AI writes: Beyond the hype | Insurance Blog

Wee occasionally made by the survey oni writing down A Members Over 15 years of age Understanding the work of work and how technology is–either is not–To help appear. The most recent report Rewrittenwe asked What percentages of time do not spend time spending on non-basic jobs. By this time, We saw increased improvements year–upstairs–year match our 2021 Study But still more than than third of The author of the underlying Time spends which is not the core activities such as data collection or administrative activities.

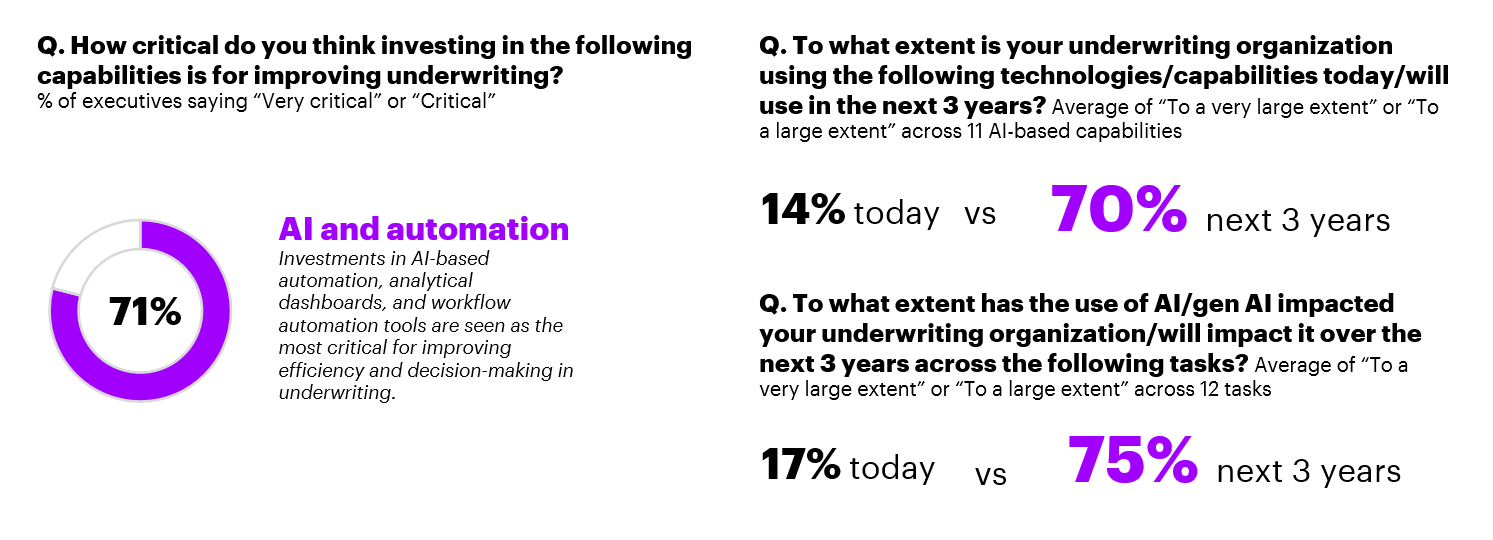

But more than that, our 2024 surveys constantly produces hope for the future Automation and Ai Technologies can help change the role of writing down and truly reduced the time spent in non-economic activities.

It has been long enough to remember other waves of new ideas and technology such as information management, Internet, and Analytics. And when each one has found a place within all insurance and technical nature, a person can argue that no one is really changed to write down. But every time we did our industry research over my 30 year job, I have never seen such numbers:

Automatic Automatic and AI

According to the above information, the percentage of the Time WANDER FIRETERS turned down unimportable activities set to reduces more low rather than ai and automation to forward. At the living, group, politics, and commerce, the Insurance Managers are convinced that AI and Automation Tools will change and write very low.

3 years ago carriers have been trying this technology – they make ESB, pilots in the data collection, data consolidation and writing advice. And when all the pilots could be successful, the ending all seems to be now as there is now a reason to hope to deal with sharing an actuary. In fact, if you do not consider some form of AI issued a struggle for a continued strategy, you may already have already in our survey.

Here are some important data items from our latest mortgage survey:

- 81% of the administrators who are writing under the examination of the AI and Gen Ai will form new roles to “a large scalp” or “very large”.

- 65% of management believes that their employees will require UPSkilling as AI becomes integrated in creating new and increasing roles.

- 42% of stewards think they will need to access the ponds in the external talent to achieve fully power

Enabling Ai-LED writer

Included with modern automation tools and advanced data installation, perhaps most variable power in modern writing, measuring both efficiency and difficulties within controlled areas. It can help the processing of environmental language processing customers and consumers to deal with problems and understanding applications so that they can be directed to appropriate repair solutions. Things to make up-ups and the recognition of the pattern and allows for the processing of many comprehensive applications without direct interventions. Also, AI has the ability to organize Archastrute that will serve to provide comprehensive service solutions.

Let’s write: Written role doesn’t go, but will be changed as each carrier carrier sets the best way to integrate the quality of the quality of the quality and efficiency of the writing outcomes.

Your following steps as Gen AI AI AUGERS WORKERFORCE

To succeed in any AI trip, carriers need to think about three things in my opinion:

- Ai-LED strategy sets out a program to take advantage of these new tools in your existing location. Requires a fixed fixed replacement. As AI technology emerges that they have the Avention students, they can even increase their production by continuing their movement and transmitting activities to the AI.

- The resources strategy is also reopening the flow of work to prepare management groups and to write organizations to use the new skills of these solutions. Skilled approach will be key and in Tandem, insurance providers will need to synchronize AI and the re-recovery process, to ensure that the responsible AI principles are attached to all.

- The culture that can assess and evaluate while protecting important decisions. The Internet interviews need to take low size rather than the highest AI acceptance system, using employees’ commitment and longing for wanting to try ai.

If you want to learn more about Insurance Accounting Insurance Insurance Insurance, check Rewritten or feel comfortable to reach me directly.