Rules of Stock Market Rules

Podcast’s listener asks:

If there are no metal rules in the market and no active forever as a cursor, perhaps to study the stock market is not employed?

No – the rules apply to the stock market that work at all times.

If it were, everyone would do, and invest would be easy.

I didn’t always say anything about working, that’s not going to do anything.

Studying of the stock market history shows that although the future does not look like the past, some of the sixth common rules can help you to become a better investment in the better investment.

Here are some of my stock market rules (even if it doesn’t always work):

Fluctuation is straight. High-flexible flexibility is followed by infinite by lower-tension and argument.

The stock market will not provide a premium of accident than other property classes without exchange, but cannot live forever. It leads to the best of bad and bad leading to laughter … at the end.

It should be this way or stock market would stop being present in its present situation.

Buy where stock market. I love the stock market collision because it means you get investing in low prices, low prices and highlights. And that is usually willing forward.

Can you be the time below? No.

Can the market continue again? Certainly.

What if you never get back? If that happens, we will have serious problems in our hands.

Diversity is your beautiful fence against extreme events. Many shares smell. A small share of shares account in large number of benefits later.

Many shares are breaking and never again. Some stock markets have made decades the best time.

The best way to avoid disaster risk and survive stock market breaks and your grabbing to different geogains, market hats, categories and shares of shareholders.

Differences do not guaranture remarkable results but helps you stay in this game.

Your biggest edge does not continue data but by behavior. Don’t try to remove the market. Try to avoid offending yourself.

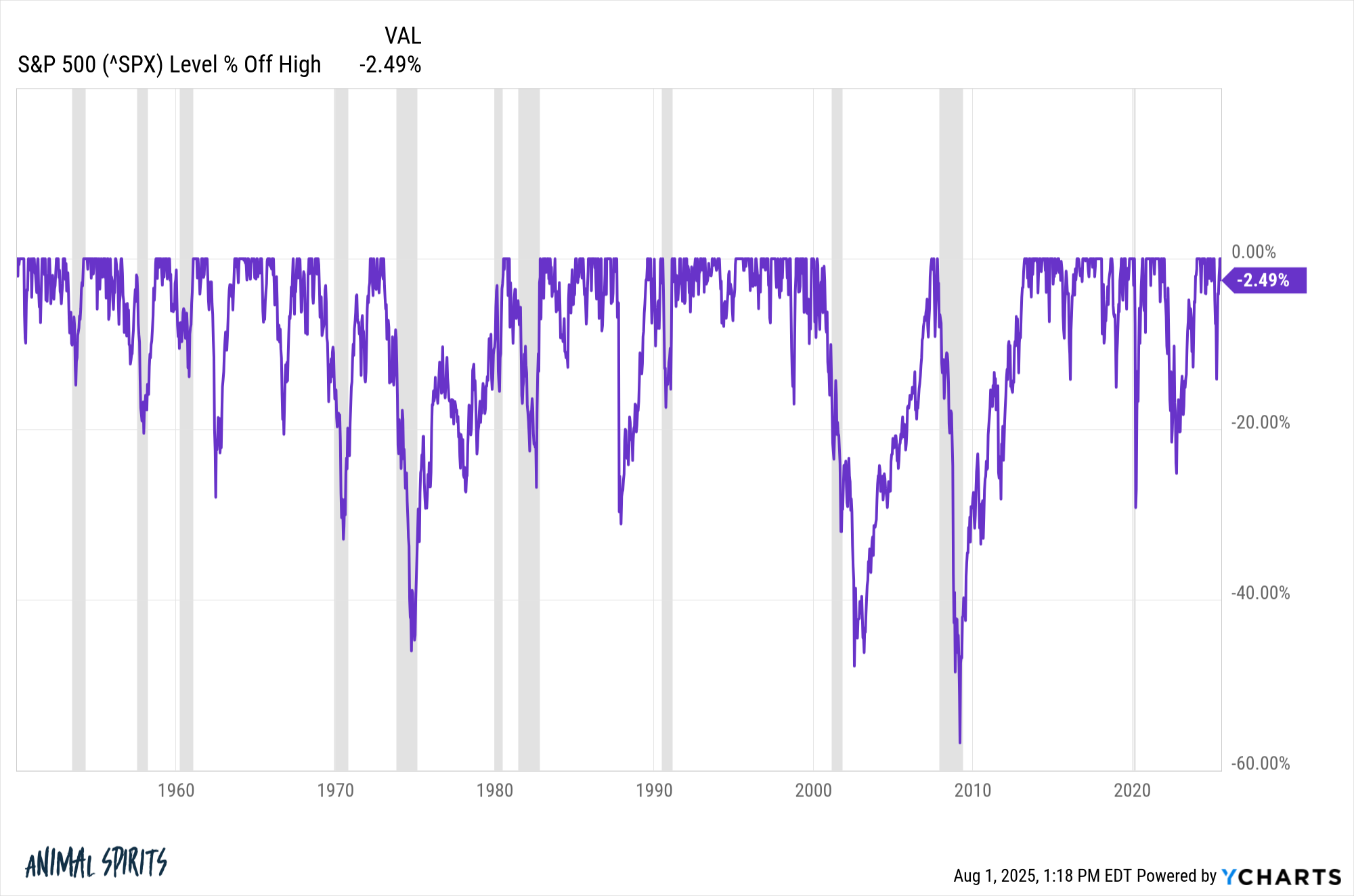

The stock market should be hit sometimes. This is a feature, not a boat:

No pain no gain.

The market is hard to hit. Can be done. Most people cannot do it. Shop correctly.

The accident never went completely. There is always available trading time.

If you put all your money in the cell, your expectations expected to go up, but as well as your chance of great loss and bones change.

If you put all your money in cash, you can reduce the loss of loss and voteetry but your expected restoration dropped.

If you have a moderate portfolio, you are always annoyed with some strategies or death classes in behalf of them.

Risk Risk Changes but does not extinguish.

Restoration and the pressure here to stay. Some investors hold on to the loss of shares hoping to return to their original price. Some are double from the cells that rise up and reduce the missing ones.

Some investors place under the market events while others work over. Some walk with the crowd and some are perma-opera.

Fear, greed, confidence, high reverse, creating bionency

The human condition means pendulum switch from one of the feelings to one of the other depends on the price action.

Trees can grow into very long but they do not grow in the sky and therefore the pressure will always be so with a certain fashion.

To extend your time the atmosphere enhances your issues of success. The stock market is a leading Casino in the world because your challenges of success increase for a long time is often invested.

The markets eventually punish sure. No one has all. If you think the market reminds you that there is nothing like simple money.

Michael and I discussed that nothing worked all the time and other stock market rules in this week’s spirit realm:

https: /www.youtube.com/watch? v = k8yt2guvcg5m

Sign up for a compound to miss the episode.

To learn more:

Why did the stock market grows 15% forever?

Now here I read it later:

BOOKS: