported participating in year-end financial planning.

2

Many survey respondents treat the end of the year as a beneficial time to zoom in and look at the bigger picture. A A full 87% of respondents said they approach the next financial plan as a long-term strategic exercise With 15% saying it’s special strategies, 19% saying some specific strategies, and 54% saying it’s equal, integration and strategic planning and understanding.

Only 12% say their planning is, in some way or the most, focused on a particular transaction.

Strategic activities

When asked what tasks they completed before the end of the year, respondents pointed more and more to tangible actions.

Review of Test Answers:

- Spending and income from the previous year (62%)

- Their Financial Performance (60%)

- Savings and progress goals (44%)

- Financial goals for the next year (43%)

- Asset allocation (37%)

Tactical activities

Survey respondents made fewer strategic changes to increase their status at the end of the year than strategic planning. However, when it comes to strategies, they are mainly interested in health, tax and investing.

- Planning their health care for the next year (50%)

- Adjusting the allocation of funds (45%)

- Preparing a tax return or conducting a tax loss recovery (40%)

- Completing a roth conversion (39%)

- Adjust asset allocation (37%)

This is a radical shift away from the old model of planning: Rushing returns, collecting statements, or answering financial to dos. People want a system that helps them connect their resources to their goals – and make thoughtful changes as life evolves.

3. Taxes and investments are top of mind

When people think about the end of the year, two priorities clearly rise above all else: tax and investment. In our survey, both are tied as a number – one concern, each chosen by 68% of the respondents. That means nearly seven out of ten people approaching or retiring are focused on how to position their portfolios and how to make a good, tax-efficient move before December 31.

This alignment tells a story about what is most important during the transition into the new year. People don’t just look back at what happened in the markets; They ask how to inform them wisely in the coming year.

Overall, respondents highlighted a mix of cost realities and planning:

- Tax and year end date: 68%

- Financial performance or portfolio mix: 68%

- Depreciation or cost of living: 44%

- Planning 2026 Goals: 43%

- Managing costs or cash flow: 42%

- Political environment: 31%

- Savings progress: 27%

- Economy or labor market: 27%

- Interest rates: 16%

- Debt payment: 5%

This combination of concerns reflects the harshness of today’s financial environment and the desire for clarity in the face of uncertainty. People are thinking about their investments, their tax strategies, their daily spending, and the economic celebrations that will build up over the next few years – all at the same time.

Taken together, these results reinforce that year-end planning is about more than creating disposable income or reducing personal income taxes. It’s about annual resolutions to align broad goals, prepare for the future, and create a sense of control at a time when external variables feel unpredictable.

4. Year planning is important to achieve financial goals

Most survey respondents do not see year-end planning as voluntary. They see it as important to stay on track with their long-term financial goals. In our survey, 72% of respondents mean year-end planning badly or indeed it is essential to their ability to achieve their goals – and surprisingly 95% he said it is important to them in some way.

This near-universal agreement shows that people see the human end as an environmental checkpoint: a moment to review their progress, make changes, and ensure the decisions they make today support future outcomes. 1% He said that year-round planning “isn’t all that important,” emphasizing how accepted this behavior is.

5. Self-confidence is a low-level reason

When we ask by whom As people plan to organize each year, one theme rises above all others: courage.

This is a group that takes financial decisions seriously. They think about taxes, health care, longevity and inheritance. They use tools, ask good questions, and want to understand different parts of their financial lives. And most of all, they tell us that confidence – not just efficiency – is what they really want at the end of the year.

These respondents provide an important window into how thinking planners use reflection, alignment, and strategic review to feel prepared for the future.

Here are the most popular answers to why people are perfect for financial jobs:

- 66% said they feel more confident in their financial decisions

- 64% feel financially secure

- 61% increase confidence in my program

- 50% to reduce my tax burden

- 48% to get more clarity on where I stand

- 45% feel like I’m doing the right things financially

- 44% stay tracking on my goals

- 43% to reduce financial worries

- 43% to build wealth over time

- 42% to reduce financial risk

This makes sense: People don’t plan to just use performance. They plan to feel grounded, informed, and able to move forward.

Planning does not eliminate uncertainty – but it does make uncertainty manageable.

It gives people confidence in what you say, “I know where I stand, I know what’s important, and I know what I’m doing next.”

6. Planning and confidence go hand in hand

The strongest signal in the data is the link between planning and confidence. In three separate questions:

Knowing your numbers leads to better financial decisions

Here’s how Boldn users responded to this question: “Knowing where I stand financially at the end of the year gives me the confidence to make the right decisions for the future.”

- 90% agreed, with 65% saying they strongly agreed and 34% saying they agreed

- 8% neither agree nor disagree

- 2% somehow disagree

- 0% strongly disagree

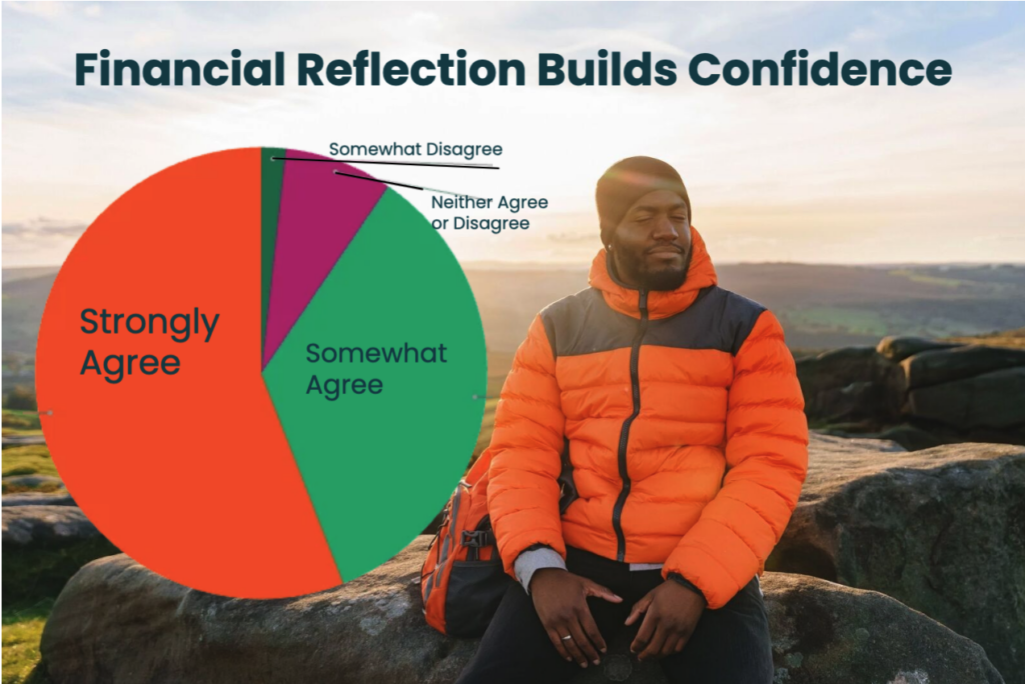

Thinking about big picture goals builds confidence

We asked users “how often (or how often) my big financial goals and progress increase my confidence,” and Boldlin users overwhelmingly agreed:

- 92% agreed, with 57% saying they strongly agreed and 34% saying they agreed

- 7% neither agree nor disagree

- 1% somewhat disagree

- 1% strongly disagree

Financial Right tools make people feel more informed

Finally, we asked this question: “The financial planning and management tools I use give me confidence in my ability to achieve my financial goals.” Here’s how Boldn users responded:

- 92% agreed, with 51% saying they strongly agreed and 41% saying they agreed

- 7% neither agree nor disagree

- 1% somehow disagree

- 0% split too much

Planning is an important answer

For all three questions, the pattern is clear: Clarity leads to confidence. When people take a moment to look back, see, and reconnect with their goals, they go into the next year feeling stronger, stronger, and more in control — which is what good fortune is meant to do.

These results tell us something important:

- Thinking builds confidence.

- Confidence builds better decisions.

- Better decisions create better results.

- Confidence builds better decisions.

And that long response is what keeps people involved in planning year after year.

What you need to do if you want a richer and more prosperous future, according to successful retirees and retirees

Annual planning is not about evaluating activities. It’s about getting into the driver’s seat of your financial life.

It’s time to:

- Think about what is important this year

- Check out what’s changed

- Connect your goals to your resources

- Make a change with clarity and purpose

- Set yourself up for the new year with more confidence and less uncertainty

And that’s exactly why news editing – it’s not the frequency, though display quality that makes a difference.

Boldlin is designed for planning

Boldlin is designed to help you think strategically – understand the “why” behind your decisions, see how it all fits together, and build confidence.

Whether you’re planning for tax, health care, retirement income, or estate goals, Boldlin provides you with a clear vision of your financial future and the tools to take thoughtful action.

A confident financial future starts with a more objective plan. And we’re here to help you build just that.

The last financial day: a survey of 1,000 boldin editors reveals 6 powerful insights appeared first on Boldlin.