How do you invest in a bubble time?

The student asks:

He said you think ai a particular form of bubble. Bubbles eventually appear. What can investors do if they agree with you and want to prepare that PUP? Or nothing to do without riding a wave? Even if the bubble is obvious, what do you do about it?

Jeremy Grantham from GMO is expert in financial bubbles.

Here’s something you wrote about the current cycle:

The long, long-term bull market from 2009 is finally removed from the Epic book full. The Foughter Survaliation is increasing, commercial price, and the consideration of consideration, I believe the event will be recorded as one of the largest financial history, as well as the South African seabell, 1929, and 2000.

These bubbles are good where money is done and lost – and where investors confirm their Mettle. By setting a portfolio to avoid severe pain bubble may be a very difficult part. Promoting the work in the industry and all human mind errors will work on the reprimanding of investors.

But this bubble will explode at the right time, no matter how much the FED tries to support you, with the effects of harmful damage to the economy and portfolios. Do not make a mistake – Most of the investors today, this can be the most important event for your investment lives. Speaking as an old student and market historian, it is a mental and scary. It is a privilege to climb to the market at this one time.

Investing in many market places is fun and scaring. But the way Grantham describes the market production of the market sounds scaring.

Here is the problem – Grantham wrote this in January 2021. Despite the bear market in 2022 and the Day of Kermefle’s earlier freedom of this year, is & P 500 has 90% increase from writing. NASDAQ 100 has doubled.

That returns about 15% per year.

These things are not easy to predict even if they feel like a sequel in the movie we’ve seen in the past.

All that forms the membre-stock and spacu’s 2021 sounds like mini-mania but no bubble burst. I don’t want to put the words in her mouth, but Grantham probably just can say that we’re just building a big bubble and even AI using a bling.

A large amount of spending at AI waderout feeling Like some of the best investment bubbles in history. The problem is that everyone knows where we’re in trouble but no one knows exactly when we are in bubble.

Nobody can say certainly but because of the conflict, let’s say this is a bubble. What should you do as the investor finded between the MANA?

The way I see, you have four choices when you invest in the bubble:

1. You can go all with you. When George Soros said, “When I saw a shape bubble, I rushed to shop, never adding gasoline.”

You can try to be a soros and ride a wave. Who knows how much is this AI item?

Maybe Invidia is the first $ 10 trillion company? Oracle may hit the Quad Commub and be the next dollars organization. Mark Zuckerberg can receive AI to steal all our social security numbers before everything is said and done.

Who knows how long this will last? Perhaps traveling all-cells associated with AI will continue to pay.

However, this is a kind of plan that works brilliant until it doesn’t.

You need a strategy for exit if trying to be the following soros.

2. You can add a fence. If you are really nervous you can go to Cash or buy bonds or buy to put or invest in some form of snaping plan.

The problem with this strategy is that the market time is always hard, but even more like a bubble like a bubble. No science after that pendulum will go from one of the following.

What if you miss melts?

Are you free to deal with Phomo?

How will you know if you are wrong?

Walking all-in or all-out-out is not too difficult because the markets are difficult but because they always massage in your psyche.

3. You can change. Whether 100% of the bubble, you don’t have to travel everything-or nothing.

You can different from your portfolio away from the HysersCalers.

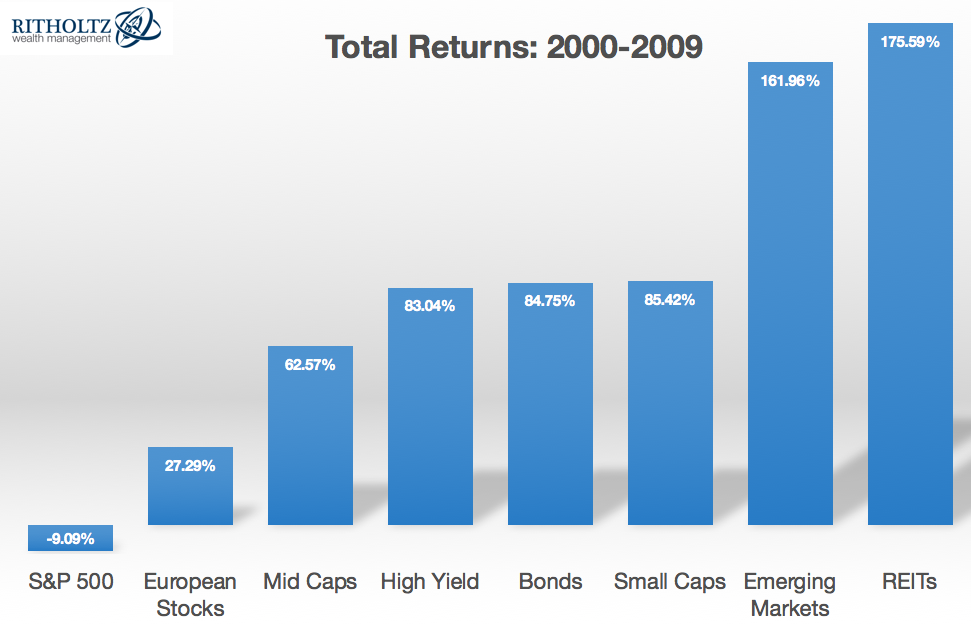

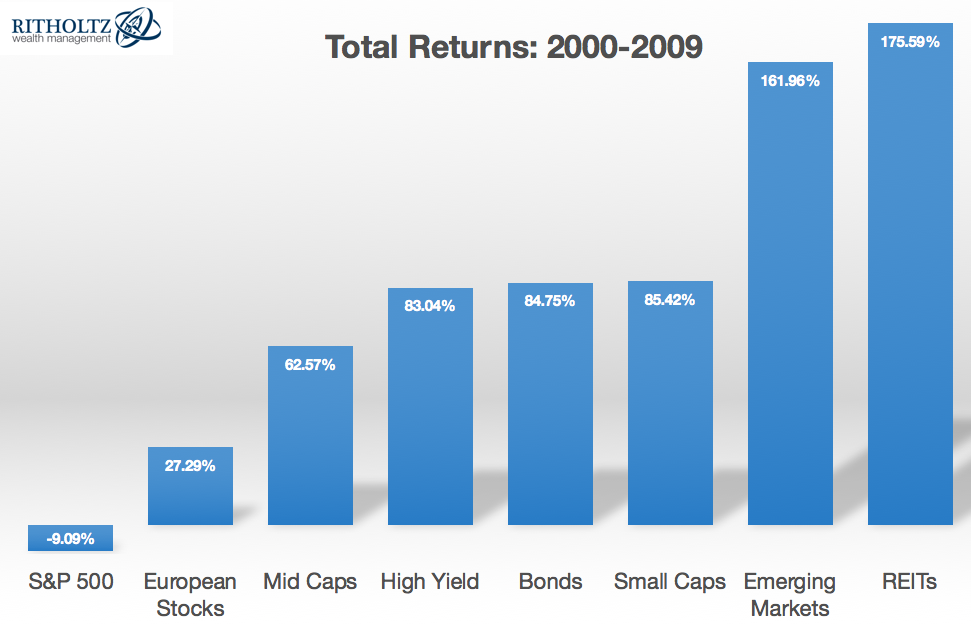

Out out of the DOT-com firm there were some market areas that did just right although tech shares were killed. Check how little price and caps are acting in DOT-com firm:

NASDAQ 100 was postponed after the end of the insane tech tech. But small caps and price calls did not keep the speed during that message – like the current cycle – and work in a big way when bubble appeared.

Working in other asset classes during the lost S & P 500 years in 2000s is a child of separation poster:

I am not lifting this cycle just playing like a dot-com bubble made but there are many parts of the goods, strategies and words and words that are approximately large technical stocks.

Distinction can be difficult when returning is fixed, but it is a great way to protect them when that victims grow their bad head to evil.

4. Don’t do anything. Don’t do anything to be selected again. As long as you have a place to invest in a place that suits your risk of risk and your best time here we may be able to follow your plan.

Stay a lesson, no matter what.

You just have to make sure you have the allocation of property and the investment plan that you can adhere to the hell or the high water. You need to enjoy staying with vegetation and flexibility and avoiding forms because you do not change your portfolio as they are as investors.

Don’t do anything is a simple plan but it is not easy any way.

I don’t do anything with my portfolio. I don’t make changes. I live in different, occasional accumulation and continue to make contributions to my various accounts.

Even if it is a bubble or something else I know that having a heavy portfolio of equity time means uncomfortable and seeing my portfolio accepted. To me long time is that important in danger.

You just have to check the traders-off and make a little breakdown to decide which route you will regret any:

- You may miss other benefits?

- Can you be a part of a role in a great loss?

Obviously, life can be easier if you can just ride a higher Ai Wave and get well when it is about to make a mental strategy but that is not a real strategy.

The experience taught me no powerful repentance of repentance in the fixed cycles.

So I won’t try.

I covered this question with the latest episode of combined inquiry:

https: /www.youtube.com/watch? v = R94OZOMDR3W

We also discussed questions about using home equity in retirement programs, how you rated spending money vs. When it is reasonable to pay for a financial advisor, and what makes the middle class in the United States.

To learn more:

The most amazing bubble