Trust of rural areas as a credit protection tool

By Dr. Marc Bradsky, Guest Guide

By Dr. Marc Bradsky, Guest Guide

Suppose the doctor, who will call on Dr.’s sample. One of the Lincheon physicians volunteered that he was in the process of establishing a DAPT center to protect his property. Dras Samathon was surprised and wanted to learn more. After lunch, he made a call to his successor of the financial planner and asked, “Oh, can it block my assets when I get charged?”

Understanding personal and financial instances

Dr Samathon is a 55-year-old surgeon who is the annual salary of $ 600,000. His partner is not working. They have grown children who do not live at home.

- Economic information: Dr. Hampla is waiting for prices to 3% per annum and for his income to comply with inflation.

- Insurance information: Dra Sampled has a professional and personal job insurance and a car insurance made for a charge of debt owed (plup).

- Investment details: Each year, Dr Samathatha offers a retirement ceremony with a trained hospital in Sofit. He also invests more tax accounts. Dr Sampling is devoted to the questionnaire that determines the level between investment. Her expected and required level of return is 8%. He expects you to maintain more as he gets close to retirement years.

- Retirement Details: Dr. Lamber plans to retire at age 67. At that time, he works that his retirement strategies and investment will replace 80% of his pre-retirement salary.

- Planning property: Dr.. The sample and his partner are will and no other material planning.

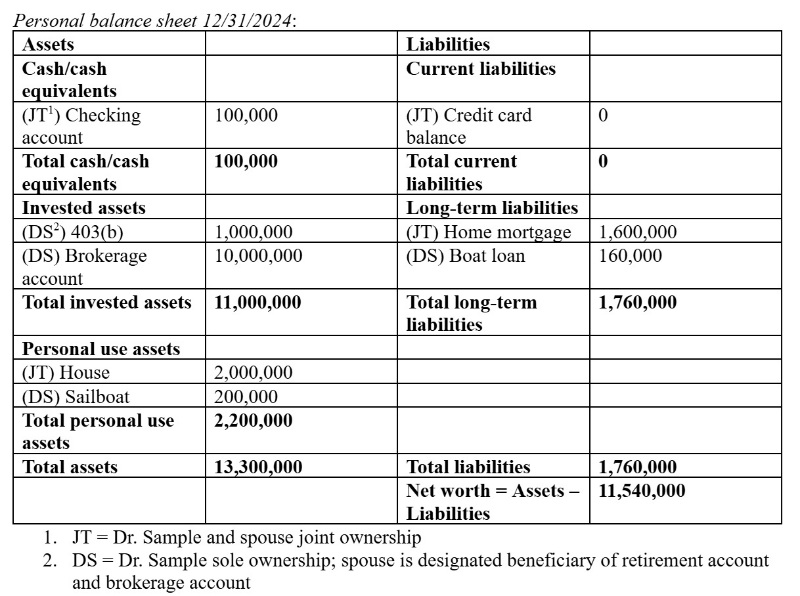

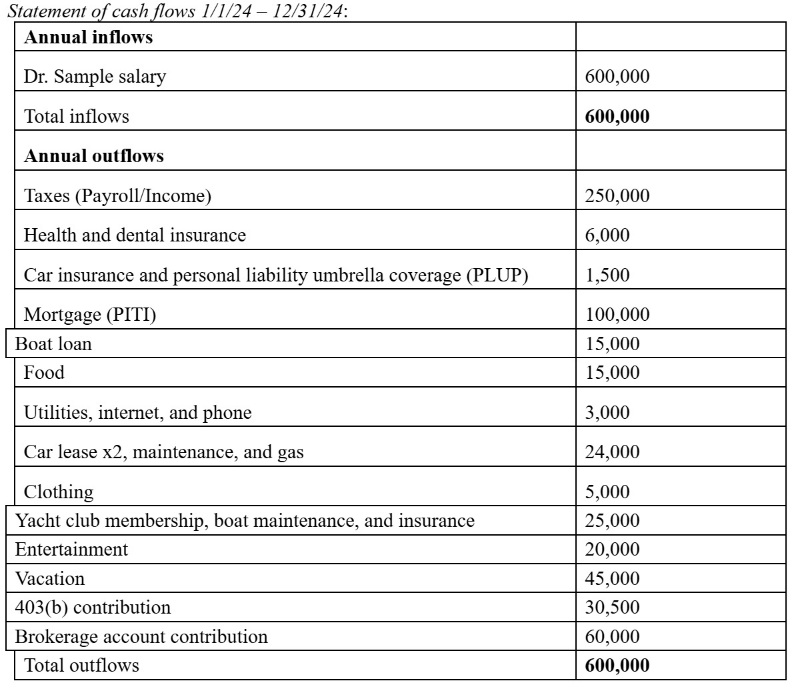

The sample fiscal editor produced a limited sheet with the flow statement of money.

Identification and selecting goals

- Protecting assets of debtors that may have a Dr. Life sample life.

- Protecting goods from debtors after the death of Drs’s sample and improving the lives of your spouse and children about their assets.

More information here:

10 things you want to know about medical malfunction

What is the decisions of the community, and how does it affect the increasing cost of medical insurance?

To analyze the current course of action and possible non-performance courses

While your known creditors, Dra sample would like to improve his heritages in the future case story. His current debt protection program rely on a large part of his professional policy. His proper retirement account provides for the debtor protection, as it costs income and penalties. Connecticut does not have strong domestic protection laws, nor does he allow married couples to be a local heading as a restrictive hiring area.

Avericed Protection Trust Trust (DAPT) is one of the protection of the assets in the case of a future case. The dapt allows the donor to transfer the property to the undeniable hope established to provide future benefits to the provider and / or other family members. According to tradition, traditions ‘prepared’ trust, when one person is a donor and a beneficiary, they would be found to pay for the creditors for the creditors. However, the State Law provides that the DAPT is not released from this traditional law, and the donor may be a beneficiary without producing reliable goods to future lender.

Earlier, donors want this kind of credit protection needed to establish trusts and transfer goods to long strategies such as Cook Islands or Nevis. Then, in 1997, Alaska passed the law that allows Dapts. The State Legislature considered its DAPT rules as a means of producing trust and outgoing business and revenue of their citizens in the financial trust of the Perses Trust. Since then, some provinces have introduced dapts (including Utah, Hawaii, and Virginia) for the same reasons, seeking to produce additional state, while lowering the risks of their areas that needed to use international trust.

While the DAPT can provide a strong asset protection, these trusts do not protect the fabricated debtors, and the manufacturer of hope and must have sufficient funds available outside the DAPT to pay lenders to any DACTI charges. Failure to do so can show that trust was a transfusion, and as a result, it would not be safe from debt. Planning in advance is important.

To promote and present recommendations

Connecticut is one of approximately 20 countries with the rules of DAPT. In accordance with the regulations of the contact, Drive Sample owed sample of Dr. However, they may not be able to reach non-trusted assets. The trust will not protect the “miscarriage of the goods from the known credit before the transfer of goods.

Each State Act varies from all the requirements for establishing trust in the country and the beneficiaries of the crime are available under the law of the law. In accordance with this, Dr. The sample of Dr. Normally, establish a given DAPT in the position requires a contribution to the management manager and / or investment manager in the situation.

Finally, it is important to note that if the DAPT donor, trust may not be inactive to remove the property from a powerful provider to death and, therefore, may not reduce any property tax payable. Some trusts of trust may carry out the purpose of avoiding taxes, but the representatives may require that the donor gives control and “enjoying” from the relief than this. For example, to disassemble trust from the Dead Tax Debt, the contribution is usually not beneficiaries. Trusts may vary from taxes’ issue Dr. Sampled must consult with its own financial planner and a suitable attituder.

More information here:

How doctors can prevent accusations

How can you survive the medical malfunction

Using the program

Sample Chamber may include lawyers for qualifications with design and repair the DAPT, a discussion that must include benefits and injuries of receiving under Connecticut Law vs. As soon as the power of power is selected, Dramama will assign a local citizen’s manager or trust in Company Bank with a component of the entity. Trust goods may include Dr. Account. Sample sample and perhaps even his recreational goods, a private boat. DAPT The child and supports with other assets – including money, limited companies (LILECS), the site of sale, mental property, and business assets.

Developing DAPT is a complex strategy that can easily produce $ 10,000 or more in lawnical fences, and thousands of dollars each year to be controlled. With addictive addiction of $ 10 million and high risk of special special charges, Dr. The sample can properly determine these funds into the appropriate price to pay for datti.

Monitoring progress and renewal

After the Trust, Trustee will be responsible for overseeing the investment of reliable property, records and management and distribution. In addition to accessing credit protection benefits and housing options, Dr.

A lower row

DAPTE is another sample option to achieve his main purpose of asset protection, and may contribute to the preservation of his financial possession. The sample Drive should continue to discuss each sense advisors, taxes, and legal advisers and carefully consider the benefits and injuries of the DAPT with Connecticut or other law.

Do you use DAPT? What are your benefits? Is there any lower?

Disclosure: Marc Brodsky, MD, is a registered representative of Avantax Wealth Management Management Inc. Secantax Investment Services Inc., the Finra member, SIPC. Financial Advisory Services Offer Avantax Advisory Services Inc., 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. 972-870-6000. Avantax family of companies specifically provides financial products and services for their financial representatives. Although Avantax Wealth Management Inc. It does not provide or focus on the tax services or financial services, Avantax representatives can provide these services for their private business outside. This content is intended for educational and experienced purposes and the Avantax opinions and opinions of Avantax Wealth Management Inc. or company companies. This information is not intended as tax or legal advice. Please refer to legal or tax professionals for specific information about your condition. Investment and insurance products are not investigated by FDIC or any Federal Held Agency, are not cash-free or any bank promoter, and may not lose the price. Jeffrey A. Coord is not associated with Avantax.