Vanguard backdoor roth step-by-step guide [Screenshots]

![Vanguard backdoor roth step-by-step guide [Screenshots] Vanguard backdoor roth step-by-step guide [Screenshots]](https://www.whitecoatinvestor.com/wp-content/uploads/2021/12/Vanguard-Backdoor-Roth-Tutorial.png)

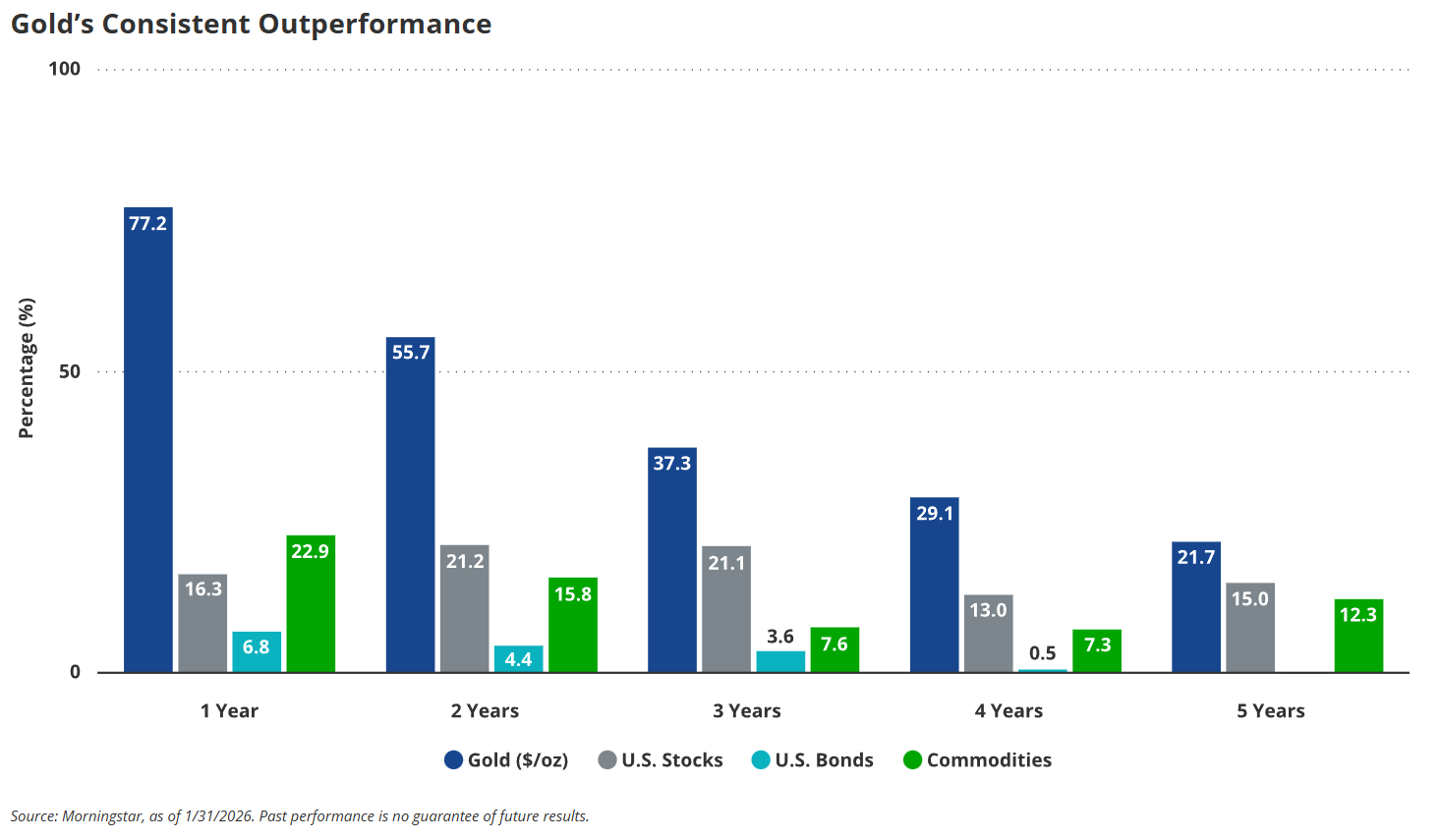

Every year or two, Vanguard changes its process slightly. If you understand the Backdoor Roth IRA, these small tweaks aren’t a big deal. If it’s your first time, they can be confusing. From time to time we update this post, but if you do this process sometime after this post is published again, don’t be surprised if it looks different from what you see here. The most recent update uses screens from 2025.

Here’s everything you need to know to create a Backdoor Roth IRA with Vanguard.

Step 1: Contribute to the traditional Vanguard IRA

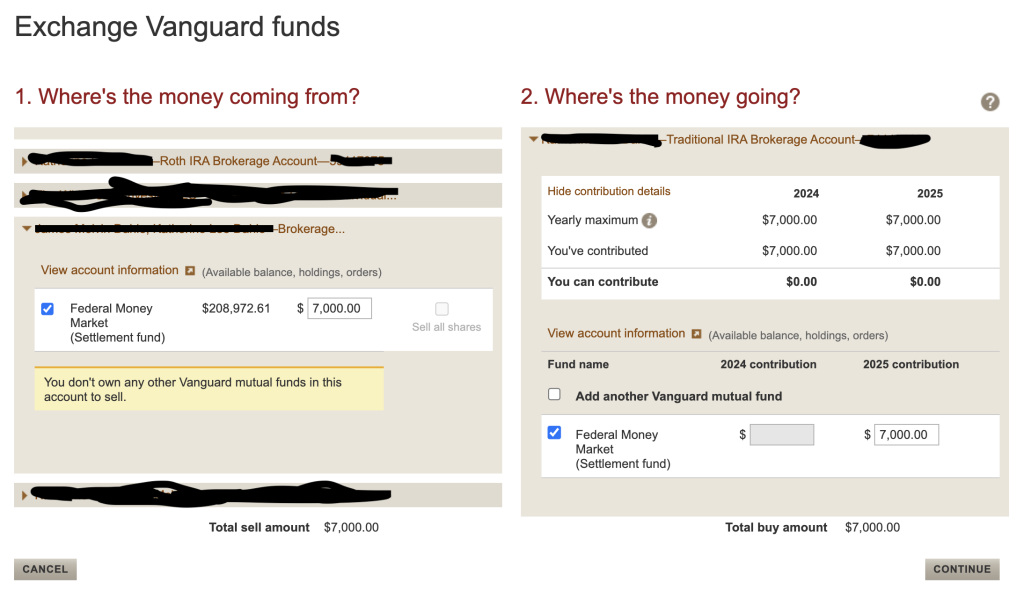

First, go to your traditional bank account and click on transact. That will give you a drop-down menu, where one of the options is “contribute to an IRA.” Click on that.

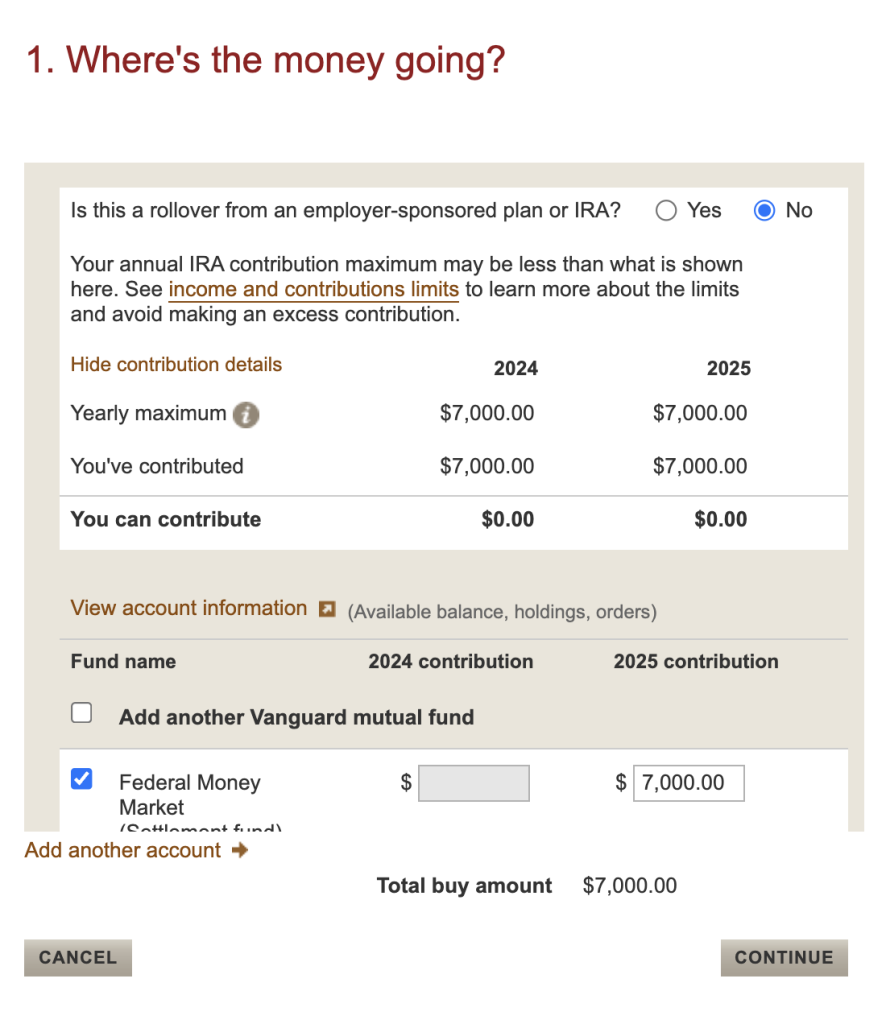

This will bring you to this page.

It shows you the contributions made up to the end of the eligible years. You can see that we previously increased the 2024 offering, so all that is left is the 2025 offering. Also note that only money comes in – the Federal Money Market (Fund of Residences) – There is no loss between the contribution and the conversion step. After that, you need to choose where the money comes from.

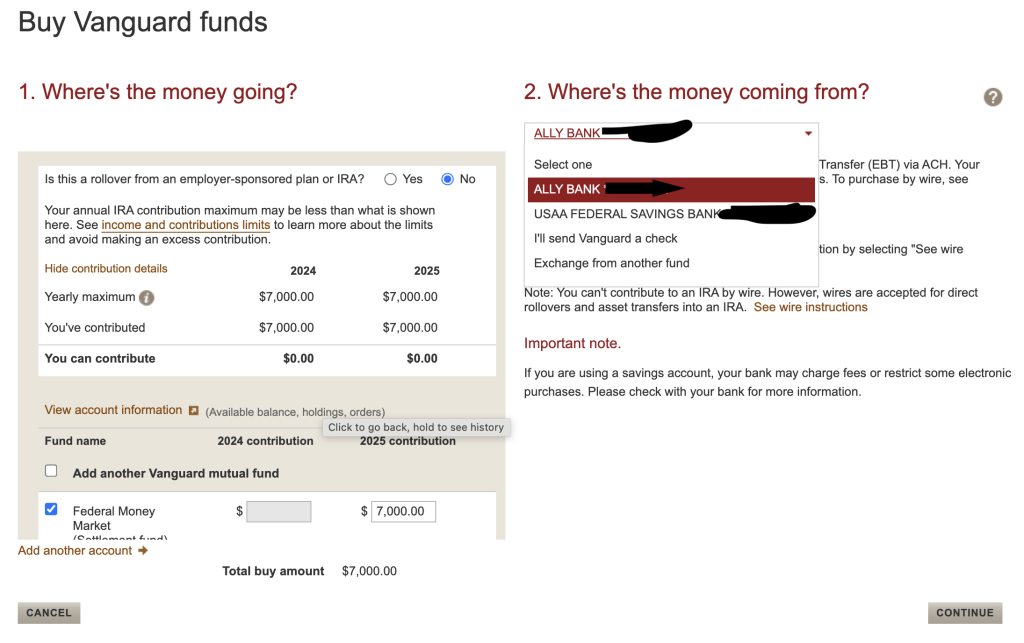

You will have many options, including any banks you have linked to this account, sending Vanguard a Check, exchanging to another fund, or using your resident fund. If you can’t, use a wallet in your BrokerAge account. It will reduce the amount of time the money “lives” and allow you to complete the Backdoor Roth IRA process in a few days much faster. This is a bigger deal at Fidelity than at Vanguard, but, when I used money from my bank account to make an IRA contribution at Vanguard, I had to wait about a week between the contribution and the conversion.

You will end up on this screen next. In this case, we withdrew money from the Federal Money Market (Fund of Places) in our merchant account, so if you make a maximum of $7,000 [2025 — visit our annual numbers page to get the most up-to-date figures]type in that number and hit continue.

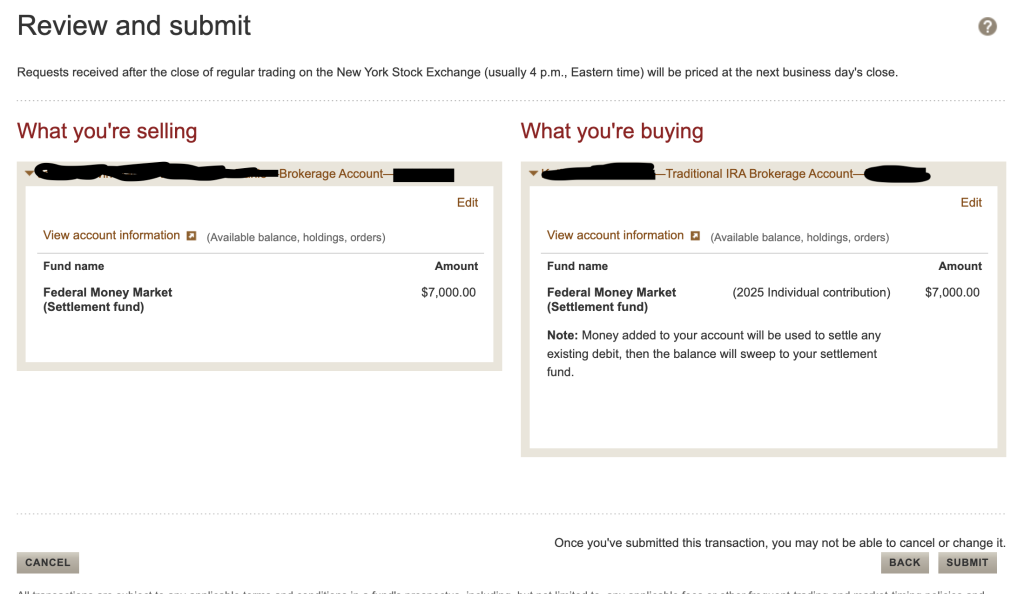

That everything looks fine, so hit continue.

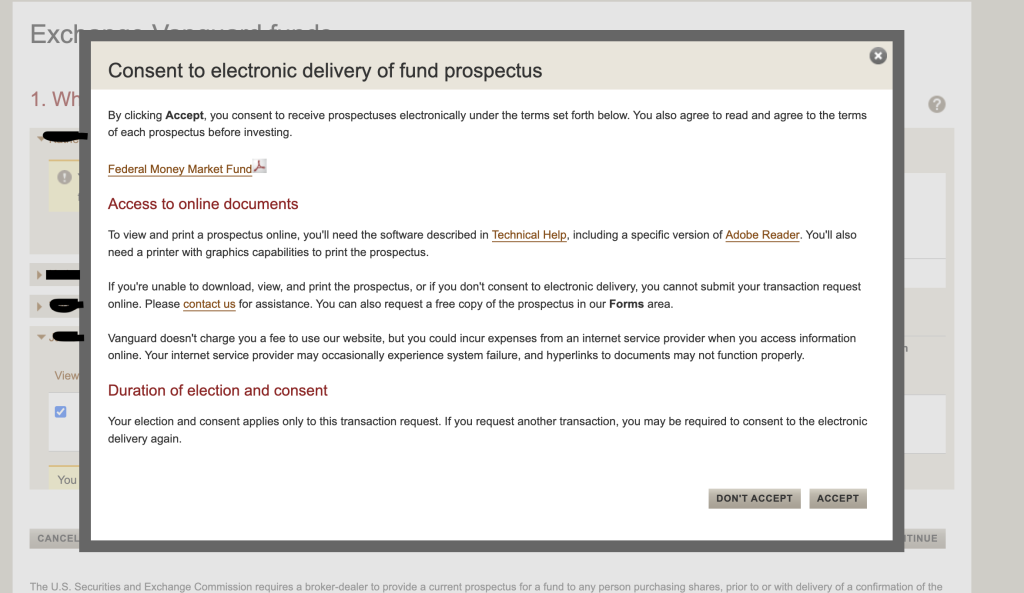

Hit the welcome here, and it brings you to the update and move page.

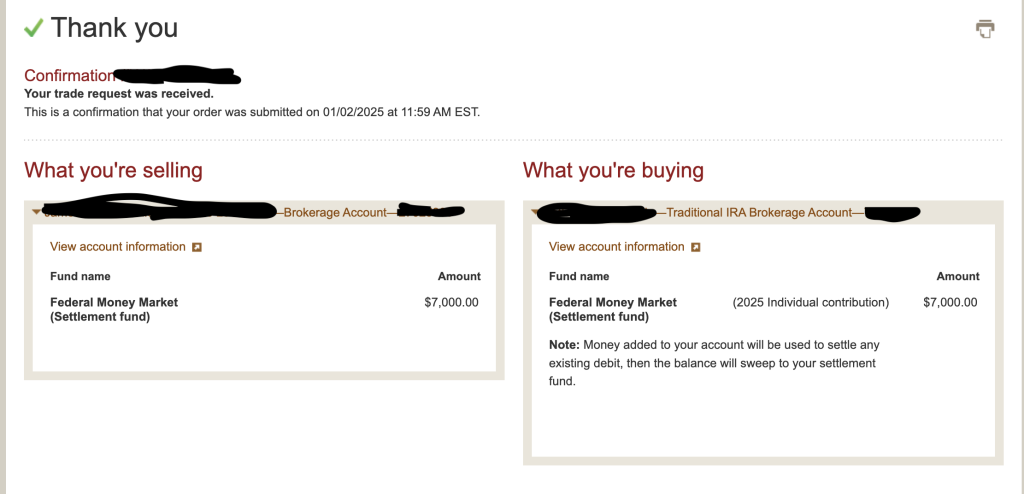

Check it out and hit submit. That will take you to the confirmation page.

Congratulations! You made a contribution to a traditional IRA and left the balance in cash. At Vanguard, you’re done for the day. If you’ve spent your stay, come back tomorrow (or the next business day). If you used your bank account, come back a few days after the donation “settled” to do step 2.

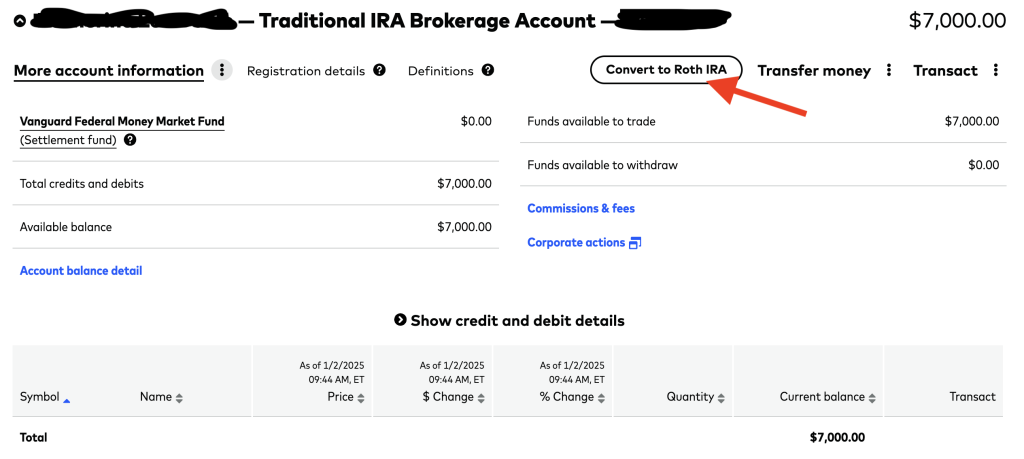

Step 2: Convert a traditional Vanguard IRA to a Roth IRA

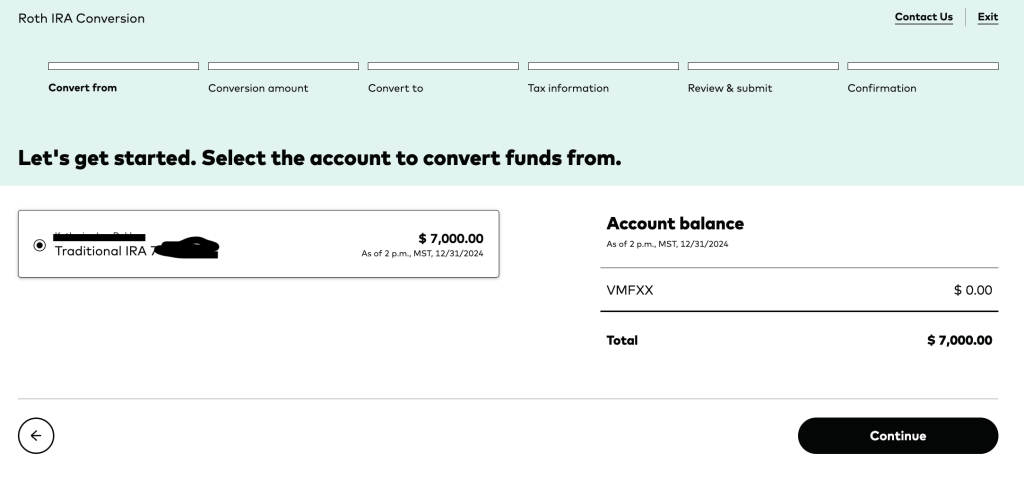

On day 2, go to your traditional IRA and hit “convert to Roth IRA”.

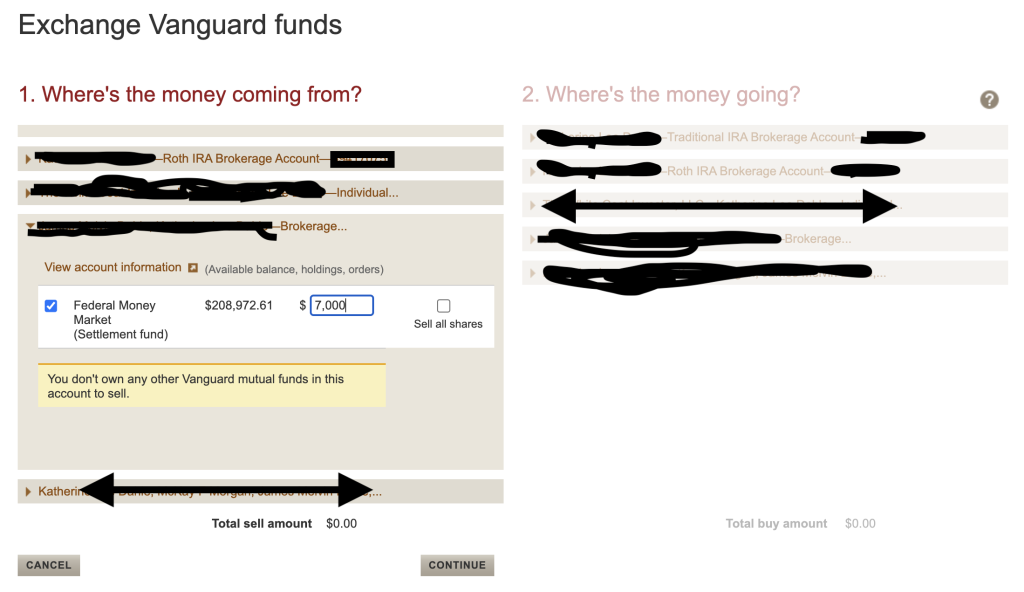

There are other ways to get to the same place, such as going to the “Currency Exchange” link (in the buy and sell menu). But this way it seems easy. You will come to a screen that looks like this.

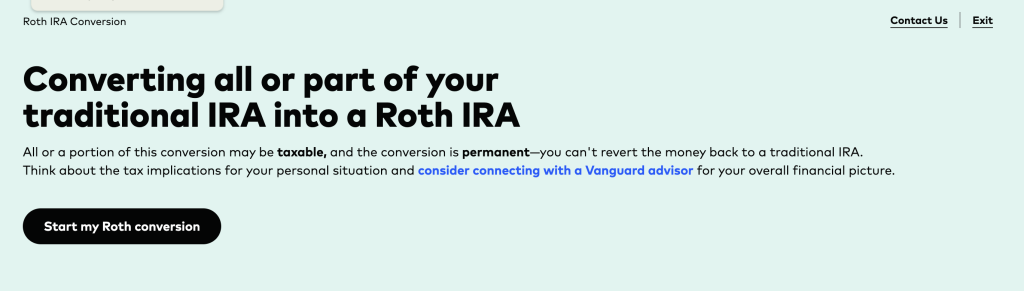

This page is just a warning; You don’t need to worry. Hit the “Start my roth conversion” button, and you will go to the next page.

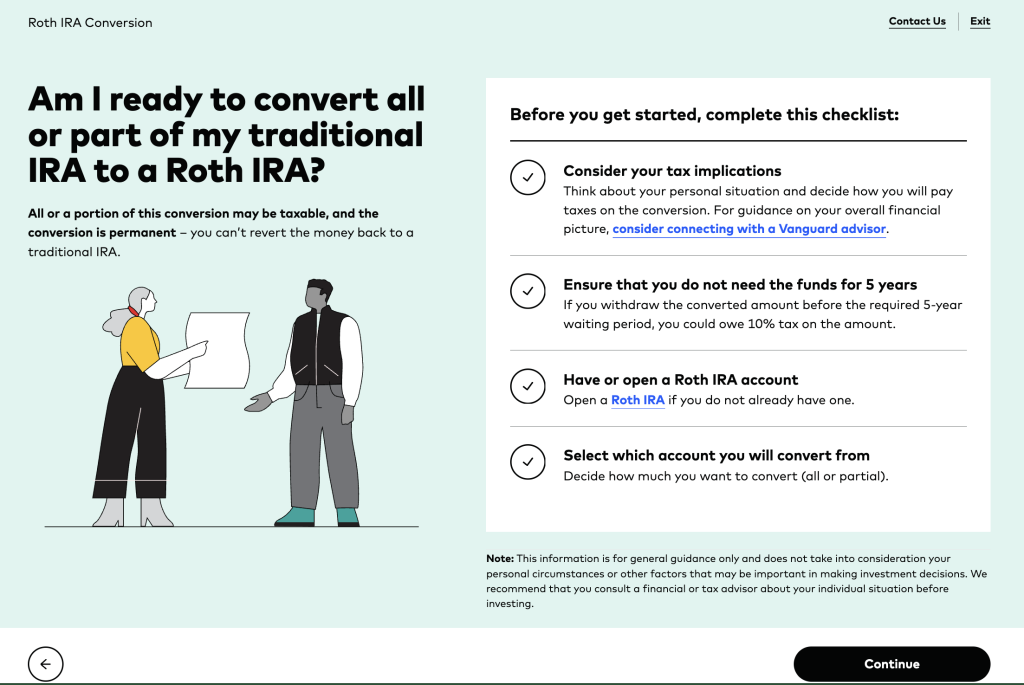

There’s a lot of good stuff on this page, but you can ignore it all if you’re a typical white coat investor making your own Backdoor Roth IRA coat. Hit Continue.

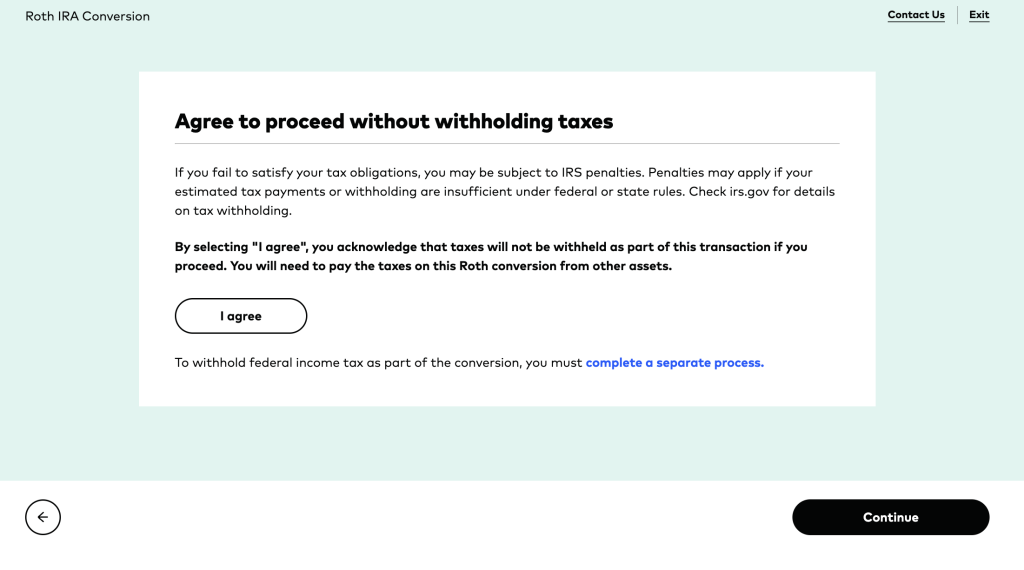

I like this page. It doesn’t ask if you want to withhold tax (you don’t); You just admit that you won’t. It’s complete. (You won’t file a tax return on a tax-free contribution anyway, and if Vangulard did that, it would be as if you ended up with your IRA return and hit “and go to the next page.

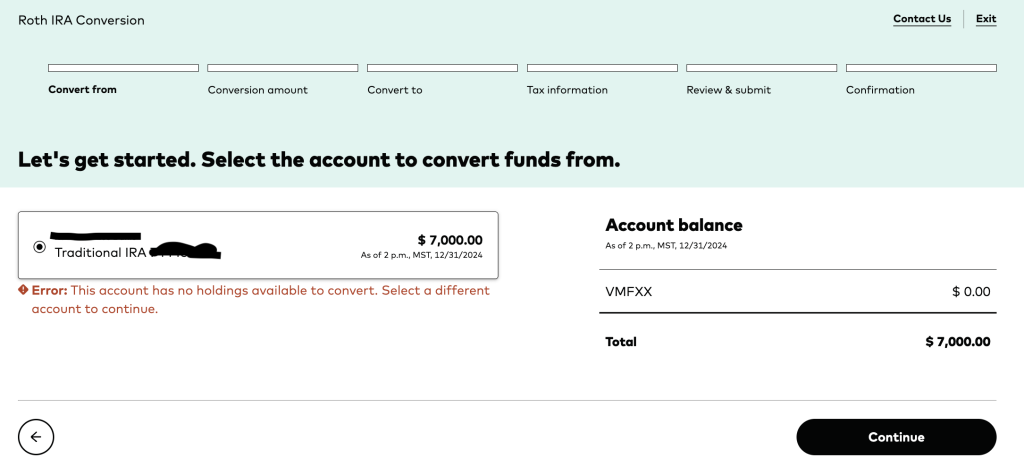

I like this page, too. Vanguard’s new look, and there’s a nice bar at the top to track your progress with roth conversions. Hit Continue and move on to the next page. Note that the page may give you a warning that looks like this:

That just means the money in your traditional IRA isn’t sitting right now. Come back in a day or three when it has. Once resolved, the next page will look like this.

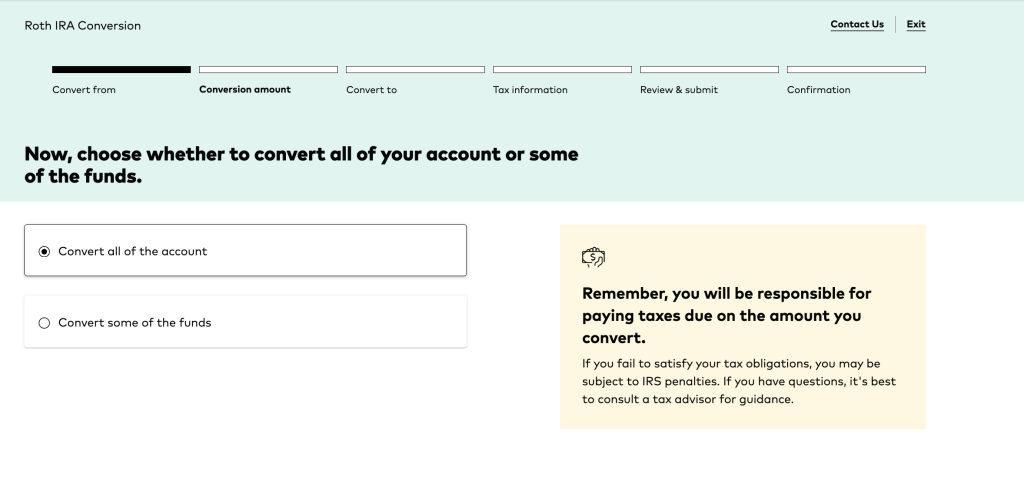

If you’re doing your Backdoor Roth RATA process right, just convert the entire account because all it has is an IRA contribution for the year. Don’t worry about the tax warning. Remember, some capital gains are taxable but not in the Backdoor Roth ROTA process. Hit Continue and go to the next page.

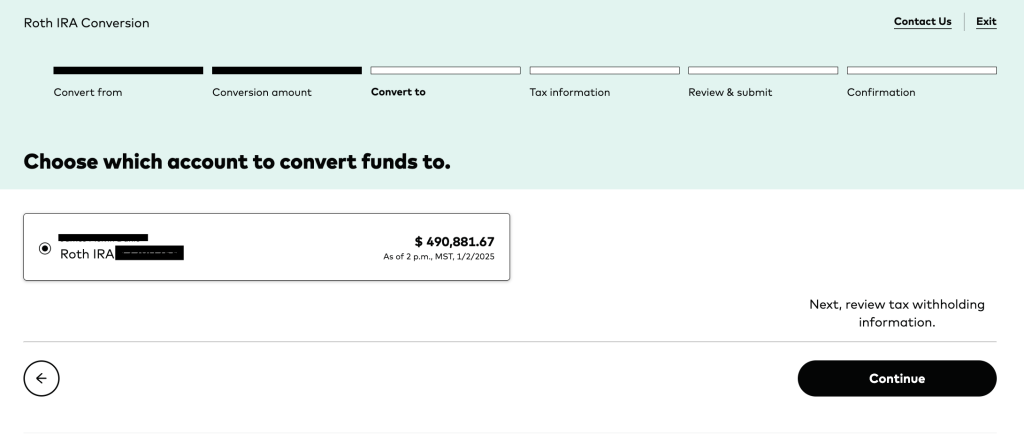

This page seems a little strange when you only have one roth, but I think it’s necessary. Hit Continue.

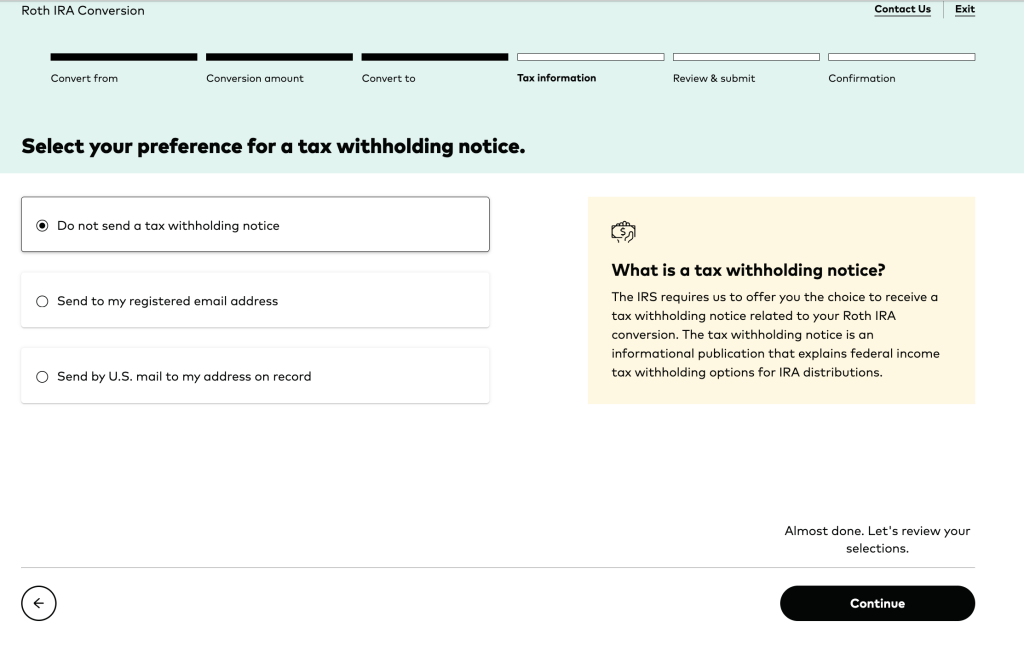

This is another unusual page, but I think it is an IRS requirement. I don’t need a notice that says Vanguard won’t withhold unpaid taxes, but you can get one if you want. After that hit Continue.

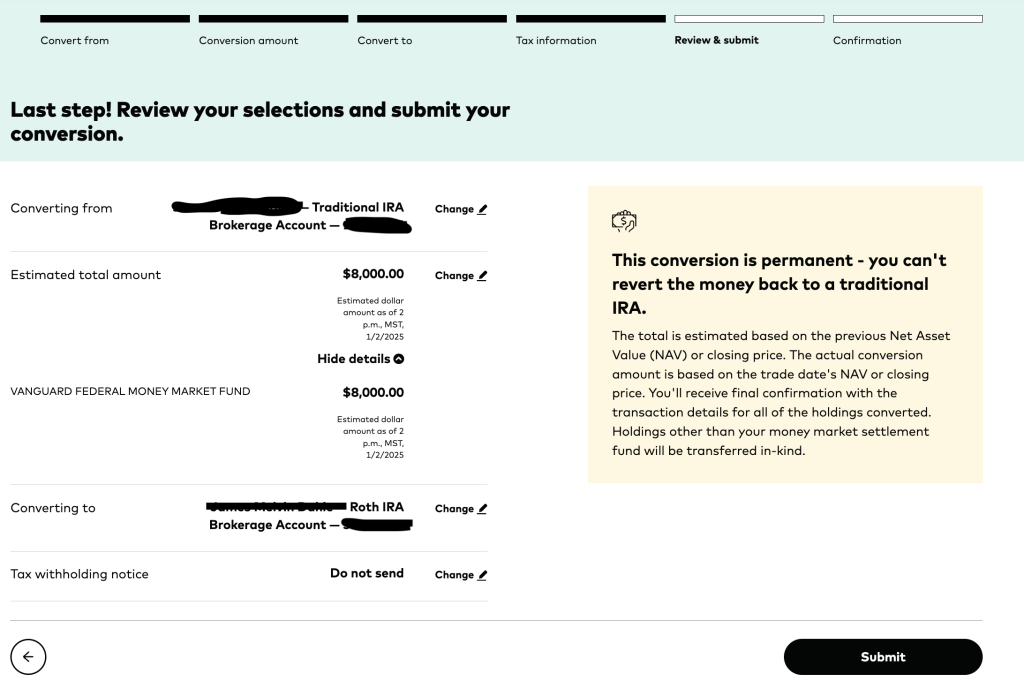

This is your review page to double check before placing an order. An astute observer will notice that the form says the conversion amount is $8,000. That’s because I used screenshots from both katie’s and my roth conversion this year. One of us turned 50 this year, so he qualifies for a $1,000 first-time hosting donation. Your conversion rate should be approximately the same as your contribution rate. If you have a few extra dollars available in cash while sitting in a traditional IRA, convert those, too. You will owe tax on those few dollars, but I’m sure you can afford it.

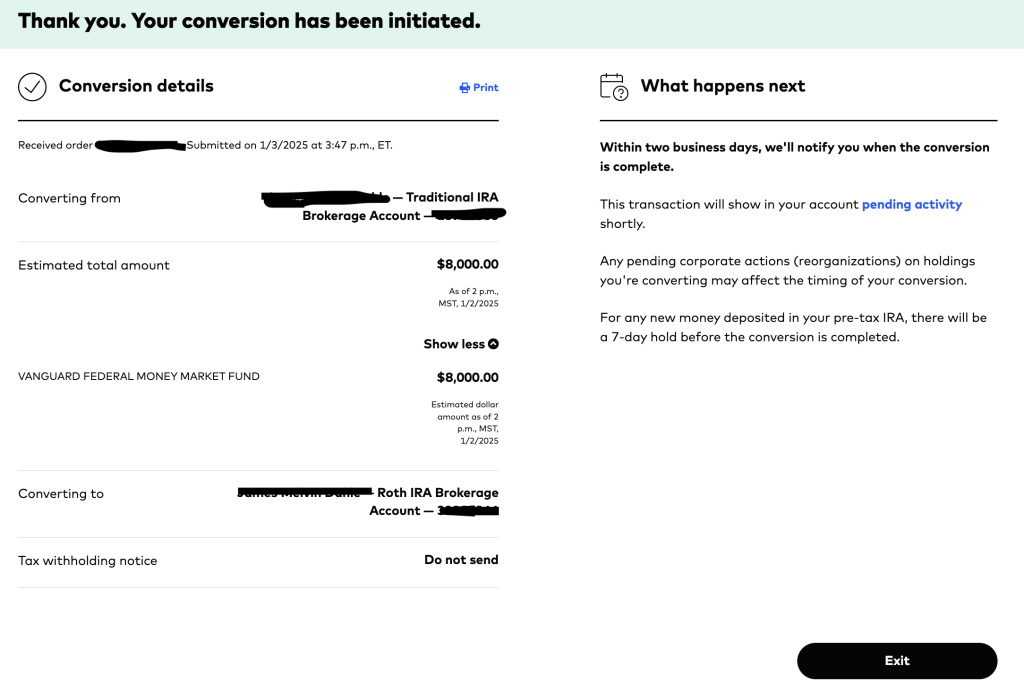

This is just a confirmation page. Go ahead and hit the exit. Note that you should have to wait two days for the conversion to complete. It wasn’t like that for me. Money was immediately available to invest, so I did.

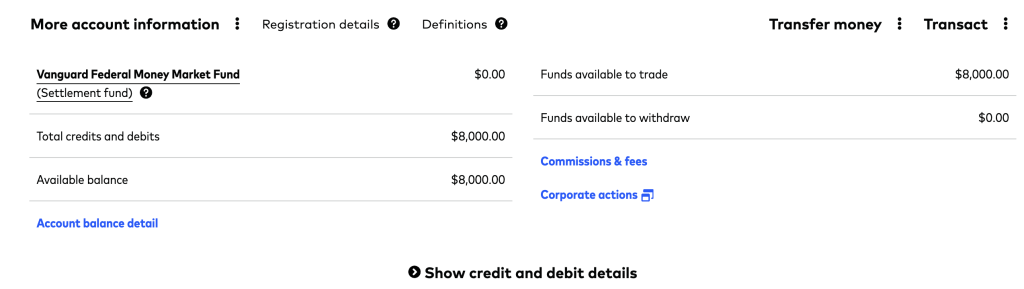

Don’t forget to invest your Roth IRA money, or it will just sit in the money.

More details here:

Pens and backdoor roth IRA

How to Fix Backdoor Roth Screwps

Step 3: Choose Vanguard Routh IRA investments

Return to the page that lists all of your accounts and click on the Roth IRA account.

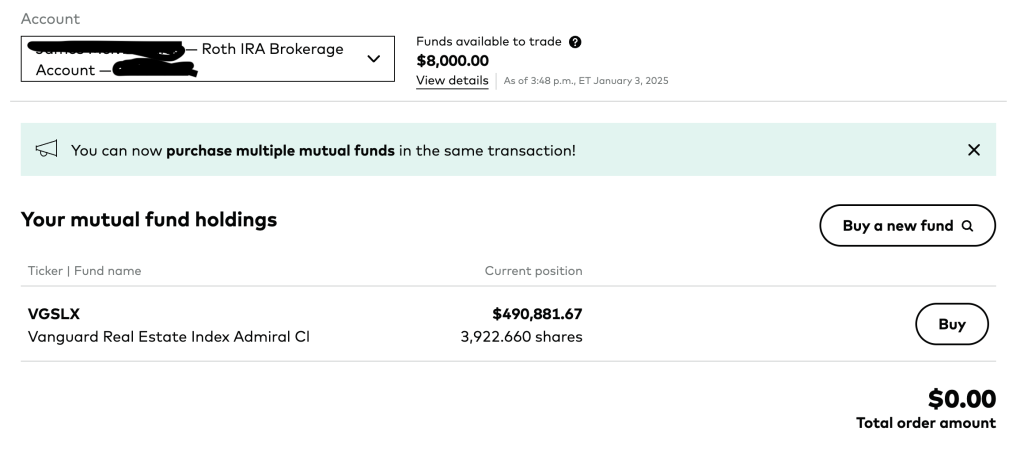

Click on transact and say “Buy Vanguard Mutual Fund” (whatever you want to invest), and you will be taken to a page where you can do that. Mine looks like this.

All of these Roth IRAs are already invested in the Vanguard Real Estate Index Fund, so the new contribution will go there. I hit purchase, and it takes me to this page.

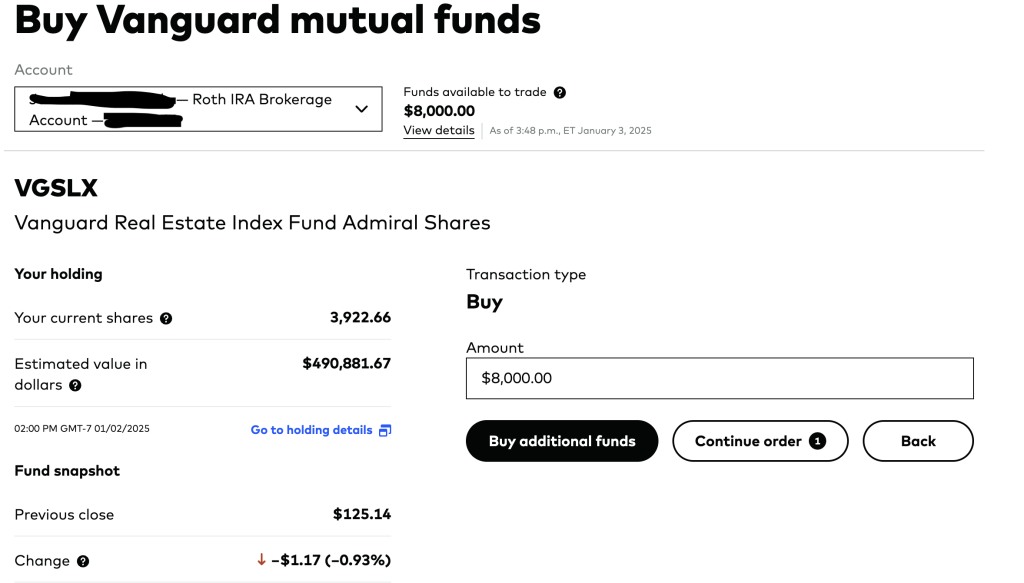

I put in $8,000 ($7,000 when you do a katie roth IRA), hit “continue to go to the next page.

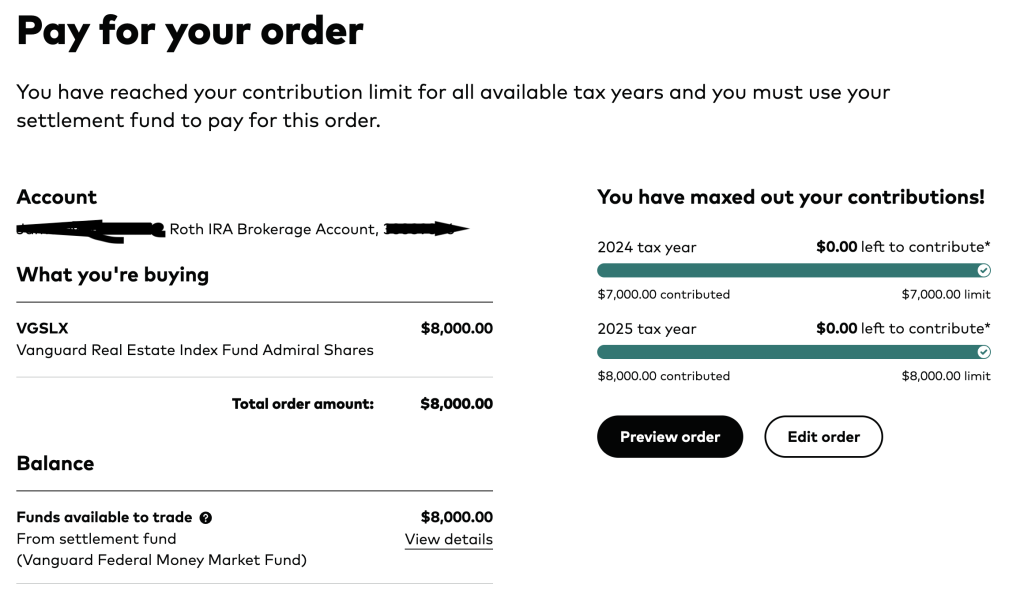

Also, you must click “preview first order” and move on to the next page. I like the new section here where Vanguard updates you on where you stand for IRA and past IRA contributions.

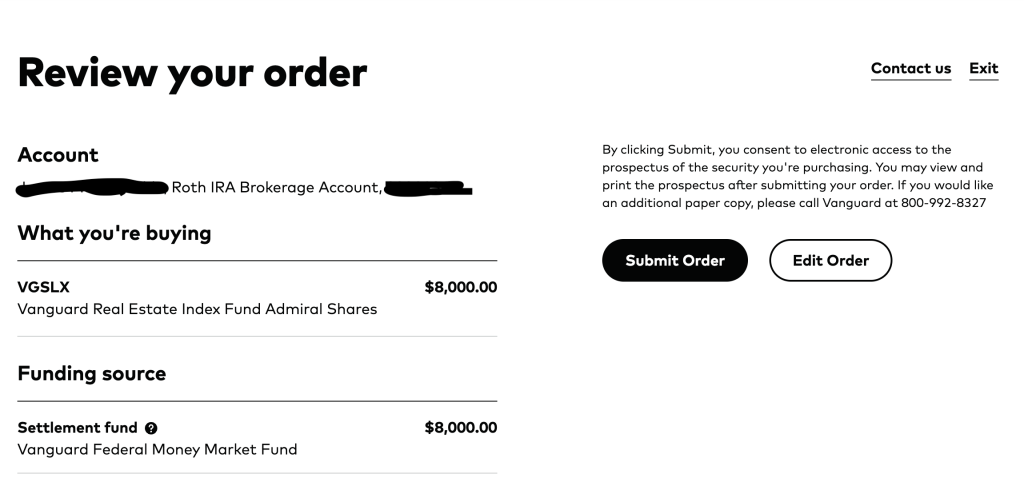

Here is your trade/order confirmation page.

That’s it, you’re done until next year. Don’t forget to set aside a Backdoor Roth IRA if available.

The process will be slightly different for trust, Schwab, and other IRA custodians, but the basic steps will remain the same.

If you have a question about the Backdoor Roth IRA and not specifically, you should first read this in-depth Backdoor Roth IRA tutorial before asking your question in the comments below. I promise you there is a 99% chance your question is answered there.

WHAT DO YOU THINK? Do you do your Backdoor Roth IRA(s) at Vanguard each year? What problems have you gotten yourself into? Any questions?

[This updated post was originally published in 2021.]