Denmark recently raised its retirement years in 70 – Retirement Resources Center

We, we must return the balance to our system, but inequality prevents the prevalence of the bone.

Denmark has just raised its 70 years of retirement for 1971 Dani or later. Should we do the same thing? The answer is closer twice.

On the other hand, Congress should strive for the Balance Restoration Act in our social security system, which is experiencing similar costs in 10 years as did Denmark. Our benefits currently exceed our income, and shortages covered in the Trust Fund Fund. In 2033, areas stored in the Trust Fund fund will end and retirement benefits will be cut by 23 percent to reach revenue. To avoid such a greater and quick cut, Congress must provide a package that deletes system shortages. And the Congress should do sooner than after a period of an older American population and spread the load in the same way between different groups.

On the other hand, the US, unlike Danish, not in the event of the rise in it is performed in retirement years, because we have a much unequal society than Denmark. According to OECD, the US poverty rate is three higher than Denmark, as well as the broadest rate of unequivocity – Gini Coefficient (Coefficient of Gina.

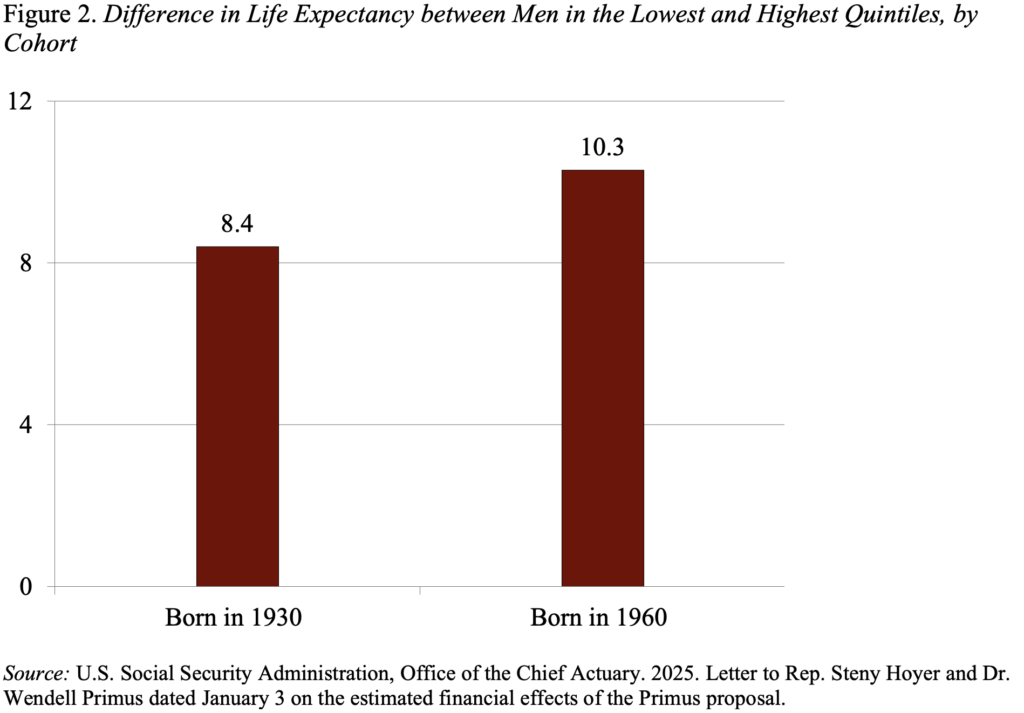

Inequalities inequality intermittently translate inequality and life expectancy. Remember the issue of the highest retirement is based on the hand that people live longer, so why you are not working longer. Yes, on average, we face life benefits, but those benefits have been enjoyed primarily by the highest part of the receivables.

The recent study of public safety, supporting a wide body of evidence, drives this point home to the spades. Listen to the record, actuarial numbers may prefer relationships between the receivables and the time of life for two reasons. First, these statistics release all benefits from the Disability Insurance program – a low-income program that has a low risk of life that would reduce the lower level. Second, unlike the previous lessons looked at the 50-year-old life time, these numbers are about the age of 62 years of age; Eliminating those who died between 50 and 62 produces a healthy part of a perfect. Despite these research materials, analysis of all employees that retirement benefits the time of life we are orderly increased.

The results show that when life time has been up to 18.1 men born in 1930 years of age. That is, the men who are 20 percent of the receivables are expected to live about 77, and the high men are considered to live about 88.

Due to the greatest differences in life, analysts propose to raise full-time retirement for long-term retirement. That is, only 20 percent of each group will work until 70, and increase will be made so that lower leaders will retire for 67 retirement.

The line below is that the oldest retirement increase reflects the fact that we need to restore the balance and confidence to our public safety system. But the US can’t accept the same options as Danmark because life time and life benefits of life vary greatly by receiving money received.