6 Simple Ways to Improve Your Investment Performance

A student asks:

What’s one simple thing that most investors don’t do?

Now this is kind of my question.

Simplicity is my thing.

Here are six simple ways you can improve your investment plan:

1. Be yourself and get out of the way. This is one of the easiest and best things you can do to increase your wealth.

Automate your contributions, what you invest in, your asset allocation, how often you balance, your savings rate increases, interest returns, etc.

Make good decisions early, stop messing with your portfolio and get on with your life.

The less you do, the better.

2. Think about the big picture. Too many investors focus too much on individual investments in their portfolios.

Yes, individual securities, funds and asset classes are important to your investment plan. But you have to think about how those individual parts work together and complement each other.

When adding any investment you should consider how it fits within the context of your overall portfolio, not just its individual merits.

Each piece of your portfolio should have a function but those individual pieces add up to the whole. It’s all a lot of money.

Your overall portfolio performance is more important than individual performance.

3. Combine. One of the best ways to view an overall portfolio is to combine your accounts. It is very difficult to track your asset allocation and true performance when you have accounts all over the place.

Things can get out of control when you have a 401k, traditional IRA, Roth IRA, brokerage account, 529 plan, HSA and a handful of old retirement accounts from former employers all over the map at different financial firms.

This is something I have been working on personally to make my investments easier.

We had a 403b from my wife’s previous employer sitting there in her account so I finally rolled it over. We have all of our retirement accounts at Schwab and Fidelity so I have moved my crypto and brokerage accounts to those platforms as well.

It is much easier to understand the whole picture of your investment plan when everything is under one roof.

4. Track your performance. I have a love hate relationship with investment performance.

Some investors focus too much on short-term performance metrics and benchmarks to their detriment. Long-term returns are all that matter so who cares if you have a bad month, quarter or year?

However, some investors are not experienced in performance. This is especially important if you manage some or all of your portfolio. You should thoroughly track the performance of your chosen stock to determine if it is worth the time, effort and potential grief.

Once a year, I do a reverse envelope that takes into account our starting portfolio value, annual contributions/distributions, and the ending portfolio value.

It is a useful activity even though the annual results are not that important.

5. Define your time horizon before investing. The three most important variables in any investment decision are:

1. Your goals.

2. Your profile is at risk.

3. Your time horizon.

The last one can get you into trouble if you don’t define your time in advance or confuse it with someone else’s.

Do you trade? A buy and hold investment? Something defined above or below?

Comparing your investments with a well-defined period can save you from unnecessary mistakes but also help guide your decisions when it comes to buying, selling or holding assets.

6. Save very little money every year. The best alpha in your portfolio usually comes from saving more money, not from the investments you make.

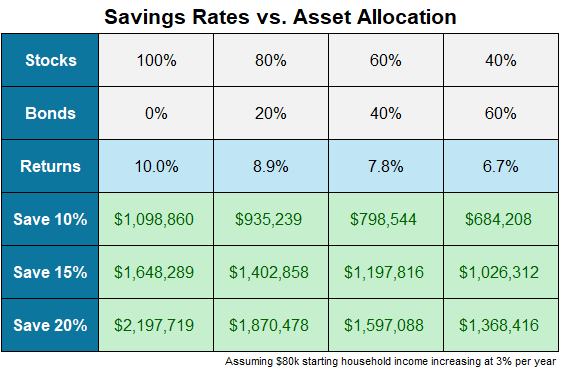

I created a chart using simple assumptions – median household income, historical rates of return and inflation – and compared different asset allocations and savings rates over a 25-year period:

Saving 15% of your income results in a higher net worth for the 80/20 and 60/40 portfolios as a 100% stock portfolio only saves 10% of your income. Saving 20% of your income leads to a 40/60 better portfolio result than 100% in stocks and 10% savings.

Savings isn’t funny but it’s one of the easiest ways to improve portfolio results.

I answered this question in the new Ask the Compound:

We’ve also compiled questions from our viewers about 10 things you need to know about investing in stocks, the difference between cyclical and sovereign markets, how bonds affect your retirement plan and 15-year vs. 30-year mortgages.