People work longer, but does they say social security soon? – Resources Center for Retirement

Two different steps are the same story.

Long work has often been accepted as good retirement advice. It specifically raises current income; Allows people to give a lot to 401 (k) s; It reduces retirement period; Also, importantly, delay seeking that social security leads to the monthly achievement. The good news is that people have answered; A long-term trend went to prior retirement and set up in the mid-1980s, employment levels in the old age role in the 1990s, and since the retirement years ranged in three years. The question is how works when you work longer to translate the delayed public safety benefits.

Some information may be obtained from the Data for Published Every year by the US Social Security Administration (SSA). This data exhibition, because All employees say the benefits per year, Percentage of 62, 63, 64, etc., educational about any year. But when the size of a group converts 62 weeds a lot from year, the details of the claim looks down the custom in the late maturity. That is, the details will indicate the age – 62 complaints who make up a large part of new complaints in a prescribed year or less than 62 percent of those 62. Following the behavioral of the behavior over time, one should look at cohort data. Such data, of potential surprises to turn 62 per year, Percentage immediately says. In the latest study, we used both data sources to look at long-term procedures.

Another way of gleaning is that people say that in time and work longer. The line of year for the year reflects the percentage of all who claiming the year to be given 62; The birth year indicates the percentage of those born in the year offered in 62. These two methods provide the same results until 1997; Then, this series of eyebrows begin to divide. The birth year shows an uptick in the power of the employees who start in the 1990s and shows a larger decrease in three decades ago than the last days.

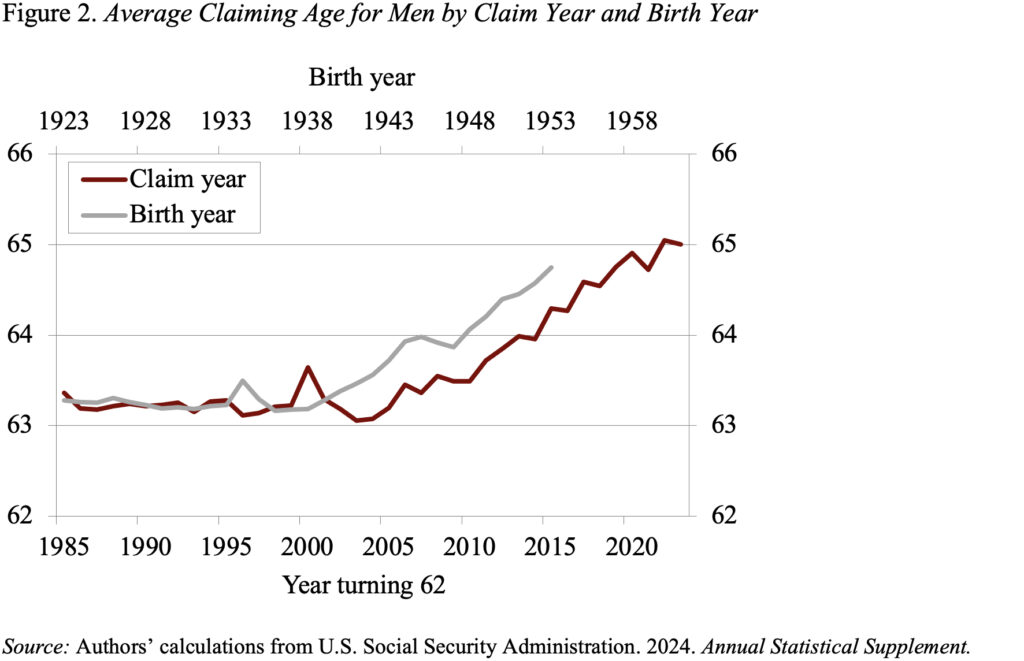

Figure 2 brings a habit of 1985-2023 on average that claiming men ‘year after birth (those cohorts turned 62 after 2015 at 2023). As a person can expect, increasing the growth of the year of birth, but both support conflict that retirement delays is accompanied by seeking delays. The delay of the claim, however – even using birth of birthday – almost two years – less than three years increase.

The lower line is that “yes” people say that later, but the increase in year’s demand is less than a person can expect to increase in age – and to find that people say no year said.